Vortex Indicator – A Multipurpose Tool for Entries and Trends

The Vortex Indicator is a trend following and a signal provider tool that will help us to spot entries in any asset of the market.

It is an indicator that has some resembles to the Aroon indicator.

In this article, we are going to review what is the Vortex indicator exactly, how to use it, and how to apply some of the Vortex indicator strategies. Also, we will look for a good intraday setting that will allow us to profit from an asset using either options or stocks, buying or selling call or puts.

Let us begin!

Table of Contents

What is the Vortex Indicator?

The Vortex Indicator is a trend following tool that will help us to determine a positive and a negative trend movement separately.

How does the Vortex Indicator work?

It is composed of two lines.

The Vortex Indicator Positive (or VI+) will measure the distance between a previous low and a subsequent high.

The Vortex Indicator Negative (or VI-) will measure the distance between a previous high and a subsequent low.

Using these two lines, we will be able to generate entry signals and spot opportunities on the asset.

Fortunately, this indicator is included in the vast majority of the charting and trading software, just like with ProRealTime in its free version.

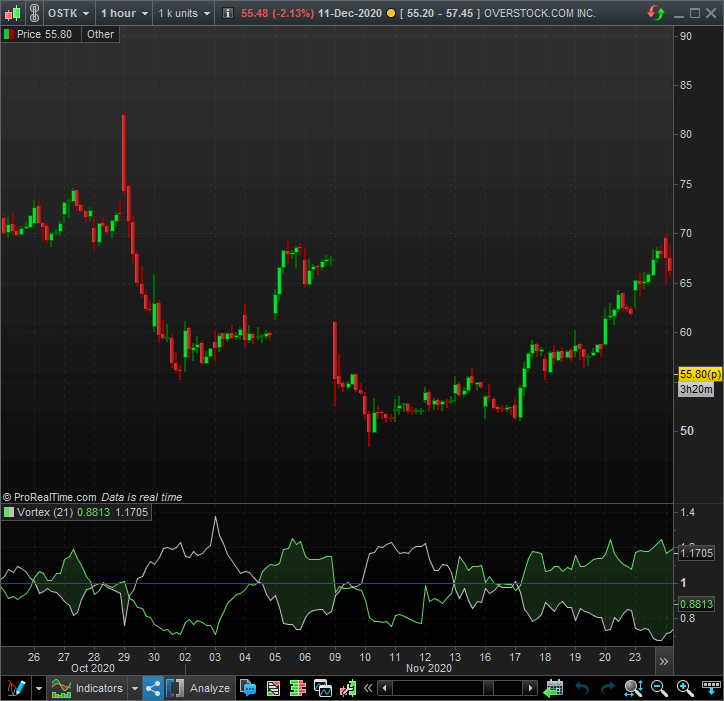

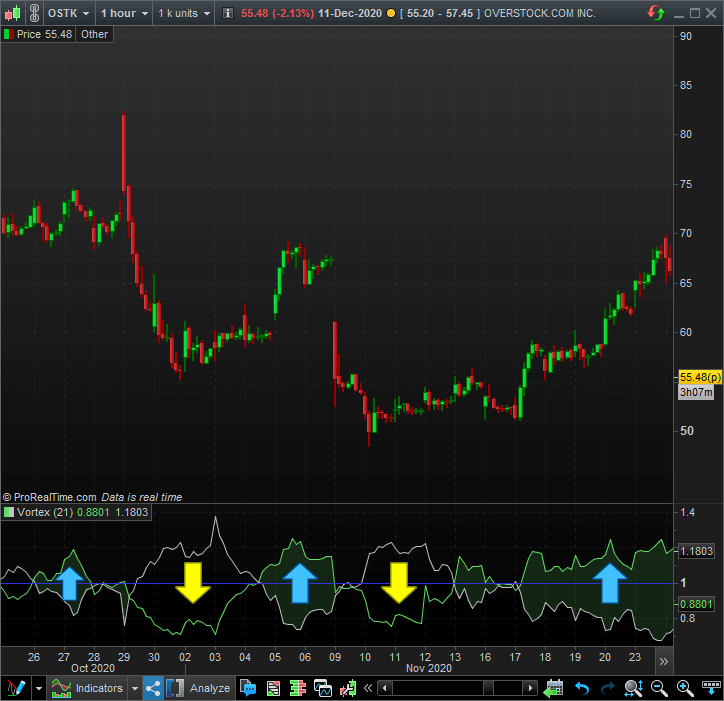

To have a better understanding of how this indicator works, let us take a look at the following graph in which we have represented the Vortex indicator over a stock in a 1-hour time frame.

