Coppock Curve Indicator – A Strong Long Term Indicator To Identify The Best Reversals

With Coppock Curve indicator is a technical analysis tool that will help us a trend detector to identify when a bear trend has finally stopped.

In this article, we are going to be reviewing how to read the Coppock curve indicator.

Also, we will learn how to calculate it and use it in our trading strategy to detect potential entries in the market to trade both stocks and options.

Let us get started!

Table of Contents

What is the Coppock curve indicator?

The Coppock curve indicator is a monthly indicator that is typically used to find support zones or bearish reversals in a long term chart.

It is handy for investors rather than traders as it will help us make the best entries in the market and avoid bad timing.

The Coppock curve indicator works particularly well used in the general market indices such as the Dow Jones or the Nasdaq.

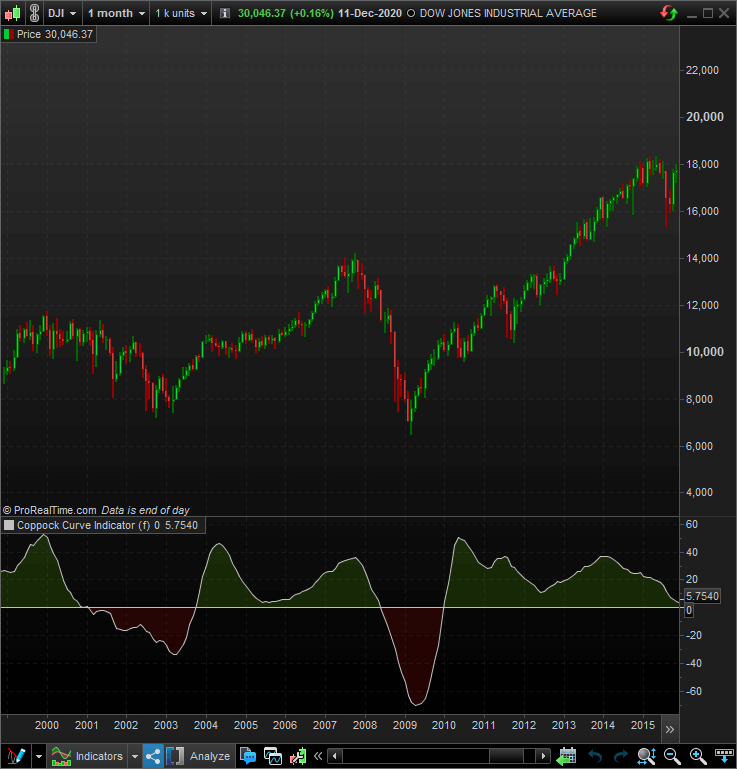

In the previous image, we can have a look at the Coppock curve indicator. We will continue to learn how to read it and use it to our purpose as investors.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

How to read Coppock curve indicator?

The Coppock curve indicator is only a bullish indicator. As such, we will be looking for bullish signals when the indicator is below zero and turns upward. As simple as that.

In order to make things easier for you to understand the use of the Coppock curve, we will be using two coded examples to help you visualize the signals.

In the previous image, we can see the Dow Jones Industrial Average Index (DJI) and the Coppock curve indicator in the inferior zone of the monthly japanese candlestick graph.

