Put Ratio Backspread Option Strategy – High Risk, High Probability of Winning to the Bears

The put ratio backspread strategy is a unique technique that provides us almost a guaranteed profit with a high level of risk.

This is a strategy that may not be very suitable for any investor because of the severe danger that we may be facing if the trade does not work as intended

In this guide, we will learn what is a put ratio backspread, how to use it, and how to configure it to take the best from it. Also, we will learn the put ratio backspread risks and the profits so we can understand how it really works.

Table of Contents

What is a put ratio backspread strategy?

A put ratio backspread strategy is a particular strategy that provides us with more money when the underlying approaches to the risk zone until a certain threshold.

The put ratio backspread allows us to make a limited profit when the asset rises its value. At the same time, it has a peak of profit when the underlying comes close to the danger zone.

However, if the price of the asset comes down under a certain threshold, the losses we can obtain are quite huge and we could end up owing money.

It is a very high-risk strategy but with a very high probability of profit. In some cases, it is almost a winning trade if we decide to open it.

How is a put ratio backspread option strategy composed?

To create the put ratio backspread strategy and to profit from it, the most typical approach is to sell a very high number of Out of The Money put options while at the same time, buy a few At The Money or slightly Out of The Money put options.

The aim is the selling put options will pay for the bought puts while trying to keep a specific net credit that will be our maximum gain if the underlying rises in value.

The reason we will be buying the puts is to protect ourselves in case things go against us.

When to use the put ratio backspread strategy?

The put ratio backspread strategy is better used with an asset that has a very high value, and when we are sure that it is going to rise over time.

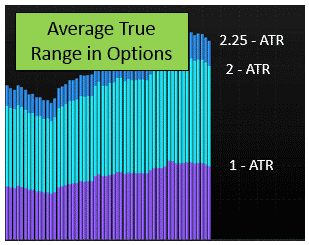

We highly recommend you to use any kind of technical indicator to help you carry out this strategy. For example, we would use the Relative Strenght Index indicator and the Average True Range because they will help us identify thresholds.

Just like with the call ratio backspread, with the put ratio backspread strategy, we are trying to reduce the risk when the price of the asset approaches the danger zone. As we are dealing with a selling strategy, our primary focus is to keep the premium we have received for opening it.

The best way to understand how the put ratio backspread risk and profits work is by providing an example.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Put ratio backspread strategy example

Let us suppose we wish to trade a put ratio backspread strategy over the QQQ, which is the ETF that replicates the behavior of the NASDAQ Composite Index. Due to the pandemic, the market is becoming quite turbulent, and the general lockdowns are creating a bearish market.

However, we believe we are at the bottom of the market and from now and on, the trend is going to change to the upside. Also, we are going to use the implied volatility in our favor to open the put ratio backspread strategy. As we believe that the market is not going to fall anymore in the next month, we will be opening the strategy.

In this case, as the QQQ stock price is today at $274, what we will be doing is to sell quite a lot Out of the Money put options at the strike price of $250 while at the same time, we will be buying an At The Money put option whose strike price is $275. We can assume the volatility in both cases to be at 36.56% to simplify the matter.

