The Elder Force Index is a technical indicator that will be very useful to determine the strength of the current market.

As with many other indicators, we can use the Force Index Strategy to trade both stocks and options.

In this article, we are going to be reviewing what is the Elder Force Index, how to use it, and the many different strategies we can use and develop to apply a reliable trading system in the market and profit from it.

So, let us get started!

What is Elder Force Index?

The Elder Force Index can be both a trend follower and an oscillator, depending on the settings we decide to apply.

In any case, it will allow us to measure the strength of the buyer and the sellers in the market, and it is a great choice to help us foresee what is going to happen in the very near future by reading volumes.

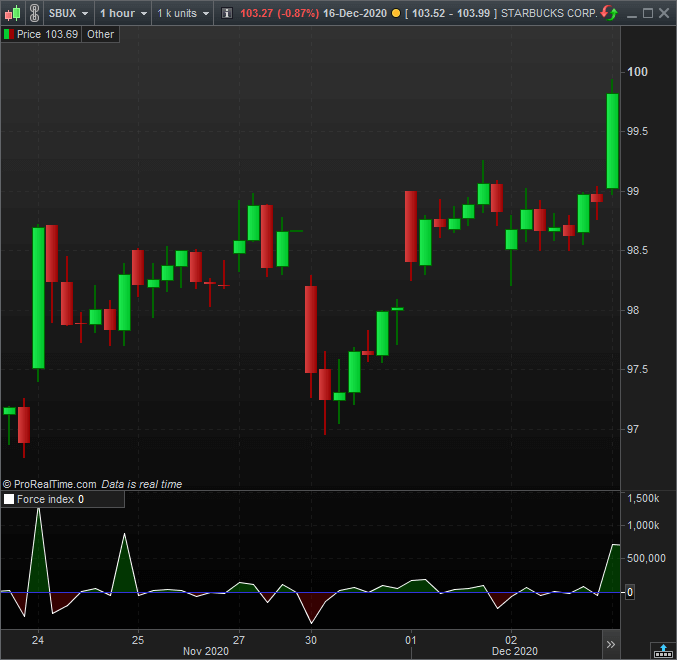

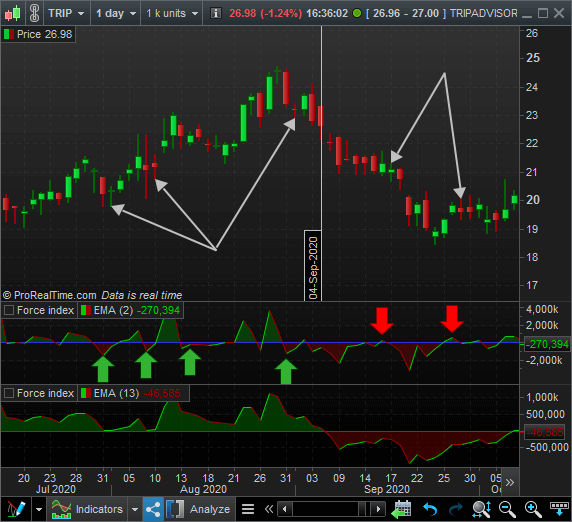

Let us take a look at the following chart, where we will display the price of a stock over a 1 hour time frame along with the Elder Force Index configured as an oscillator.

That is how the Elder Force Index looks like. Now, let us see how does it work.

How does the Force Index work?

When the Force Index is above the zero line, we could say that the buyers are ruling over the sellers, so the momentum is bullish.

However, when the Elder’s Force Index is below the zero line, we could say that the sellers are ruling over the buyers, and then, the momentum is bearish.

To help you understand why that is so, we need to take a look at the formula used to calculate this indicator. The Elder Force Index formula is the following:

As you can see, the Force Index formula is based on the stock trading volume, and that is why it can spot bullish and bearish momentums in the market.

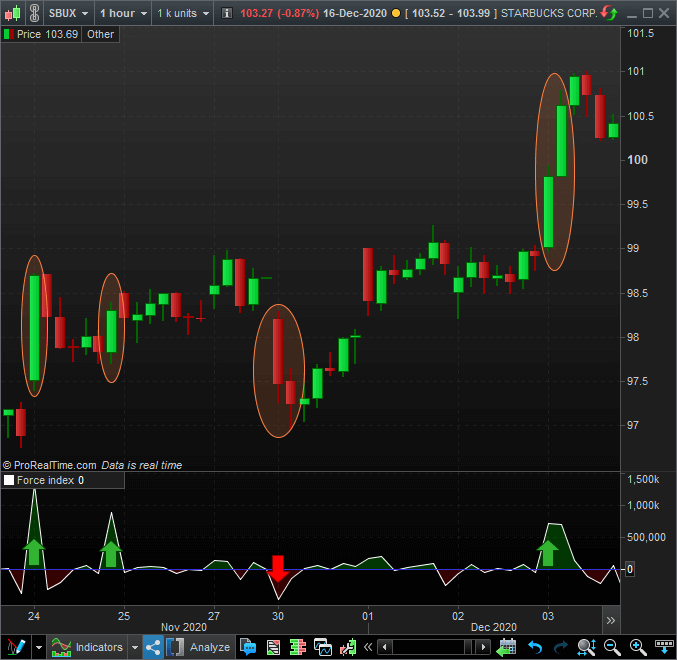

Let us take a look again at the previous graph to apply these concepts over it.

