The 3 Main Prices of Options: Strike Price, Premium and Underlying Price

When many investors coming from the stock market and begin to study the different concepts from the option trading world, the first thing they encounter is many terms related to prices, such as the option premium, strike price, or underlying price.

If we want to understand how options trading works, it is essential to differentiate each term when we are dealing with call options and put options.

In this article, we will learn the strike price definition, we will learn the differences between the strike price vs stock price and every concept related to price in the option market.

Table of Contents

What is the underlying price or the stock price?

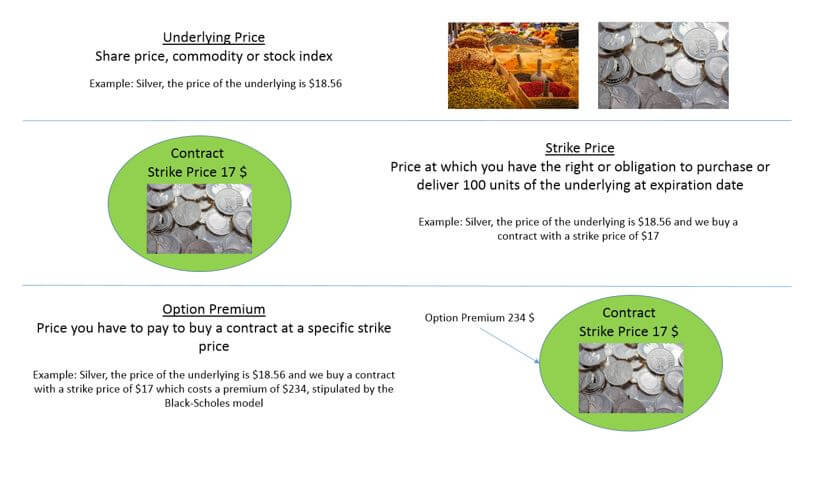

The underlying price is the price of the asset we are working with.

Typically, we will be trading with stock options, so the underlying price of the stock options is the stock price, the same we find in the stock market. If we were dealing with commodity options, the underlying price would be the current price of the commodity and so on.

Basically, the underlying price is the price of the asset the option is referring to.

Example of the underlying price

For example, if the stock price of Roku is $95.70 per share, in the world of options trading, this price would be known as the underlying price.

Here we can see a Japanese candlestick chart from the Nasdaq ETF. In the option trading jargon, the price of the stock is the underlying price.

What is the Strike Price of an option?

Many people confuse the underlying price with the strike price, since both are entirely related to the value of the stock, but the reality is they are very different concepts.

The strike price of an option is the price at which we set the contract we are trading.

- For the buyer of the option, it is the price at which the buyer is entitled to acquire the position in the market.

- For the seller, it is the price at which the shares must deliver, assuming the buyer asks to do so.

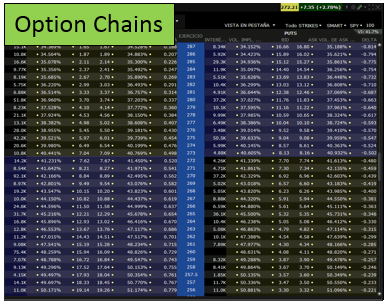

When we open an option chain, we can see a list of strike prices available for trading, and typically, this list is quite extensive.

For example, following the same case with the company Roku, if we access the option chain at a specific expiration date, we can find a large number of option contracts that will cover a large strike price field.