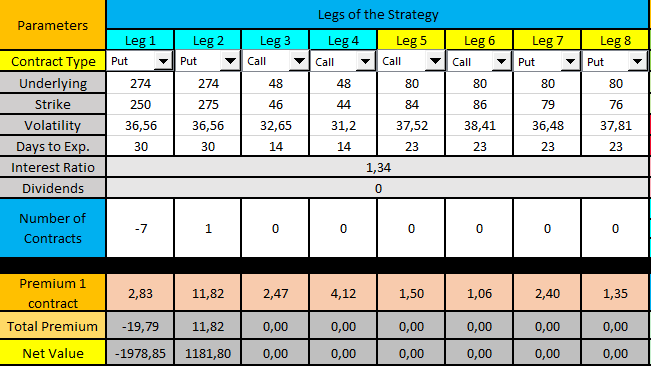

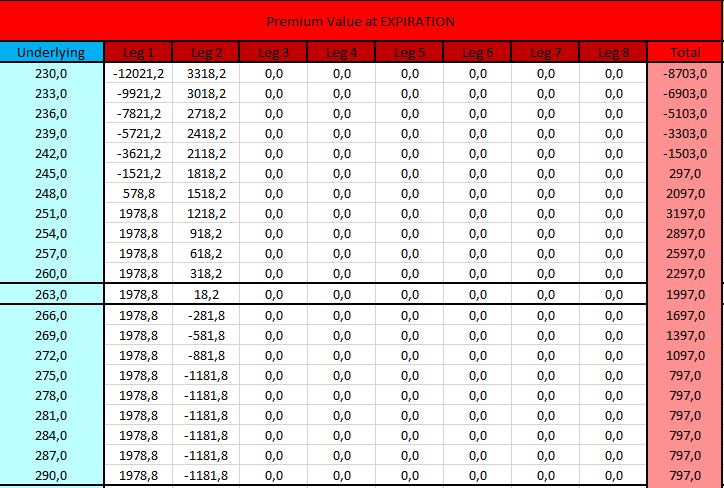

Let us take a look at the put ratio backspread calculator to learn the results of opening this kind of trade.

In this case, the put ratio backspread calculator is showing us the values of every branch. We can see that we will be selling seven Out of The Money put option contracts, and we will receive for them $2.83 each. At the same time, we will be buying one At The Money option contract whose price is $11.82.

In other words, if we subtracted both prices, we will find a total net income of $7.97 for opening this trade, and this is the maximum profit to the upside.

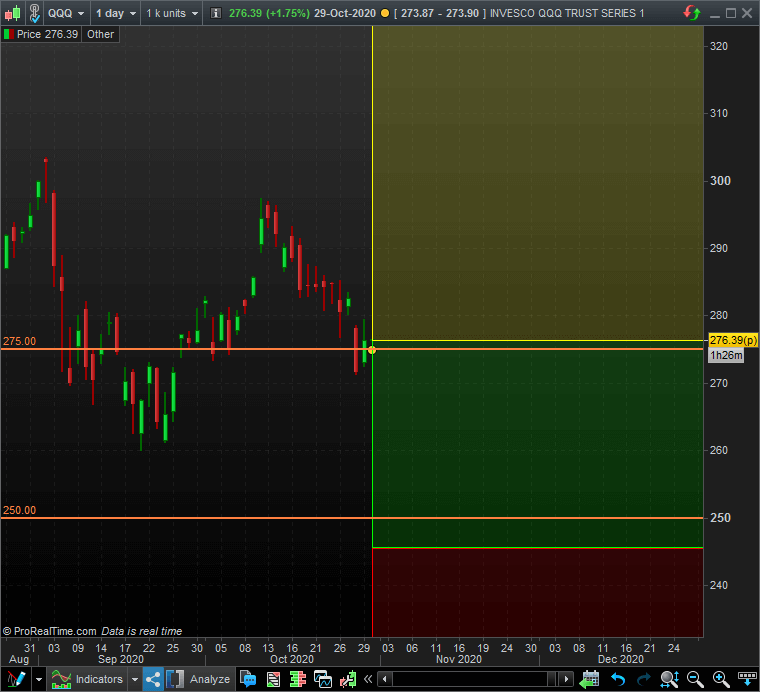

To have a better perspective of this trade, we are going to have a look at the chart, in which we will be representing the strike prices of the strategy.