In the previous chart, we have marked with a green arrow the most significant bullish momentums and with a red arrow the bearish ones.

As you can see, the strongest spikes in the Force Index coincides with the biggest movements in the market, either bullish or bearish, and that is because of the high volume we could expect in such candlesticks.

Smoothing the Elder’s Force Index Indicator

Before jumping into the Force Index strategy, we need to talk about ways to smooth the indicator. Typically, in many of the trading software available in the market, we will find that the Force Index can be smoothed with an average just like we can do with ProRealTime.

The reason to do this is to avoid the spikes in the indicator and create more of a rounded bottom or peak that could help us identify better opportunities.

The most usual to find is that the Elder Force Index is smoothed with an Exponential Average.

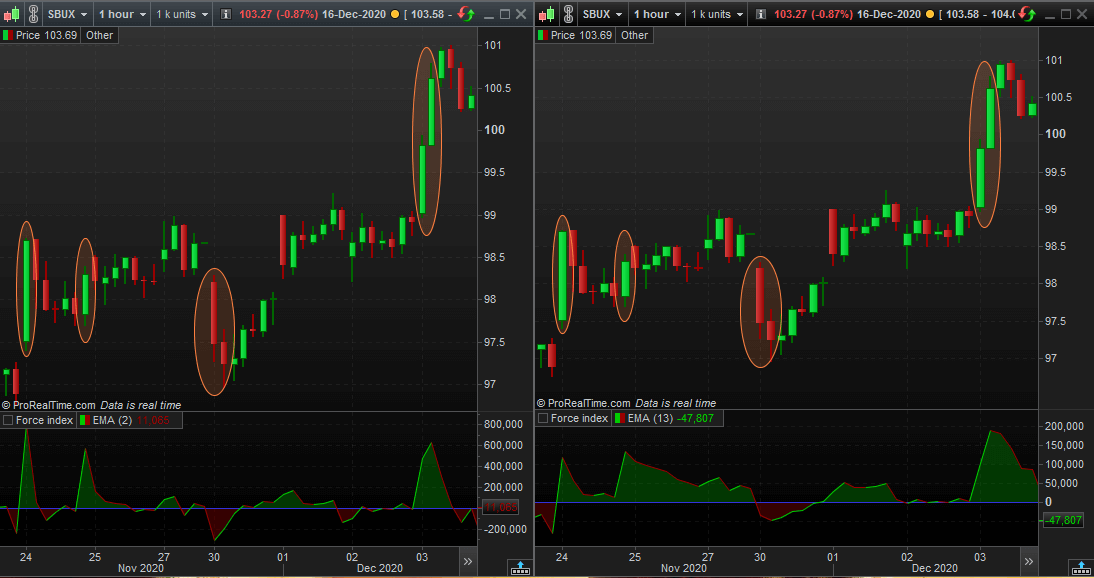

Depending on the periods we use in it, we will be able to use the indicator as an oscillator (2 periods of the exponential) or as a trend follower (13 periods of the exponential).

The left graph shows us the Force Index smoothed with a 2-period Exponential Moving Average, while the right chart shows us the indicator smoothed with a 13-periods Exponential Moving Average.

Let us get into more detail in how to interpret both variants of the indicator.

Using the Elder Force Index Strategy

As we have previously seen, the Force Index can be used as an oscillator and as a trend follower.

First, we are going to learn the trend following strategy so we can later use the oscillator in it as a reference a create a proper trading system.

Elder’s Force Index Strategy: The 13-Periods Exponential Moving Average Strategy

Using this configuration, the indicator can tell us the current strength of the market and then its trend direction based on the volume registered over a certain period.

The best way to interpret this configuration is as follows:

- Bullish Trend: We will spot a bullish trend in the market if the Force Index is above the zero line.

- Bearish Trend: We will spot a bearish trend in the market if the Force Index is under the zero line.

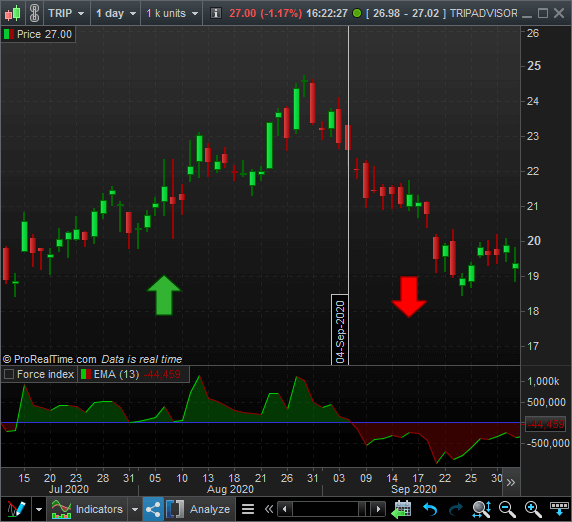

In other words, we can use this indicator to follow the trend and trade with it. Let us take a look at the following example

The previous chart is represented with 1-day candlesticks.

