Open Interest vs Volume in Options- The Key of Success In Options Trading

One of the things we might want to do when trading options is to compare options open interest vs volume, because these two are one of the most important factors that we need to take into account when choosing a strike price.

Those high open interest options can help us to discriminate between which contract is better to buy or sell, because it will help us to identify which is the best strike price in an option chain.

In this article, we are going to take a look at both options trading volume and open interest, we will define each one, and we will learn how to use the information in our favor. Finally, we will be comparing both options open interest vs volume, so we can understand the differences.

Table of Contents

What is the option trading volume?

The option trading volume is the number of contracts that are being traded in a certain period. Typically, when we access an option chain, the volume will provide us with the information of the strength of the current price movement in the market.

In other words, the volume is crucial for the options trading strategy to be viable because of the liquidity and because oof a potential price move.

Just as with stocks, if we expect a strong movement, the current volume should be higher than the average volume, because it is a relative measure.

Generally, a high volume in stocks will provide a high volume in options. You can check the volume in finviz.com, using their free scanning tools

What does open interest mean in options? – Open Interest definition

The easiest way to define open interest is by thinking of it as the number of active contracts over a certain strike price. It will show us the total number of contracts that other traders still have opened but are not exercised or assigned.

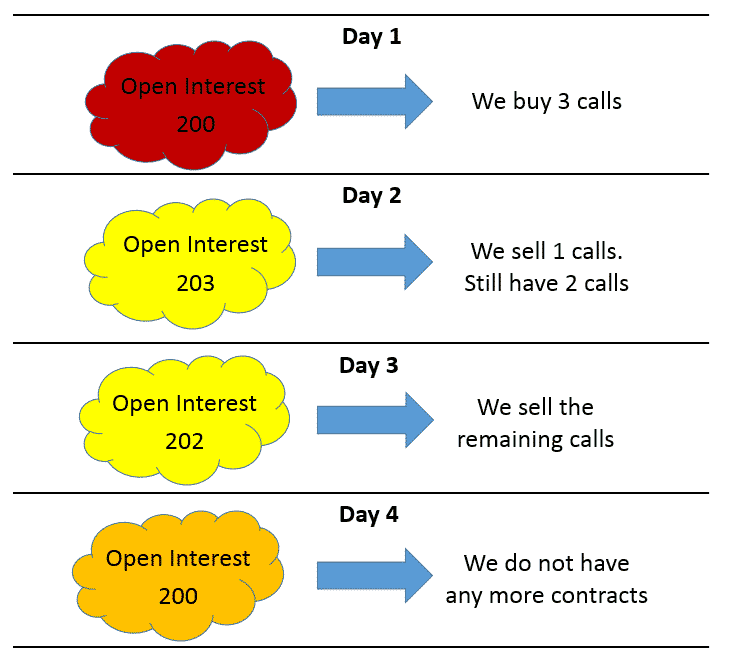

In other words, it is the number of open positions in the options market over a certain strike price. For example, if we decide to acquire 3 call contracts and keep them for a few days, the open interest in the current strike will increase in 3 points, as we have an open position in our account.

However, when we decide to sell those calls or if we want to exercise our contracts, the open interest will decrease by 3 points, as those three contracts are now closed.

Open interest example

One thing we must keep in mind is that open interest will not refresh until the next day, unlike option trading volume, that will keep changing throughout the session. Let us take a look at this open interest example to help you understand this better.

Open interest options definition

Through the previous open interest example, we can learn how many open positions are in the market, which is key to know how liquid a contract may be. We must ensure to look for a strike price whose open interest is fairly high for our intended operation.

Why is the open interest so important in options?

Open interest can be used as a static measure of the volume of the past day. If we decide to compare it with the current volume, we will know if that particular contract is being very traded or not.

For example, if the current volume today is 150, and the open interest is 800, the options traders have lost their interest in this particular contract. However, if the current volume were 1500, it would be the other way around, and that contract is highly traded.

