The 3 Different Frequencies of Expiration Dates in Options

In this article, we will be reviewing the different expiration dates we may find when trading in the options market, and we will learn how to find those options with a higher expiration frequency.

Table of Contents

What is the standard expiration date of an option?

Whenever we enter an option chain, depending on the ticker we are looking at, we will find the most common scenario is to find option contracts that expire every month and usually on the third Friday of the current month.

This is the norm for almost every stock option that we can find in the entire market. Whenever it is decided that a stock is popular enough in the entire investing community to create options surrounding them, we will find that the common thing is to add them every month.

However, sometimes, when some stocks are top-rated among investors, we will be able to find options contracts that expire every Friday of every week.

These are the most traded stocks and those that already have a considerable volume of transactions in the stock market.

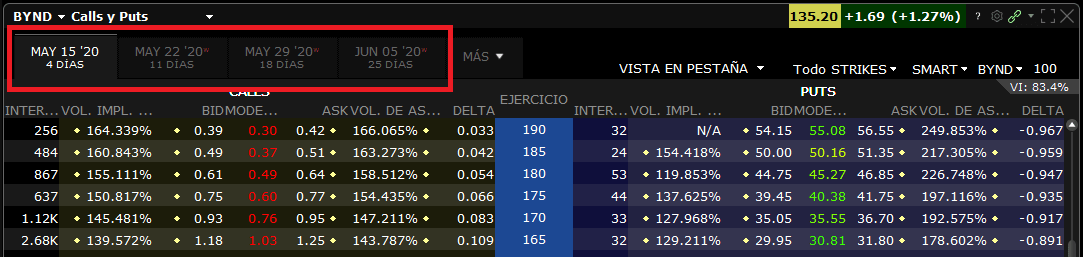

For example, when the company Beyond Meat went public for every investor to trade, its option chains had expiration dates every week. That was because of the high volume that was expected.

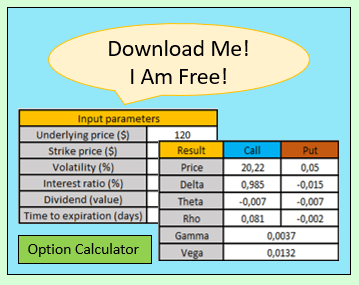

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Why would I trade a stock option with a weekly expiration date?

Typically, the stocks that have a weekly expiration date also have a higher volatility, thus creating more opportunities for buyers and sellers.

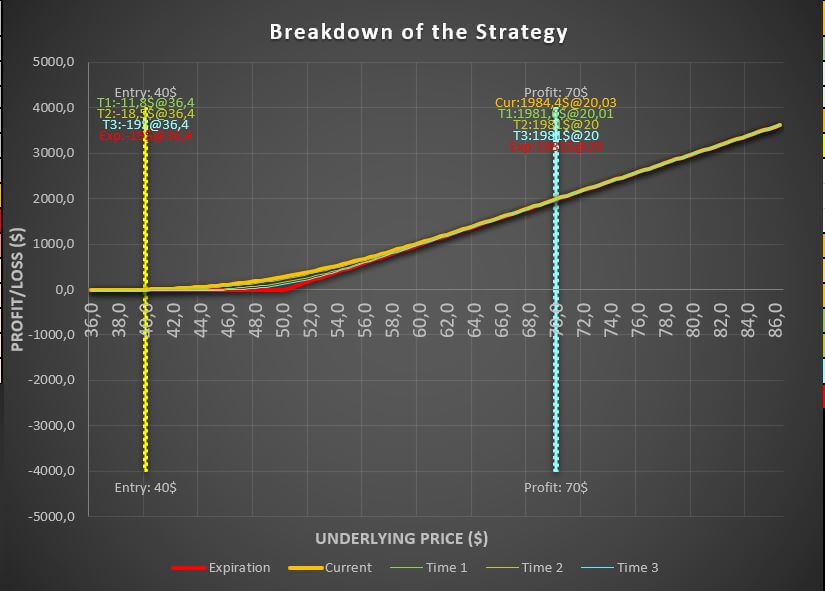

For example, if we were to sell options, we should look for those that have a nearer expiration date because the effects of theta are stronger when the expiration is getting closer. The chances of the underlying moving against us are lower. That means, as sellers, we will take that as an advantage to our trading strategy.