Breaking down the Put Ratio Backspread option trading strategy

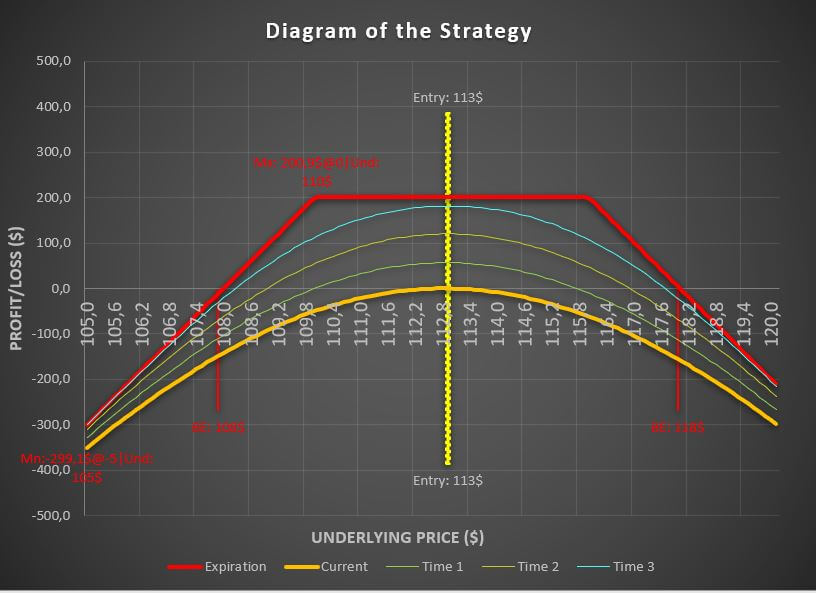

In the previous image, the orange lines represent the strike prices of the put options we are trading. Now, we need to focus on the colored areas of the chart.

The yellow area represents the limited gain we will obtain if the QQQ stock price goes up. This limited gain is determined by the premium we received by opening our put ratio backspread strategy.

The green area represents a more significant profit obtained by the put options we have bought. If the QQQ stock price stays in it at the expiration, we will receive more money than the yellow zone.

The red area represents the risk zone, and this particular one is unlimited if the stock price falls. However, we must consider that we have set the risk zone under the lowest value of the Nasdaq in several months, so it is quite improbable that we could lose any money under the circumstances we are facing right now.

