Brokerage Cash Account vs Margin Account – Explaining The Main Differences Of 2 Of The Most Used Accounts In Trading

One of the main questions we might ask ourselves when opening a brokerage account is choosing a cash account or a margin account.

In this article, we will be reviewing what these two accounts are and what we can do with them.

We will also be stating the main differences between the cash account vs margin account, and we will take a look at which one we should use, depending on our intentions in the market.

Let us begin!

Table of Contents

Why are there two brokerage account types?

When we open a broker account, we will find two accounts that we can create: the cash account and the margin account.

To understand what is the difference between them, we need to explain some concepts about short selling stocks.

Some details about short selling

Whenever we buy a stock, we will use our own money to get the shares. That is pretty obvious. However, when we short sell the stock, we may not be using our money actually.

In these cases, to open a short position, the broker will ask for some money to cover the sold stocks.

Suppose that we open a short position of 100 shares at 10$ with our 1000$ account, and then the stock price begins to rise to 11$. Just like we saw in the short position explanation article, the broker will allow us to open the trade if we have at least 1000$ in our portfolio.

However, our open position now is exceeding that threshold in 100$. We could think that would result in the broker closing out our position immediately because we have exceeded the limit, right? Well, that is not exactly the case.

Typically, a brokerage firm will provide us with some extra money they lend us for this kind of situation. For example, a brokerage firm may lend us 30% more of the value of our entire account to provide some margin for the position to close.

An example to help you understand the short selling mechanism

In our example, our account value is 1000$, but the broker provides us 300$ extra for us to use as we want. If we exceed that value, the broker will close our trade immediately because we have exceeded the money they can lend us.

When this situation happens, they will send us a margin call to warn us that we have surpassed the limited threshold.

In some situations, they may charge us with a penalty for exceeding these limits, but that is up to the brokerage firm policy.

Now that we know how the mechanism of the short sell works, we can explain the different account types.

What is a cash account?

The cash account is the first type of brokerage account that we can use to open trades in the market, and it is actually the most basic one.

With the cash account, we tell the broker that we will only be using our money to trade or invest in the market. That means we will NOT be able to open a short position in the market with the cash account.

As you can see, the cash account is more focused on the investors rather than the traders for the mere fact that an investor is more likely to buy instead of short sell.

Is it possible to practice day trading with a cash account?

One of the main restrictions of the cash account is that if we decide to buy some shares and immediately sell them, we will not be able to use the money we have used in the trade until the next two labor days.

That makes day trading with a cash account not impossible but quite complicated because we will be limited by our own account size.

So yes, we can day trading with a cash account, but with quite many restrictions. However, if we intend to day trade, the best thing we can do is to use a margin account instead.

What is a margin account?

The margin account will allow us to borrow money from the broker a certain percentage (for example, the 30% we explained before) to buy or short sell stocks.

One of the main differences from the cash account is that we will receive more money to trade with the margin account.

However, it is absolutely crucial that we do not take for granted that money. The amount we receive from the broker is not ours, so we should not treat it like it is.

Psychologically, it is very dangerous to think that we have some money that is actually from the broker. The reason is it can make us act more impulsive because we may feel that we have more money to use, but that is not true.

How does a margin account work?

The biggest advantage of the margin account is that the restrictions of the money availability we had in the cash account after opening and closing a trade just disappear.

With a margin account, we will have our money immediately in our hands once we have closed a trade. So yes, trading or day trading in a margin account is the optimal thing to do.

However, we should be aware of the Pattern Day Trading rule established in the United States market, which will prevent us from day trading 3 times in 5 labor days in a margin account if our account amount is under the 25000$.

If we break this rule, our account will be restricted to trade for the following 90 days. That is the biggest disadvantage of the margin account in the United States. So we should be careful with this if we intend to trade in these markets.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

Most common questions about the cash account and the margin account

Once we have explained the differences between the cash account and the margin account, we will be covering some of the most frequent questions that we may have regarding these accounts.

How long does it take to execute a stock trade?

How long does it take to buy a stock?

Once we have issued an order to the marked and this one has been filled in both cash and margin accounts, the stock will be bought.

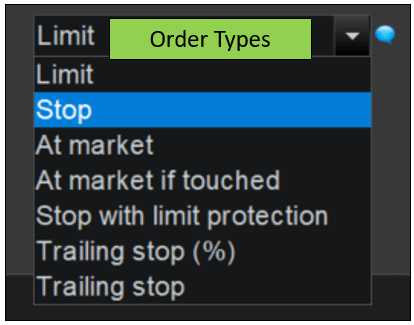

There is no difference in the time it takes to buy a stock regarding the account type we use. What can change the time to buy the stock is the order type we may issue in the market.

How long does it take to sell a stock?

Again, there is no difference between the account type we use. What it can make change the time to sell the stock is the order type we may issue.

How long do you have to hold a stock before you can sell it?

Once we have bought a stock, we can hold it as long as we wish before we can sell it. There is no restriction. We can have the stock for 1 minute, 1 second, 12 days, or even years.

Once we have paid the shares, we can do whatever we want with them.

How long do you have to wait to buy a stock after selling it?

Again, there is no restriction to repurchase a stock once we have sold it.

However, we must be aware that if we have a cash account and we have sold the shares of a stock, we will not have the money available for the following two labor days. Nevertheless, if we have enough liquid money to cover the repurchase, we can buy them at any time.

We do not have any restrictions with the margin account, apart from the Pattern Day Trading rule we discussed previously.

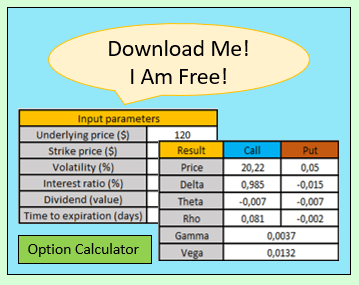

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Should I open a cash or margin account?

That depends on what you intend to do in the market.

If you want to focus on the long-term investment, we recommend you stick to a cash account.

However, if you want to swing trade or day trade, the best thing is to jump to a margin account because you will have the money immediately available once you close a trade.

If you intend to day trade in the United States market, you should at least have the 25000$ to abide by the Pattern Day Trading rule.

If you want to deepen more about this matter, in this article we explain why you need 25k to day trade.

Nevertheless, if you only are going to swing trade, it does not really matter to have the 25000$ while you consider the rules we explained before.

Last words about the cash account and the margin account

As you can see, the differences between the cash account and the margin account are not very wide, but we need to learn them before opening a brokerage account.

The cash account is more focused on long-term investors trying to profit from dividends or value investing.

The margin account is focused on the traders, providing them with liquidity and allowing them to trade in any direction they want.

We highly recommend using a margin account if you want to trade, day trade, or trade with options.