Option Strangle Strategy – Making Money Either If Market Goes Up and Down

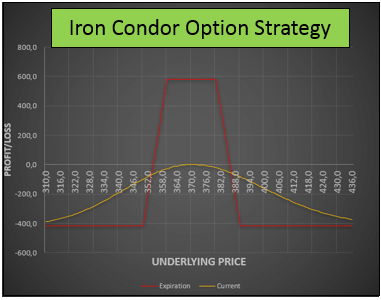

The option strangle strategy is a rather interesting strategy that will help us to take profits in two diametrical opposed scenarios, allowing us to make money if the market moves or if it does not move at all, just like the Iron Condor or the Straddle, but with its own particularities.

In this guide, we are going to take a look a what is a strangle option exactly.

We will learn both long and short strangle option strategies, and we will take a look at how to make money on both of them.

Table of Contents

What is a strangle option?

The option strangle definition says that in order to open this position, we will need to either buy or sell two Out of the Money contracts, a call and a put, simultaneously.

How does an option strangle work?

Depending on the type of option strangle strategy we want to open, there are two ways to configure the strangle.

- If we buy a long strangle, we will be able to profit from both directions in the market

- If we sell a strangle, we will profit from the lack of movement of the market.

Let us take a better look at this…

What is an option long strangle?

The long strangle option strategy consists of acquiring an Out of The Money put contract and an Out of The Money call contract simultaneously.

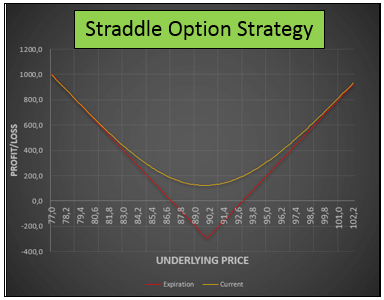

As you can see, the difference with the straddle option strategy is, this time, we are not buying the contracts as At The Money contracts.

When to use the long strangle option strategy?

We should use this strategy when we are not sure about the direction of the market, but we expect a very strong move in either direction.

Even when it seems a very useful strategy, the truth is, the long strangle option strategy is hard to use because we really need a powerful move to be able to cover the premium we paid for the options we bought.

Let us take an even deeper look with an example so we can understand it better.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Long strangle option strategy example

Let us suppose we are going to open a long option strangle over Match Group stock. The stock price today is at $113, and we are expecting a big movement in the stock due to the earning reports that the company is about to publish.

As we are not entirely sure how the general sentiment of the report is going to affect the stocks, we are going to open a long strangle option strategy, so we are confident we are taking part in the movement.

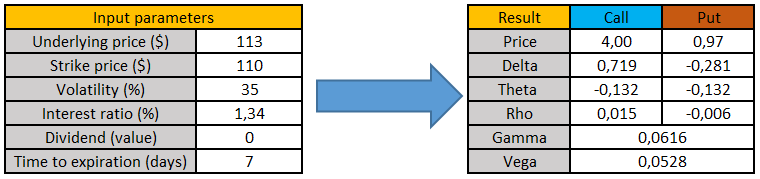

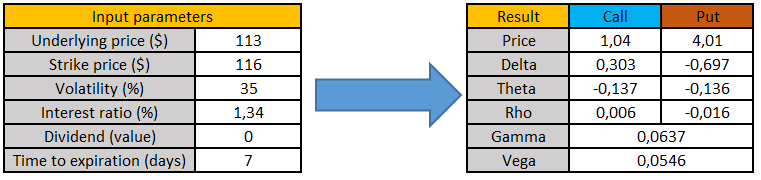

For this reason, we will be buying the Out of the Money call option $116 strike and the Out of The Money put option contract, whose strike price is $110. In both cases, the volatility is about 35%, so let us take a look at the calculators to discover how much we are going to pay to open the position.

Long strangle option strategy: Out of The Money Call Option

Long strangle option strategy: Out of The Money Put Option

As you can see, in both cases, we are taking a seven days expiration period. In the call option, we will need to pay $1.04, and for the put option, we will need to pay $0.97. So, in other words, to be able to open the long strangle, we have to pay $2.01 in total.

