Understanding Option Delta – The Most Important Greek in Options

Option delta is probably the most important option greek, along with option theta in the options market.

In this article, we are going to learn everything we need to know about option delta, including what it is, how to interpret option delta, and the formulas.

Table of Contents

So, let us begin with the most basic question we can formulate…

What is option delta?

Delta is a parameter derived from the Black-Scholes model, which governs the pricing of every option contract. And also, it is used as a measure of the probability of the option to be In the Money.

How to interpret option delta?

From option delta, we can tell how much our contract is going to reevaluate if the underlying stock price increases by one dollar.

For example, let us say we want to buy an option contract from Electronic Arts because we think the stock price is going to rise in a few days.

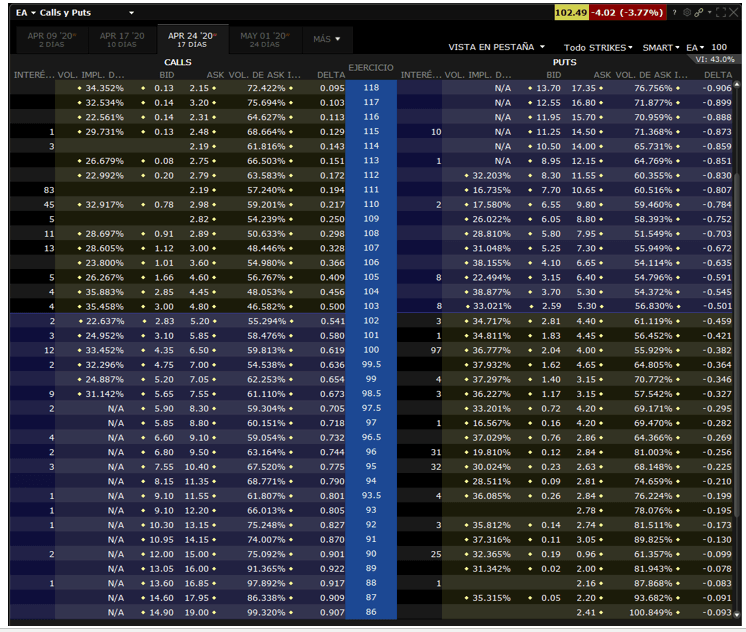

Let us take a look at the option chains with delta. We will have the possibility of choosing strike prices that vary between $130 and $50. As we can see in the following image, the premiums vary depending on the relationship between underlying or the stock price and strike prices.

Let us take, for example, the strike price of $100. For the call option, delta is 0.619. Now, if EA rises the stock price to $103.5, our call option premium will change from $6.50 to $7.119.

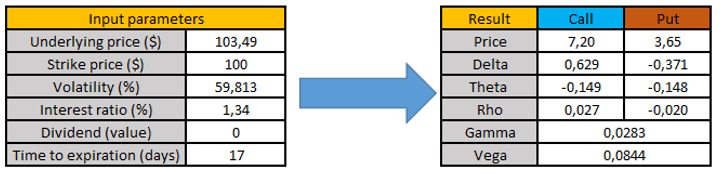

We are going to check if this is true with our Black Scholes calculator that includes the option delta calculation.

If you are interested in this particular calculator, you can download it for free at the end of the article or clicking here along with our free Options Guide!

What causes option delta to change?

Both, call and put option delta are going to change depending on the relationship between the stock price and the strike price.

Let us take another look at the option chain with delta. If we look closely, option delta fluctuates depending on whether we are dealing with an Out of the Money option or an In the Money option. And this is where the option greek delta becomes relevant.

For those OTM strike contracts, we have a much smaller option delta and a much lower premium. However, for those ITM contracts, we will encounter the opposite effect.

They have a much higher delta and a relatively high premium.

Why is option delta important then?

Having both call option delta and put option delta will provide us with the quality of the option contract we are dealing with.

If the option greek delta is high, when the stock price increases its value, the option price will increase with it, and therefore we will obtain much more profit.

However, if we have a rather low option greek delta, profits will be lower, but we will have paid much less for the option.