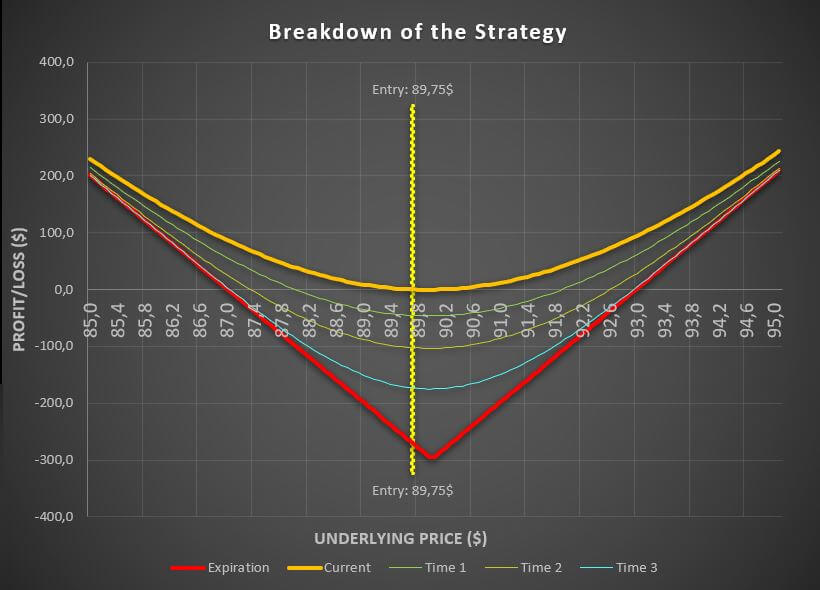

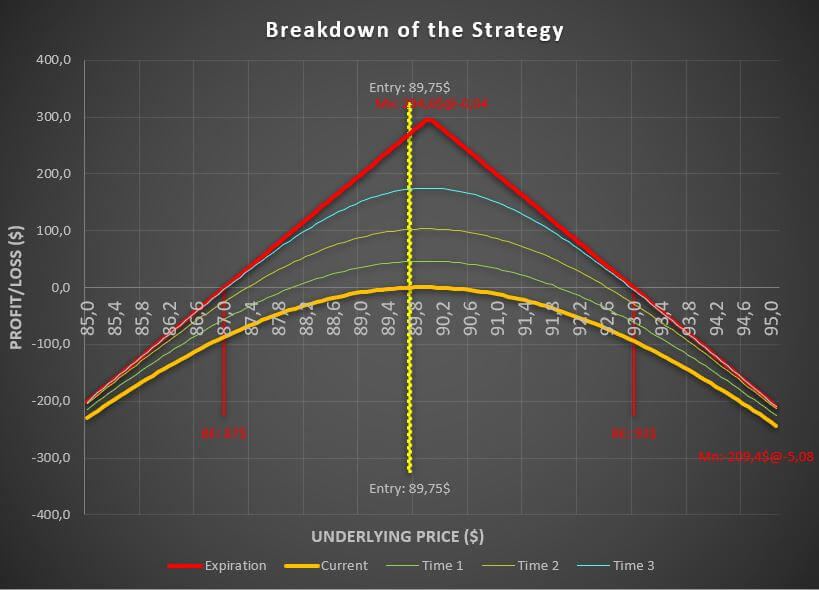

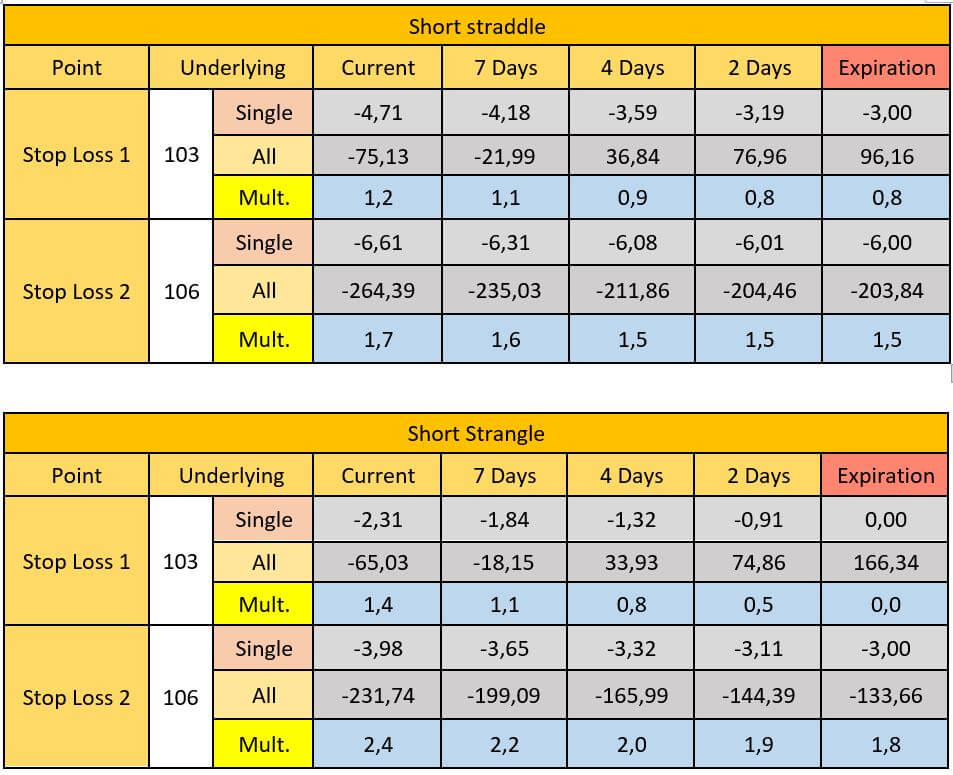

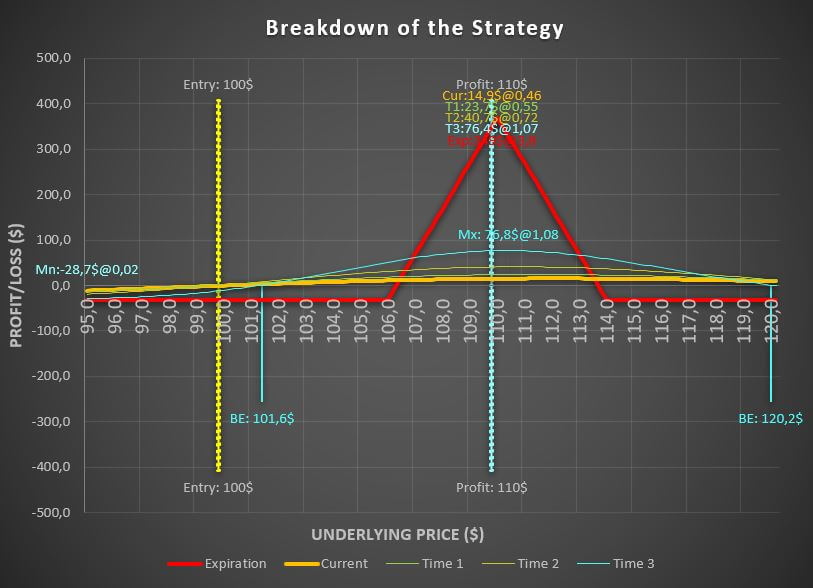

To fully understand the put ratio backspread risks, the best thing to do is to show the payoff diagram of the strategy.