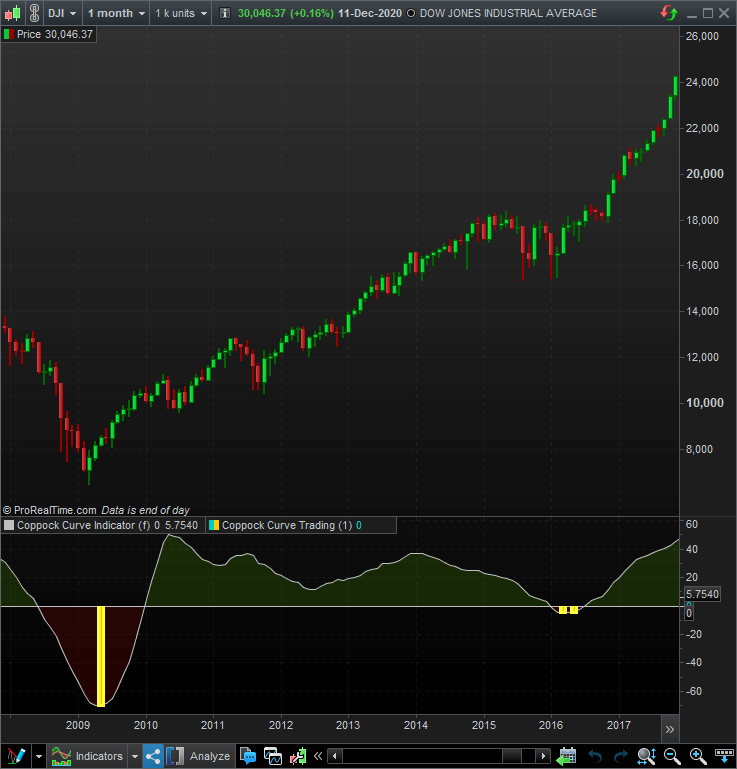

We have coded a bullish signal when the indicator is below zero, and it turns upward, and as you can see, it is quite accurate when it comes to identify the bottom of the market!

If we had decided to follow the Coppock curve indicator to invest when the signals tell us to do so, we would have caught both bottom perfectly.

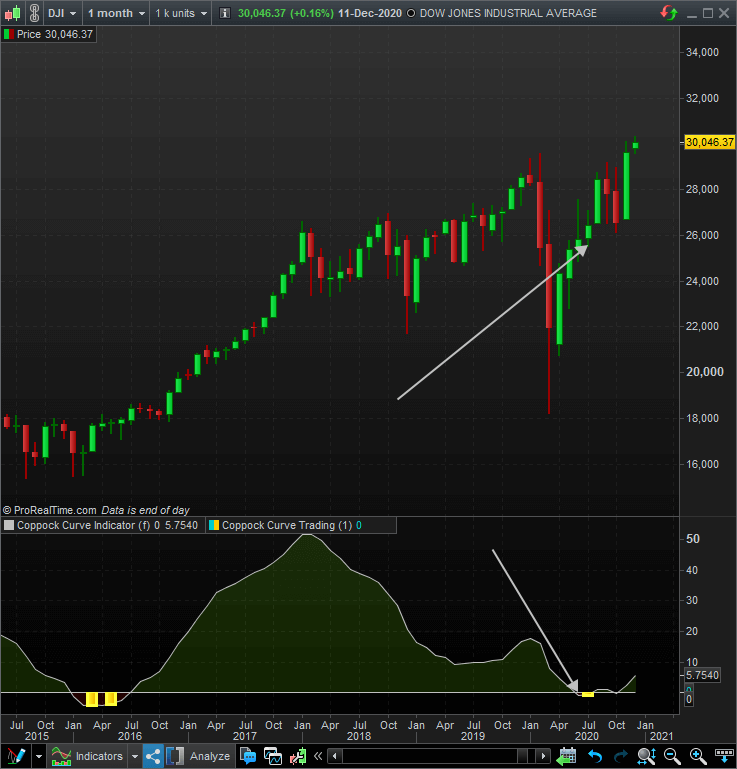

However, let us take a look now at this current year, the Coppock indicator in 2020.

Even though, in this case, the market crashed and recovered quite fast, the Coppock curve indicator does mark us a bullish signal in the 2020 year.

Using the Coppock curve indicator for a daily timeframe

Of course, we could also use the Coppock curve indicator in the daily timeframe.