In the image above, the Vortex indicator is represented at the bottom of the chart. The green line represents the VI+ while the white lines stand for the VI-

Whenever the VI+ is above the VI- we will say we have a bullish trend in the asset.

On the contrary, when the VI- is above the VI+, we will say we are in a bearish trend in the asset.

As you can see, the blue arrows marked in the Vortex indicator represent the bullish trend over the asset, while the yellow arrows represent the bearish periods.

How to use the Vortex Indicator Strategy?

Unlike other indicators, this one has only one type of strategy we can use to spot bearish and bullish signals in the market to create a valid trading system.

- Bullish signal: When the VI+ crosses over VI-

- Bearish signal: When the VI+ crosses under VI-

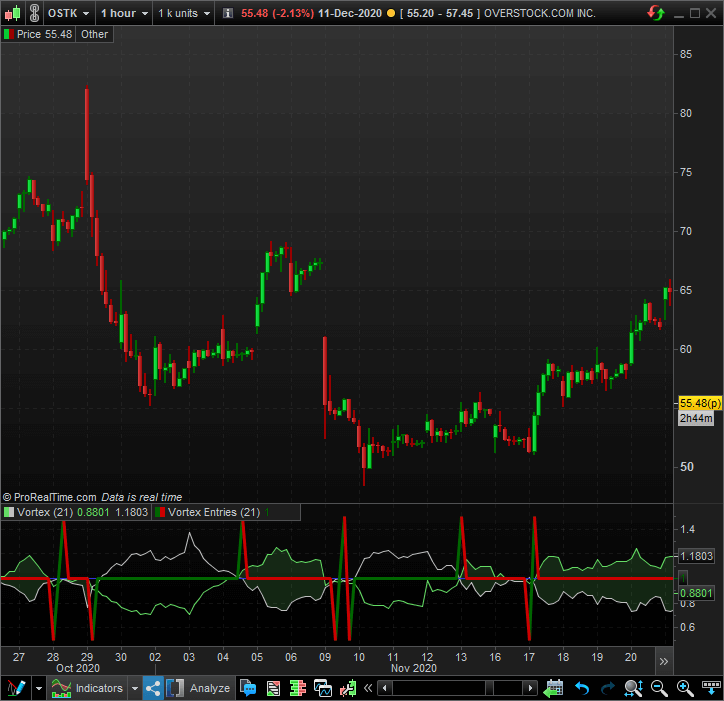

To help you understand the bearish and bullish signals with this indicator, we are going to create a little code to show you clearly the entries of the strategy.

In the previous image, we can see marked with a bullish spike the bullish signals from the Vortex indicator strategies. At the same time, the bearish spikes are also indicated in the chart.

In some situations, the indicator provides false signals, but if we managed to filter them, we might encounter a relatively reliable indicator to trade.

For example, a good Vortex indicator strategy could be the following:

