When we trade in the stock market, the typical thing to do is to buy and then sell shares of a stock with the intention to make money in the market and not worrying about what a short position is. In the trading jargon, this is called a long position or being long on a stock.

This concept is quite easy to understand, we buy a product and then sell it for a higher price, and the difference between those prices is the profit we collect.

However, in the stock market, we can sell shares without having them in our portfolio by borrowing them from the broker. This action is called short position, and we will be learning more about it later.

In this article, we will be learning everything we need to know about the long position and short position. For example, we will answer questions such as how do you borrow a stock to short sell or what happens when you short sell a stock.

Let us begin then!

What does it mean to be long on a stock?

Whenever we buy a stock, either for the long term or for trading, we can also say that we are going long on a stock.

We say we are being long on a stock because it takes longer for the stocks to increase their value over time. Typically, when we are sitting on an upward or bullish trend, the price tends to increase slower than in a bearish trend.

That is why we say long a stock, because of the time it takes to make us money compared to a bearish trend.

What is a short in the stock market?

Whenever we are short selling stocks, what we are doing is to sell shares that we do not have in our portfolio currently.

We say we have opened a short position because, typically, when the stocks begin to fall in prices, they tend to do so very fast than when they gain value.

A bearish trend is much faster than a bullish trend, which is why we say we are in a short position.

How does short selling work, and how to short sell a stock?

When short selling stocks, what we are doing is to request our broker to lend us some shares of a particular stock to use them to make money when the prices go lower.

However, the broker is not going to lend us the shares because we say so. They are going to ask us for some money as a guarantee that we will be able to cover the payment in case things go wrong.

For example, to open a short position of 100 shares whose value is 10$, the broker is going to ask us at least 1000$ to cover the guarantee.

Doing so, the broker avoids people who start to short selling stocks without control, which makes them keep a much more regulated market.

As you can see, opening a short position is quite similar to being long on a stock in terms of the money we need to open the trade.

How do you borrow a stock to short sell?

To be able to open a short position and borrow the stocks, the only thing we need to do is to open a sell limit order or a sell market order in our brokerage account without having the shares of that particular stock in our portfolio.

The broker will understand that we are trying to open a short position in these cases, and it will be ready to provide us with the shares that we indicated in exchange for the guaranteed money.

How long can you short a stock?

When short selling stocks, we can keep the trade open as long as we want. However, we must be aware that some brokerage firms tend to charge us some commissions for leaving a short position open at night.

We should be careful with these cases, as they might be quite harmful to our trading accounts.

Being long on a stock and shorting a stock: examples of how both of them work

The easiest way to understand when we should be opening a long position and a short position is by using a visual example to describe this more accurately.

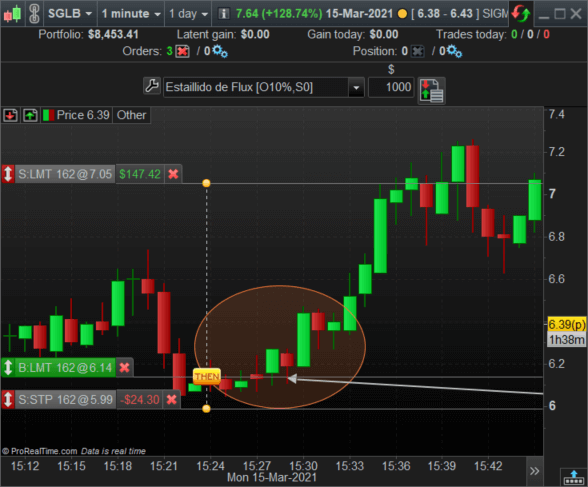

Example of being long on a stock

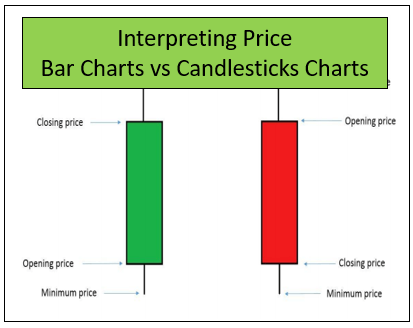

Let us take a look at the following Japanese candlestick chart, in which we can see that the prices are going to rise.

In this case, we would be opening a long position to make money taking advantage of the bullish trend we are in.

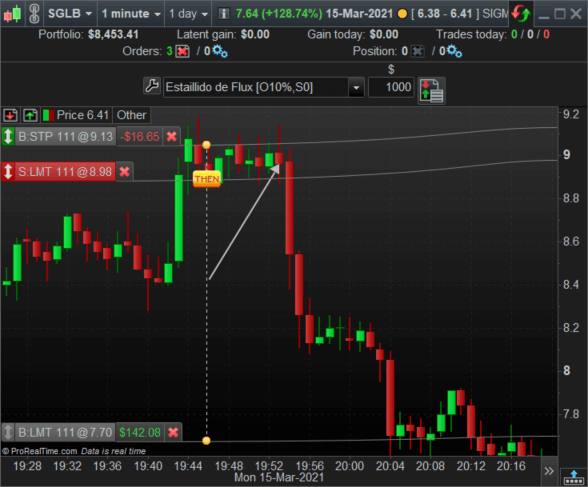

Shorting a stock example

In the following chart, we are going to be opening a short position to take advantage of the bearish trend.

As you can see, our current position before opening the trade is 0.

That means we have no shares in our portfolio, so we are currently opening a short position in this trade.

Last words about the long position and the short position

As we have seen, even when the short position might sound confusing, it is exactly the same mechanism we use to long a stock.

Using the long position and short position, we will be able to make money in any market direction, making this a powerful tool to help us trade.