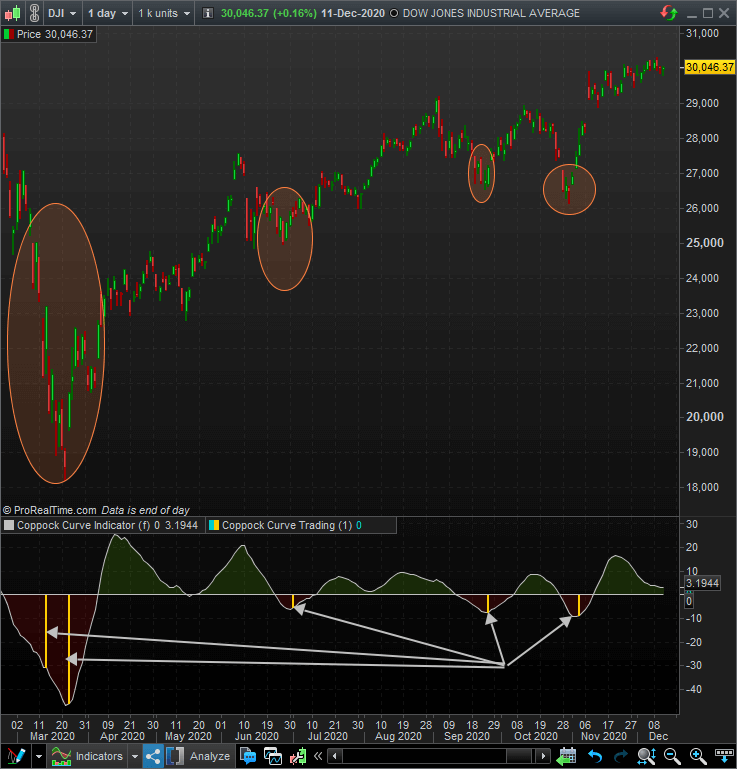

However, we should be aware that it might spot more false signals than intended. Let us take a look at the following chart, which includes all the signals from this year 2020 in a daily timeframe.

As you can see, the most dangerous signal is found at the beginning of the 2020 year crisis, and it would not have been a very comfortable signal.

Some may argue that the market recovered pretty soon after that crash. And indeed, it is true. However, we should consider our emotions too. Image you have invested when the daily Coppock curve indicator tells you so in the first signal.

The market would drop another 5000 points after that point, and a vast part of your investment would have been lost. Would you have kept your faith and wait until the recovery? Would you take your money before it was too late adding a stop loss order? Or would you even trust the Coppock curve indicator from now on?

That is why we should be careful with the daily timeframe, as it could lead to this kind of unfortunate situation.

It is better to stick to the monthly timeframe for this indicator.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

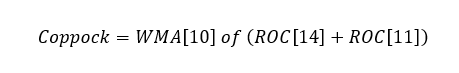

How to calculate the Coppock curve indicator?

The Coppock curve calculation is quite simple compared to other technical indicators. It is calculated as the sum of an initial rate of change, which is 14 periods or candlesticks by default, and a second rate of change, which is 11 periods by default.

After that, the summation is smoothed by a 10 periods weighted moving average. In other words, the Coppock curve calculation would be as follows:

Where can I find the Coppock curve indicator?

In any of the trading software available in the market. You can find the Coppock curve in Thinkorswim if you are a resident in the United States.

However, if you do not have access to thinkorswim, you can find the Coppock curve in Tradingview or Proreatime (which is the one we use)

Last words about the Coppock curve indicator

As we have seen, this indicator is a bullish signal provider which is better specialized for the long term investor as it is

. We should always stick to the monthly chart to find out the best signals to enter the market and avoid the daily timeframe, as it could lead to false signals, just like the one we saw in the Coppock indicator in the 2020 crisis.

As always, we would recommend you to take a look at the indicator by yourself, play with it, and experiment with different approaches and different indices to help you integrate it into your trading or investing systems.

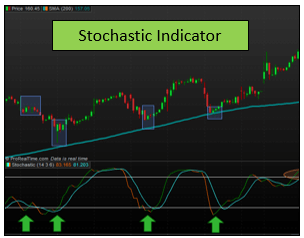

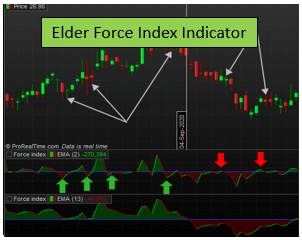

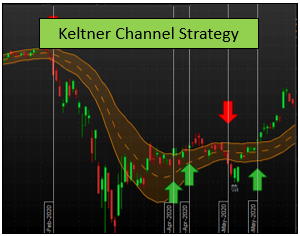

In any case, if you are looking for an indicator that provides more signals, we would recommend you to take a look at the Relative Strength Index indicator, which is one of the best, if used correctly.