As you can see, when the Force Index is above the zero line, the trend is indicated as bullish with a green arrow. Alternatively, the red arrow marks the bearish trend.

Okay, let us take a look now at the oscillator variant of the Force Index.

Elder’s Force Index Strategy: 2-Period Exponential Moving Average Oscillator Strategy

The second way to use the Force Index strategy is using the indicator as an oscillator. So, we will be using the 2-Period Exponential Moving Average to smooth it.

The best way to use the strategy is by applying a trend detector to trade in the direction of the trend, so we will be combining what we have seen with the previous strategy.

- Bullish signal: We will find them when the Force Index oscillator variant is under the zero line and begins to move to the upside in a bullish trend.

- Bearish signal: We will find them when the 2-Exponential Moving Average Force Index is above the zero line and begins to move to the downside in a current bearish trend.

To help you clarify the matter, we are going to have a look at the following example, using both indicators variant at the same time.

As you can see in the previous image, using both indicator variants, we can spot many entry points in the trend. However, we should be cautious with the trend changes, as we could find many false signals in between.

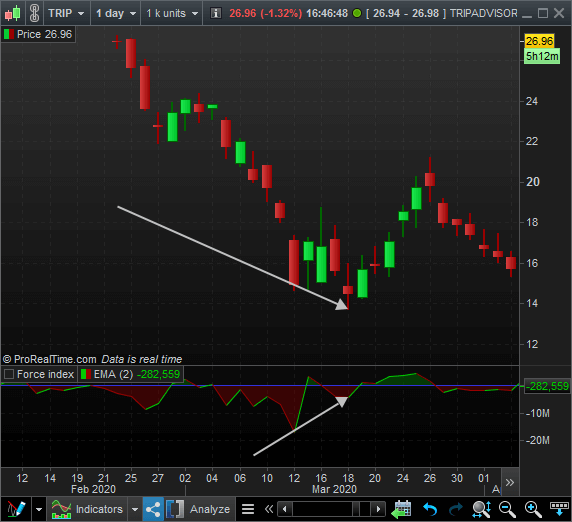

Elder’s Force Index Strategy: Divergences With the Oscillator Variant

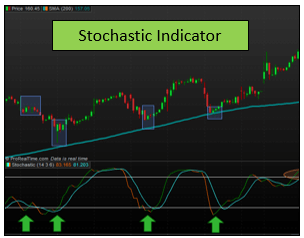

As with many other indicators, such as the stochastic indicator or the awesome oscillator, the Force Index also includes a divergence variant.

As always, this one is the hardest to find, but when it appears, it provides the best price movements in the market.

- Bullish divergence: When the oscillator variant of the Force Index creates a new bottom higher than the previous one, and the price keeps getting lower and lower.

- Bearish divergence: When the Force Index creates a new peak lower than the previous one, and the price keep getting higher and higher

Let us look at the following example of a bullish divergence with the Elder’s Force Index oscillator.

As you can see, the following movement in the price is quite strong after the bullish divergence is confirmed in the indicator.

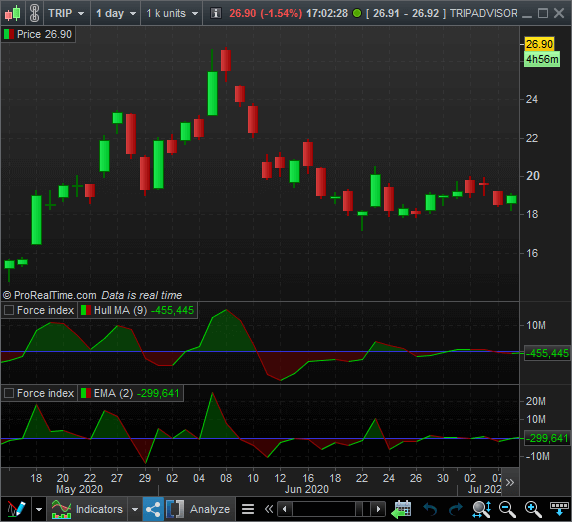

How reliable is the Force Index?

This indicator is actually reliable when we try to find the trend of an asset, but one of its problems is that the oscillator variation is quite sensible to the changes and it could lead to many false signals in the trend.

One thing we do use is to change the 2-periods exponential moving average for a 9-period Hull Moving Average, as it becomes the oscillator a little more reliable. Take a look at the following example

Applying these changes, we will find a more smoothed indicator, so it could be a good idea to use this instead.

Last words about the Force Index Indicator

As we have seen, we are dealing with a multipurpose indicator whenever we decide to use averages to smooth its signals.

The oscillator will help us to find entries and exits in the current trend of the market, while the trend follower variation will allow us to spot the direction of the current trend.

The best signals are those provided by the Force Index divergences, but these are the less common to find.

In any case, we highly recommend you to test this indicator and change the averages to find out your best setup.