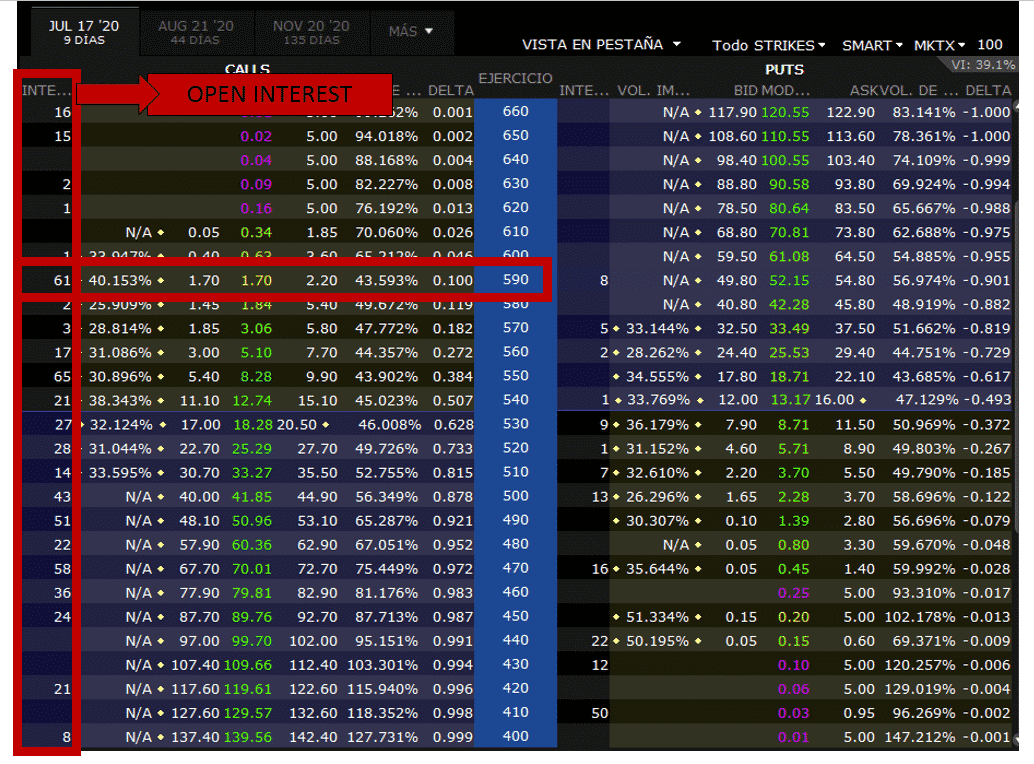

Those high open interest options will have a reduced spread between the bid and the ask option premiums of the contract, thus, making it easier to obtain better prices in reality. For example, take a look at this option chain

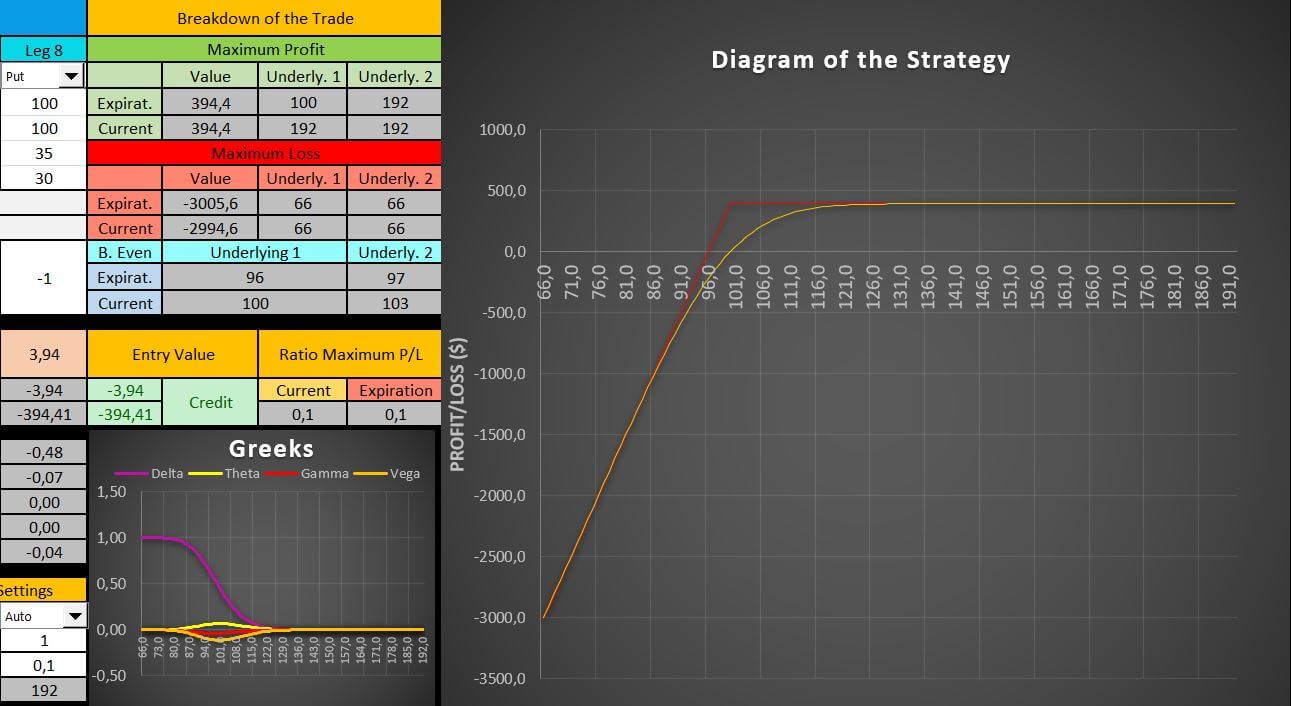

Option open interest vs volume

In the left column, we can spot the open interest, as it is marked with an arrow in a red box. As you can see, in general, the open interest is quite low for this stock option.

That is actually a problem, because the spread between bid and ask is quite high, as you can see in the $590 strike price. If we want to buy an option there, we must pay $220, while if we want to sell, we will receive $170.

This is due to the fact of a low open interest. Now, imagine we want to place a stop order. With this low open interest, we are more likely to encounter problems buying and selling the option, and we may get filled with an option premium lower or higher we expected.

That is the reason why we should look for a high open interest in general to avoid these kinds of surprises.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Options Open interest vs Volume

When we compare options open interest vs volume, at the end of the day, both factors are significant to trade options, as they indicate to us if a contract is being traded or not.

Remember, option trading volume will provide us with the current volume of the session, and it will help us know if the contract is currently being bought and sold.

Open interest will indicate to us the number of contracts that were opened in the option market the previous day, and it will modify the spread between the bid and ask. The higher, the better.

Even though these two are not factor included in the Black-Scholes model, they serve as one of the main factors to price an option. Open interest and volume are the energy that powers the machinery in the option market.

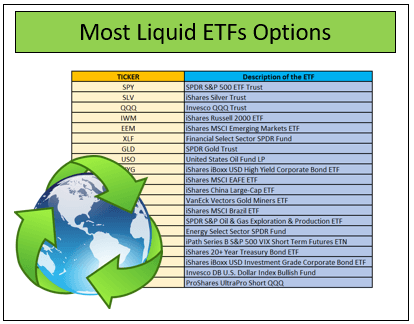

The highest option volume and open interest in options is typically found at the ETF stock options. Take a look here to know more about the most liquid ETFs options.