Put ratio backspread risks and payoff diagram

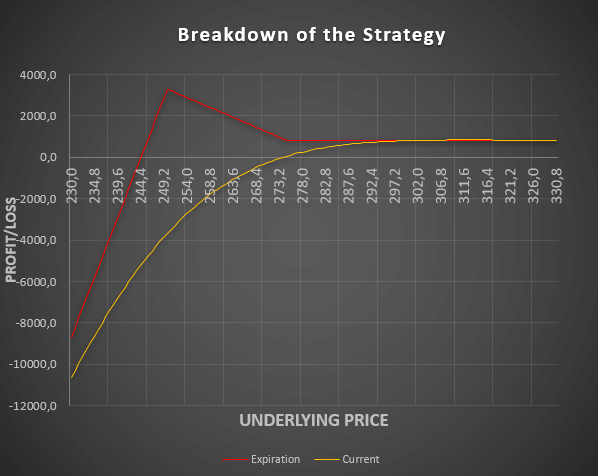

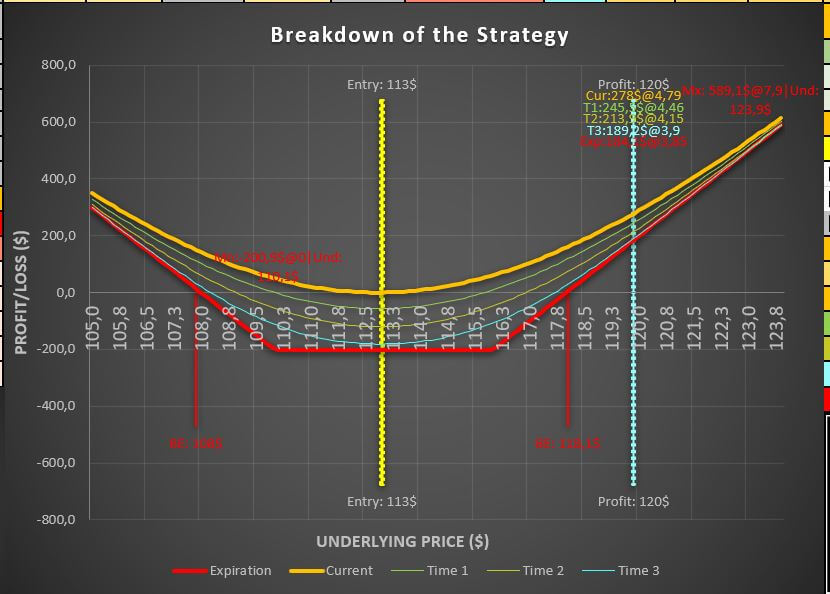

To represent the diagram, we have used our option strategy calculator, in which we will be able to see the expected results at the expiration date.

As you can see in the put ratio backspread calculator, we have a limited profit to the upside, which would be the net credit we received when we opened the strategy, which was a premium of $7.97.

However, if the stock price begins to fall while is trying to reach the shorted put options, the money that the put ratio backspread strategy generates becomes higher and higher.

When the stock price reaches a certain threshold, about $245, the strategy will generate an enormous loss, unlimited because of the shorted puts.

The unlimited losses of this strategy is what makes it a very, very dangerous technique if we do not treat it carefully.

Put ratio backspread strategy margin requirement

As with any other option strategies with a short-selling leg, the put ratio backspread will also require a margin by the broker. In other words, we are going to need a margin account to be able to execute this trade.

However, the margin the broker is going to ask us is enormous because we are shorting many Out of The Money options. To be able to perform the put ratio backspread strategy, we are going to need a considerable amount of money as the strikes are quite far away in between the option chains.

Last words about the put ratio backspread option strategy

The put ratio backspread strategy is a very, very high risk, high probability of profit strategy. This one is always better used with assets whose prices are relatively high because it will allow us to sell Out of The Money options that are far away from the current market price.

We should keep in mind that, to perform such a strategy, we must be sure about what we are doing. If we have any doubts, we could always use a limited risk strategy, just like the bull credit spread or the bear credit spread.