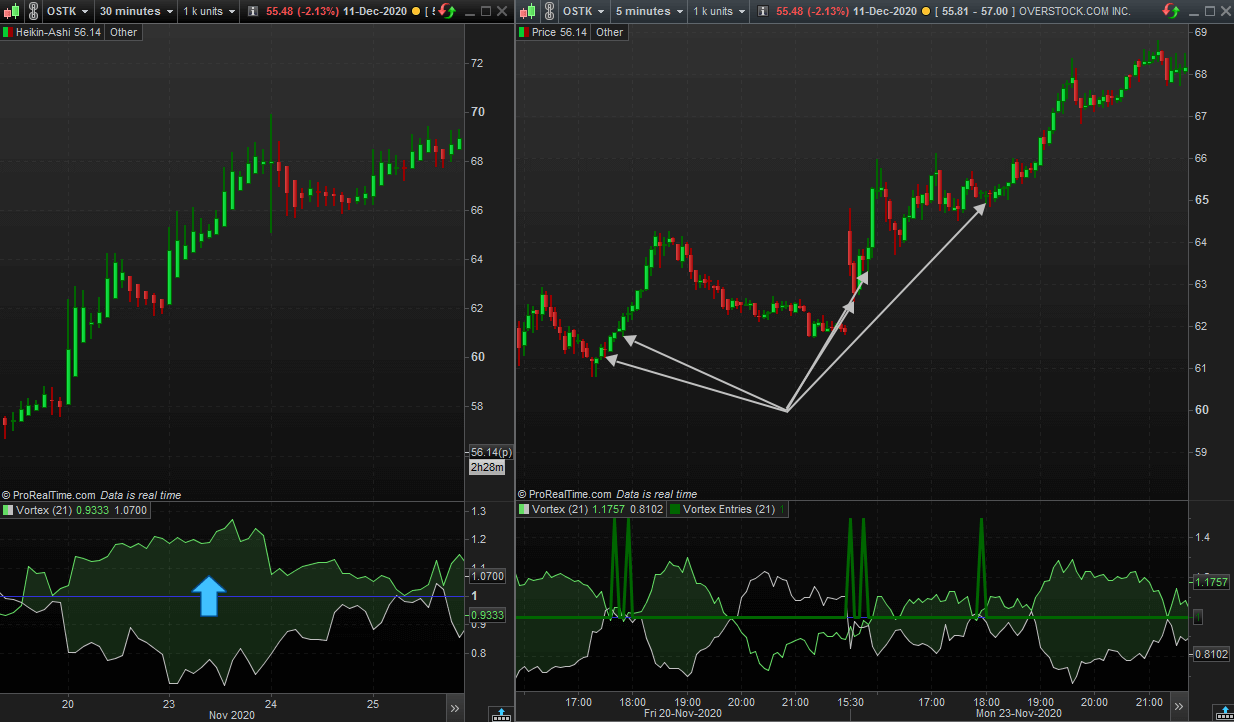

- Using a longer time frame to determine the current trend of the asset, for example, a 30 minutes chart.

- Using a shorter time frame, like a 5 minutes chart, to make the entries and exits following only the direction of the longer-term chart.

- Using the Vortex indicator for intraday as a signal provider.

Let us take a look at the strategy described in the following example.

In the left chart, we can see the 30 minutes time frame marking a bullish trend in it.

If we decided to use a 5 minutes chart with the Vortex Indicator strategy, we should only pick those bullish signals, as we are right now in a bullish long-term trend.

Every bullish signal we spotted in the 5 minutes chart would be perfectly valid, as we can see in the right image of the chart.

This is a very good way to use the Vortex indicator for intraday.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

Which is the Vortex Indicator formula?

The Vortex Indicator calculations are quite complex compared to other indicators. We must divide it into four parts to fully calculate it. Let us break it down piece by piece.

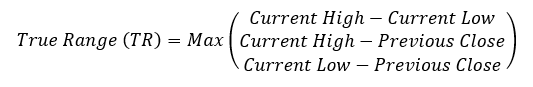

- First, we have to calculate the True Range, that comes from the Average True Range indicator

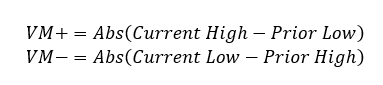

2.Second, we must obtain the uptrend and downtrend movement

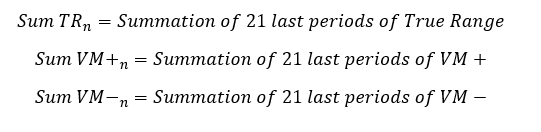

3. Third, we should choose the parameter length. If we choose, for example, 21, we must now…

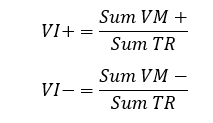

4. Fourth, calculate VI+, VI- and finish the Vortex Indicator formula

And that is how the Vortex Indicator formula works.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Last words about this indicator

As you can see, this technical indicator is quite useful to determine the trend of the asset we want to trade, but not very reliable if we decide to take its bullish and bearish signals without filtering with a trend following indicator.

As always, we recommend you to play with the indicator first before, including in your trading or investing strategies.

Performing a backtest of the Vortex Indicator could help you to avoid false signals and allow you to perform a better use of it. Also, remember to use different volume indicators combined with the market order types to cut losses and maximize gains.