Example of the strike price of the stock option

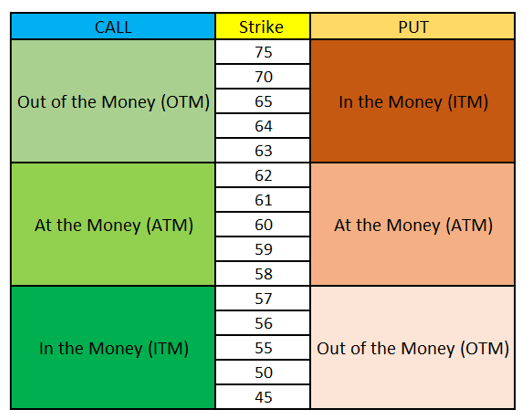

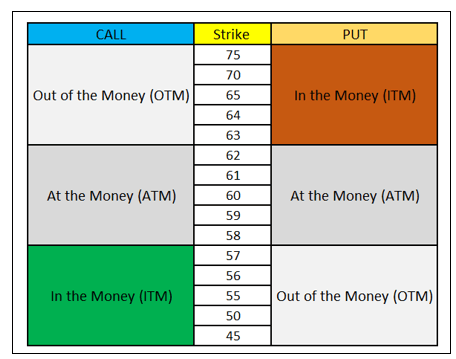

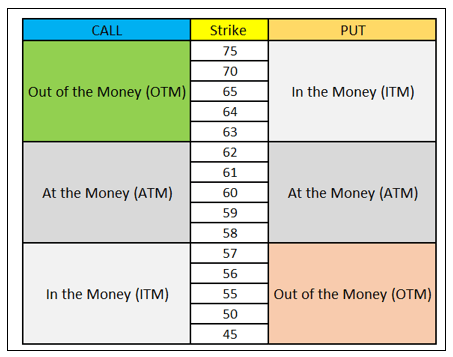

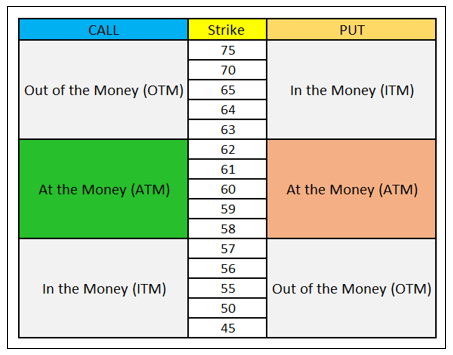

Let us suppose that the underlying price today is at 60$. We can find a large variety of option contracts whose strike prices vary from 45$ to 75$ for example.

Of all of these strike prices, we can buy or sell whichever contract we want at whatever strike price we desire, but only if there is enough option volume and open interest in the contract.

What is the Option Premium?

Now, the next question is: What would be the point of buying the option contract that is at a strike price of $110, knowing that there is one at a strike price of $100?

Well, the reason is the price we will pay for that contract, also known as the option premium.

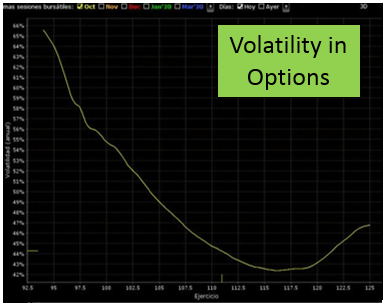

The option premium, in general terms for a call option, will be lower the farther the strike price is above the underlying price. That is, an option with a strike price of $150 will have a much cheaper option premium compared to an option whose strike price is 100$.

However, for a put option works the other way around. The farther the strike price is under the underlying, the cheaper the option premium will be. In other words, for a put option, a strike price of 50$ is much cheaper than a strike price of 80$

Last words about the option premium, the strike price and the underlying price

These three prices are the ones that we need to dominate to understand how options work.

- The underlying price is the value of the asset we are dealing with.

- The strike price is both, the value at which the buyer wants to acquire the position and the price at which the seller must deliver the shares.

- The option premium is the price of the option contract we are dealing with.

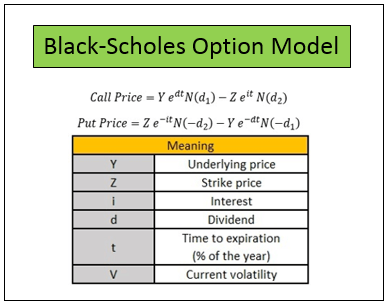

Remember that you can get our completely free option trading calculator to obtain the premium of every option you need

To help you understand this a little better, take a look at this little summary here:

Do you need a Calculator that helps you create and analyze any option strategy in record time? |