In any case, it is quite important to have an option chain with delta configured so we can see the quality of the option we want to trade. Also, it is desirable to calculate delta with the proper tools out of the broker to double check that everything is correct. At the end of the article, you will find our free option trading calculator that includes the delta calculation.

When is option delta highest?

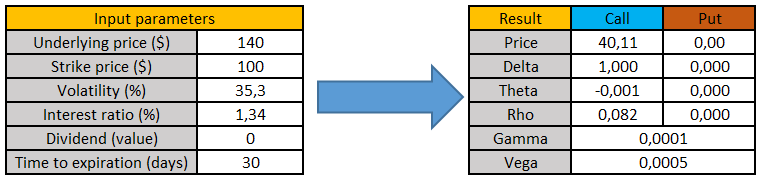

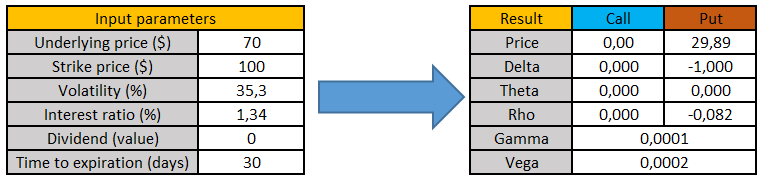

We will find the highest call option delta when we trade with very deep In The Money options. Let us take an example with our option trading calculator, which includes the option delta calculation.

And doing the same, we will find the highest put option delta when we trade with the same types of options.

In both cases, we can check that it is true by looking at a real option chain with delta included in the data.

Can option delta be greater than 1?

We will find that option delta cannot be greater than 1.

The reason is simple: as we are dealing with derivates, it makes no sense that the option premium increases faster than the underlying asset. As a maximum, the option premium will increase at the same rate, which is precisely 1.

That is why option delta is less than 1 if we are not trading very deep In The Money options.

Can option delta be negative?

Yes, but only when we are dealing with put options. The reason why put option delta is negative lies in the nature of the contract.

For the call option delta, we will have positive delta because it will gain value when the underlying rises in price.

For the put, is on the contrary: it will increase its option premium when the underlying falls.

So the reason why the put option delta is negative is because if the underlying rises, the put option will lose value of delta.

Do you need a Calculator that helps you create and analyze any option strategy in record time?

How to calculate option delta?

The way to calculate option greek delta comes from an expression given by the Black-Scholes model. First, it is necessary to obtain all the parameters of the mathematical model, since we are going to need them to obtain both call option delta and put option delta. Also, is recommended to calculate the option price, which you can consult here.

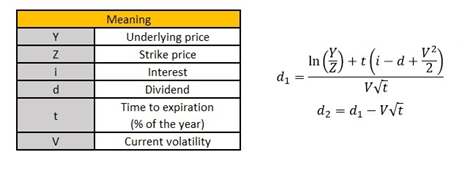

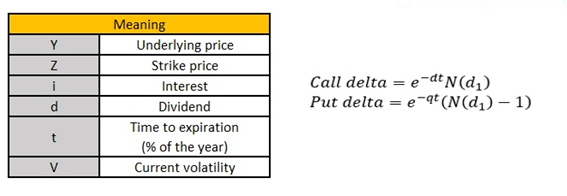

First of all, we are going to need to calculate two auxiliary parameters called d1 and d2. These are obtained as follows

In these case “ln” is the Neperian logarithm and “t” is the percentage of time to expiration, that was calculated as the number of days to expiration by 365 days.

What is option delta formula?

This is the formula we will use to calculate this greek

In these case, “N(d1)” and “N(d2)” are the Gaussian or Normal Distribution with mean equal to zero and standard deviation equal to one.

At the end of the day, both call and put option delta formula are the same with the difference that put contracts will have a negative sign, as we have already discussed previously.

How to calculate option delta in excel?

As we have seen through the article, calculating option delta might be a little challenging to begin with.

If you do not want to replicate the formulas we have seen in the previous section, we have a free calculator that includes how to calculate option delta in excel already. It is precisely the one we have been using in the examples above. You can download it here along with our free Options Guide:

Where to find delta online?

If your broker does not allow you to visualize the option greek delta, you can always check delta on the main page of the Nasdaq market activity chains to know its value.