What is Supertrend Indicator? – A Quite Handy Tool To Spot Trends

The Supertrend indicator is one of those tools that are quite useful to help us determine the overall trend in any asset we want, whether stocks, futures, or forex. Combined with other technical analysis tools such as the stochastic indicator or the Elder’s Force index, we will be able to create a robust trading system.

Whether if we decide to make it part of a trading strategy or not, with this indicator, we will be able to optimize our trades and identify the direction of the prices.

In this article, we are going to be reviewing what is the Supertrend indicator. Also, we will learn how to set it up, and we will see some examples so you can have a better understating of this tool.

Let us get into it!

Table of Contents

What is Supertrend Indicator?

The Supertrend indicator, as its name suggests, is an indicator that works as a trend detector, and its particularity is that it works in every single timeframe we want to apply it to.

The Supertrend indicator is a very optimized tool that will help us increase profits and stay on the right side of the market when trading with it.

How does Supertrend Indicator works?

The indicator is displayed as a changing line under the price whenever we are on a bullish trend or over the price if we are facing a bearish trend.

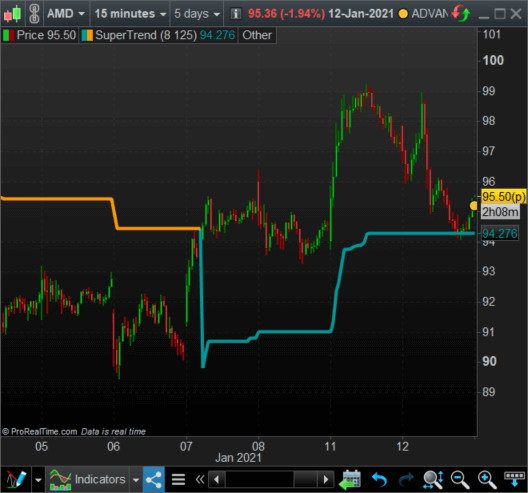

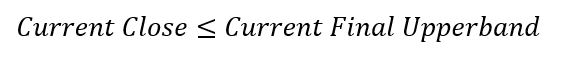

To help you understand this better, let us take a look at the following graph in which we have displayed the Supertrend indicator.

In the previous japanese candlestick chart, we can see how the Supertrend indicator looks like. The orange line will represent a bearish trend, while the blue line represents the bullish one.

Now that we know what is the Supertrend indicator, let us take a look at its calculations.

How Supertrend Indicator is calculated? – Supertrend Indicator Formula

When we are trying to calculate the Supertrend Indicator formula, we need to take into account that we will need to calculate several previous steps to reach the final indicator.

In the end, the Supertrend Indicator formula will be changing base on the volatility of the asset and base on the closing price, and it uses the Average True Range indicator to calculate some steps.

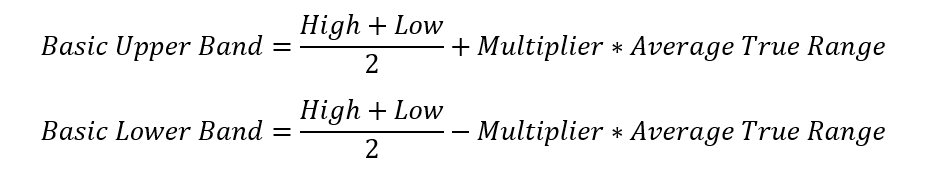

First, we need to calculate the basic upper band and the lower band of the Supertrend Indicator. Its formula is as follows:

Once we have calculated the Supertrend Indicator formulas of the upper and lower band, we will need to check which band will stay in the current period. To do so, we will use a logic condition to determine it.

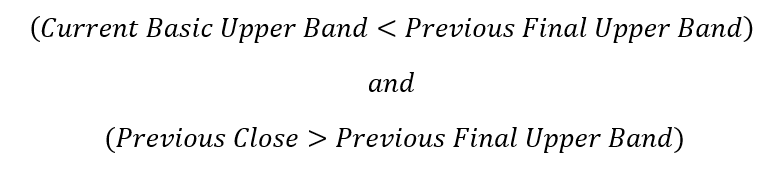

- The Final Upper Band will be the Basic Upper Band if these criteria are met:

However, if any of those criteria fail to be true, the Final Upper Band will be the same. In other words, we will keep the previous Final Upper Band as the new Final Upper Band.

