KST Oscillator or Know Sure Thing Oscillator – A Velocity and Change of Rate Oscillator

The KST Oscillator or Know Sure Thing Oscillator is a relatively unknown technical indicator that can be used to measure the rate of change in the stock market.

As with many other indicators, the KST Oscillator provides its own strategies and ways to use it.

In this article, we are going to be reviewing the complete KST Oscillator to learn how to include it in our trading system. We will learn its formula, how to use it in the intraday timeframe, and we will take a look at the strategies we can perform with this indicator.

So, let us get into the matter then!

Table of Contents

What is the KST Oscillator?

The KST Oscillator is a velocity oscillator in its core.

As we have already stated, it will allow us to visualize the rate of change of the stock we are dealing with.

How does the KST indicator work?

The best way to understand how it works is by taking a look at the KST indicator formula.

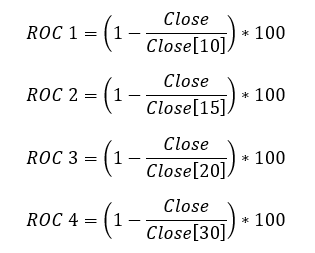

First of all, we need to identify the four different rates of change that are going to be calculated, smoothed, and then multiplied by weights.

After calculating these four rates of change, the next step is to sum them all using a simple moving average. So, the KST oscillator would be calculated as follows

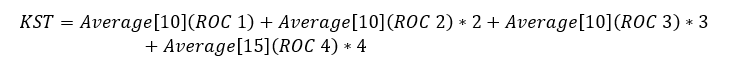

The KST oscillator also uses a signal line calculated as an exponential moving average of the KST indicator formula, and as a default, is it done with 9 periods. The formula would be the following

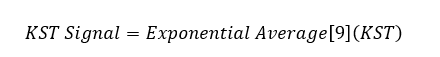

Fortunately, this indicator is included in the vast majority of the charting and trading software, just like with ProRealTime in its free version.

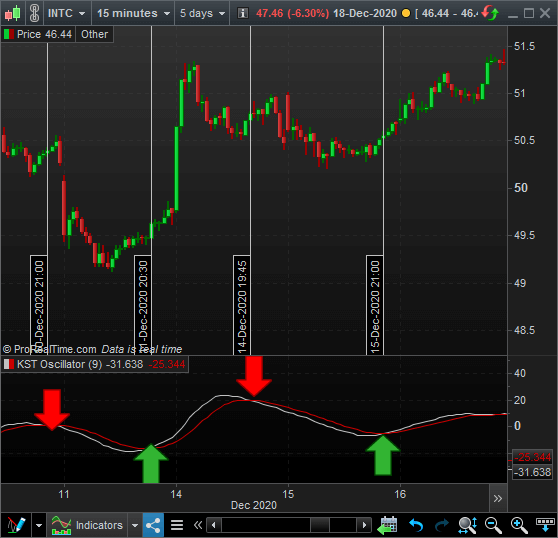

To help you visualize how the indicator looks like, let us take a look at the following chart.

As you can see in the previous japanese candlestick chart, we have represented a stock in a 15 minutes chart and with the KST oscillator in the bottom.

Now that we know how the KST indicator looks like, we are going to learn how to use it properly.

How to use the KST Oscillator

Unlike many other indicators such as the Relative Strength Index or the Elder’s Force Index, the KST oscillator will only provide one type of strategy.

We can find both bearish and bullish signals with it, but we should be using some kind of trend detector to spot the best ones.

- Bullish Signal: We will find a bullish signal when the KST oscillator crosses above its signal line

- Bearish Signal: We will find a bearish signal when the KST oscillator crosses under its signal line.

Let us take a look at the following graph to see how this works.

In the previous graph, we have marked the bullish signals with a green arrow, while the bearish signals are represented with a red arrow.

As you can see, the KST indicator manages to pick very good long and short positions in the market, even when we have not yet determined the major trend direction.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

Using the KST oscillator with a trend detector

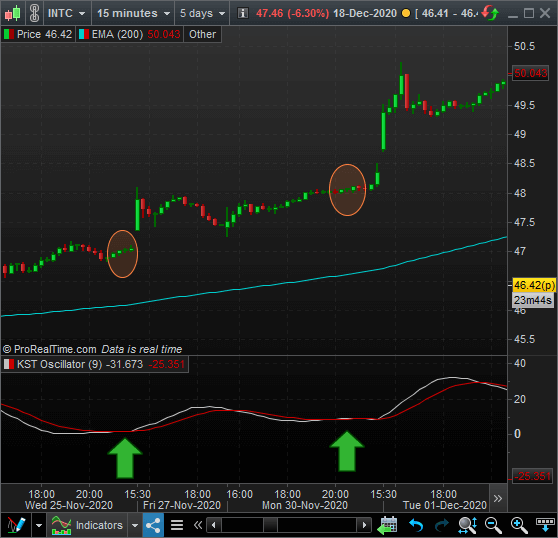

To help us spot even better signals, we are going to use a trend detector to determine the direction of the overall trend. For example, we are going to be picking a 200 exponential moving average to do so.

Now, if we only trade in the direction of the trend, we will only take bullish signals in a bullish trend and bearish signals in a bearish trend.

In the previous graph, we have an uptrend determine by the Exponential Average.

We have marked the bullish entries given by the KST oscillator, and as you can see, they are both quite correct when it comes to predict a significant movement.

Last words about the KST oscillator

As you can see, the KST indicator is quite a reliable oscillator on its own, but even more if we decide to filter and determine the trend direction.

We can use it to spot the best entries in the market and try to make a profit from it.

However, we recommend you to backtest it before applying it to your trading or investing strategies.