We believe it is better to sell stock options that do have a weekly expiration date, because it is much easier and faster to obtain a profit from them than in the common monthly expiration dates

How do I know if a stock has a weekly expiration date?

So, if you are looking for those options that expire weekly, it is inviable to search for them in the options chains one by one.

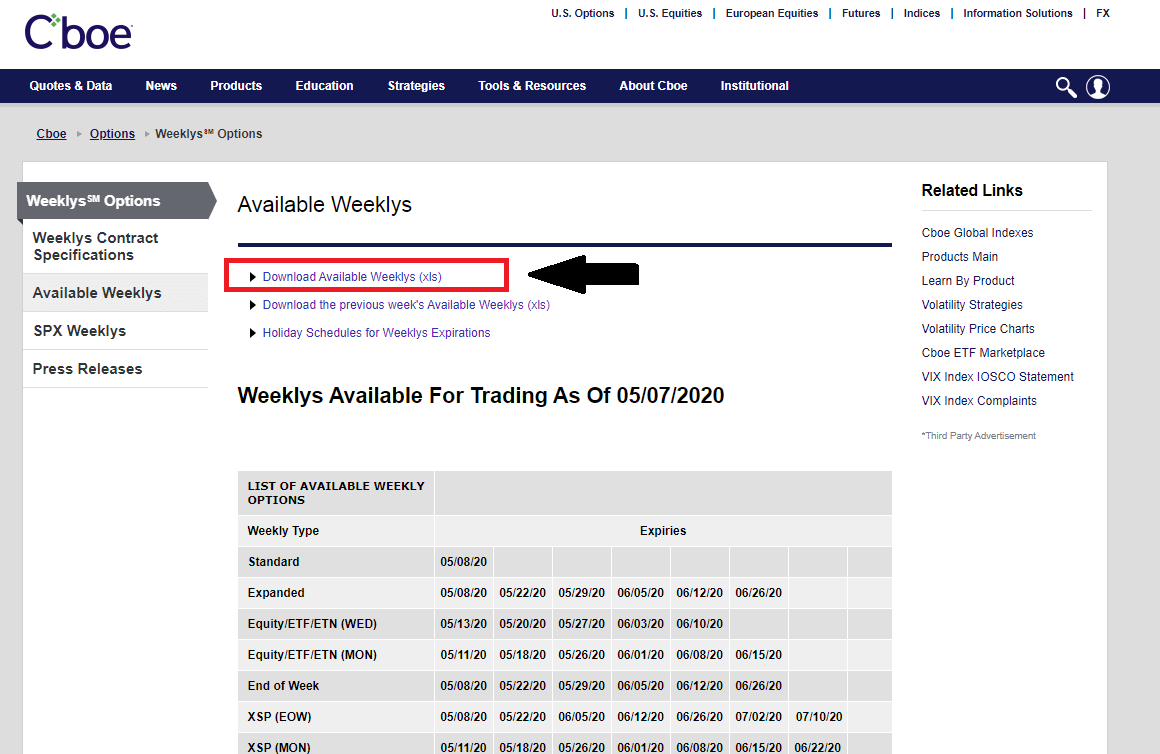

The best thing we can do is to consult a list available in CBOE web page. In there, you can check every stock or ETF options that expire every week, including the exact date.

Is there a smaller period in any expiration date?

If you still think that a weekly expiration period is not fast enough, there is an ETF that will provide us with a two days expiration date. This is the SPDR S&P 500 Trust, which is an ETF that replicates the S&P 500. It is the larger ETF in the entire world and is the most traded, and its ticker is SPY.

Of course, there are other ETFs with a high activity. Take a look at the list here.

The great advantage that it will give us is the high volume, the lower spread between ask and bid when trading, and it generally low volatility.

We can trade options that expire every Monday, Wednesday, and Friday of every week, so if you are looking to trade, whether selling or buying, this is the option you should keep an eye on.

Last words about the expiration date

In any case, whether you are selling or buying a call or a put, you should always calculate the expected premium to make sure you are paying or receiving the exact premium you need.

If you need a calculator to help you improve your accuracy when trading, you can always download our here, along with out free Options Guide.