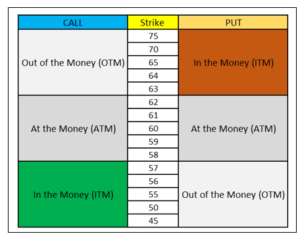

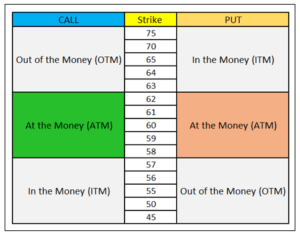

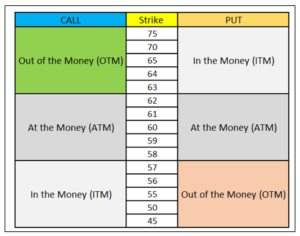

Option Moneyness: Strike and Underlying Prices Relationships

Both the strike price and the underlying price are two of the most important parameters we need to take into account in options trading because they will practically determine the value of the option premium.

When we deal with the relationship between the underlying and the strike price, we are talking about the intrinsic factor of the option. This relative position will strongly influence on the option premium of every contract.

Generally speaking, we will learn that options have three relative positions attending to the relationship between strikes and underlying.

If you want to deepen more about this, we highly recommend you to take a look at our library, in which you will find much more details about the parameters of the options

Like we said before, we can find three type of options. These are under the name of “In the Money”, “Out of the Money” or “At the Money” and each one of them has some specific characteristics that you can learn here.

In the Money Options

Here, we will learn what an In The Money Option is. Also, we will explain what happens at the expiration date, as well as… Read more

At the Money Options

Here, we will learn what an At The Money Option is, how is its options premium generated and… Read more

Out of The Money Options

Here, we will learn what an Out of The Money Option is and how to use it properly. Also, we will explain how it is best used when… Read more