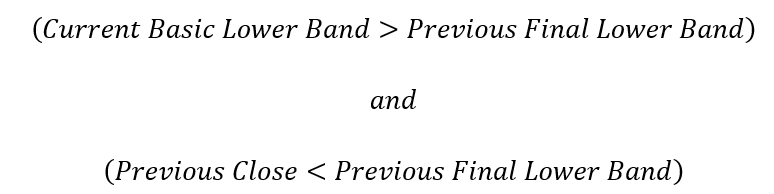

2. The Final Lower Band will be the Basic Lower Band if these criteria are met:

However, if any of the previous criteria fail to be true, the Final Lower Band will be the same. In other words, we will keep the last Final Lower Band as the new Final Lower Band.

And finally, to determine the Supertrend Indicator formula, we will apply a last logic condition regarding the Final Lower and Upper bands.

3. The Supertrend indicator will be the Final Upper Band if this criterion is met:

If that were not true, the Supertrend indicator would be the Final Lower Band.

That is how the Supertrend Indicator formula is calculated. As you can see, it is not very easy because we need to consider many different factors.

Fortunately, this indicator is included in the vast majority of the charting and trading software, just like with ProRealTime in its free version.

How to set Supertrend Indicator?

The Supertrend indicator settings that we may be able to modify by default are the number of periods of the Average True Range and the multiplier.

The most common Supertrend indicator settings are 10 periods for the ATR and a multiplier of 3 points.

What is multiplier in Supertrend indicator?

The multiplier in the Supertrend indicator will help us to detect more trend changes in the chart. The smaller the number we type, the higher the trend changes.

This means we will be finding too many false signals that may lead us to many failed trades.

However, if we decide to set a high number for the multiplier, we will face less trend changes but more accurate signals.

Depending on your trading style, you should configure the multiplier with a higher or lower number if you are a swing trader or an intraday trader.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

How to use Supertrend Indicator? – Supertrend Indicator Trading Strategy

This indicator is better use as a trend follower, as we have already discussed, so the best way to use it is as a confirmation indicator.

For example, let us suppose that the Supertrend indicator is telling us that we are sitting on a bullish trend. If we were using an indicator that helped us make better entries in the market, just like the stochastic indicator, we could combine both to confirm that we should enter into a trade. Let us take a look at an example of this.

Take a look at the previous image. At the bottom of the graph, we have displayed the stochastic indicator along with a 125 periods for the ATR and a multiplier of 8.

The Supertrend is suggesting to us that we are in a bullish trend. Thus, using the stochastic indicator, we will validate the bullish signals that it provide us to enter the market.

The other way to use the Supertrend indicator is by exiting the market if the direction of the trend changes. Let us take a look at another example.

In this case, even when the stochastic indicator is telling us that we should be bearish on the trend, the Supertrend indicator prevents us from opening a trade that would be a false signal.

As you can see, the Supertrend indicator is quite useful when it comes to confirm the trend.

Does Supertrend indicator repaints?

One of the great things about trading Supertrend indicator is that it will not repaint over the course of the graph.

Once the candlestick is closed, the indicator will be bullish or bearish, and it will not change, unlike other indicators such as the Zigzag.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Last words about the Supertrend indicator

As you can see, this indicator is excellent for confirming the trend, and combined with other tools, it will help us to stay on the right side of the trade more consistently when we open long or short positions.

Even when the standard Supertrend indicator settings are set to 10 periods for the ATR and 3 for the multiplier, we found that 125 periods and 8 points to the multiplier produce quite reliable signals combined with other indicators such as the stochastic.

Of course, changing those parameters depends entirely on you, but we always like to provide you with our best experience in the markets.