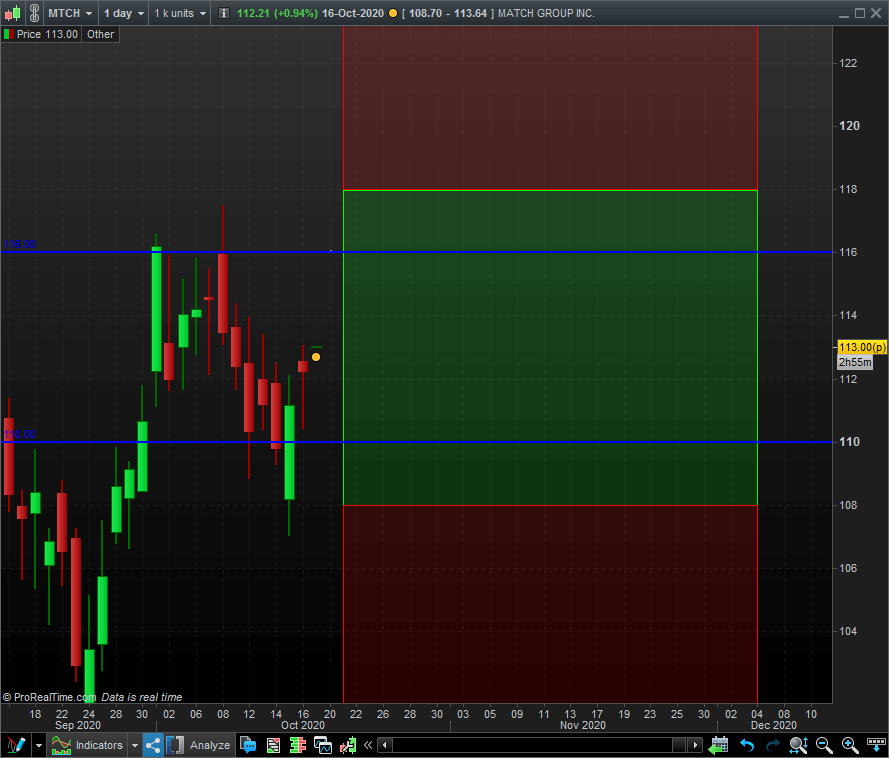

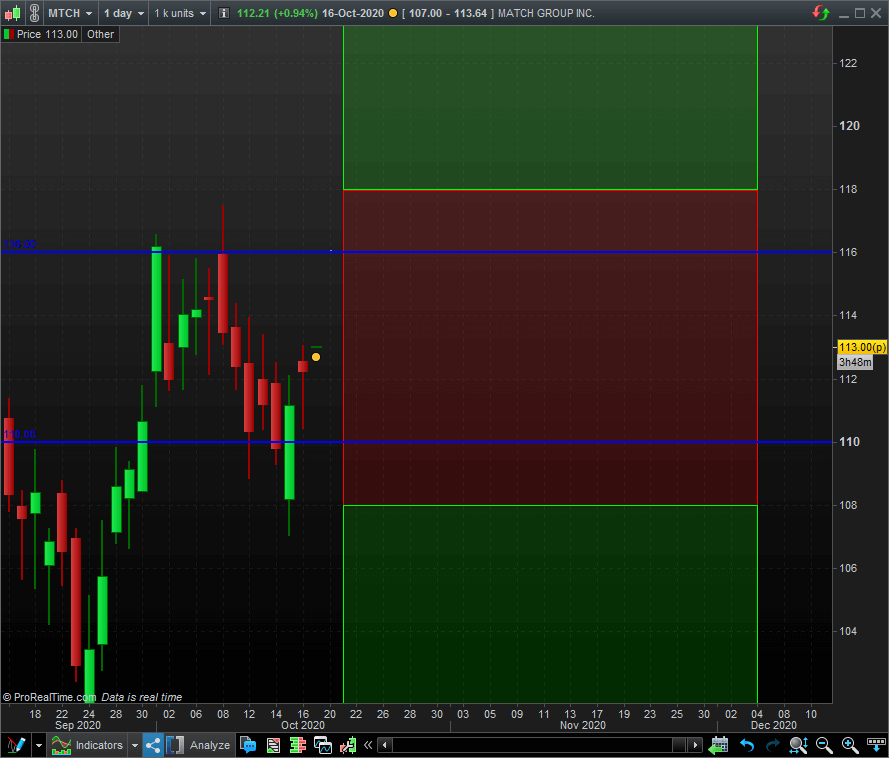

Now, we should expect that the earnings reports provide a strong movement in the market. However, to be able to identify how far should the stock price needs to move, the best thing is to take a look at the chart provided by ProRealTime charting software.

The blue lines marked in the chart represent the strike prices of both contracts. The red area is the zone in which we will lose money with the option strangle strategy. The green zone indicates the are in which our long strangle strategy will make money.

As you can see, in order to make some money, the stock price has to rise quite above the call option strike or fall quite below the put option strike, and that is a very hard thing to happen.

Long strangle option strategy payoff diagram

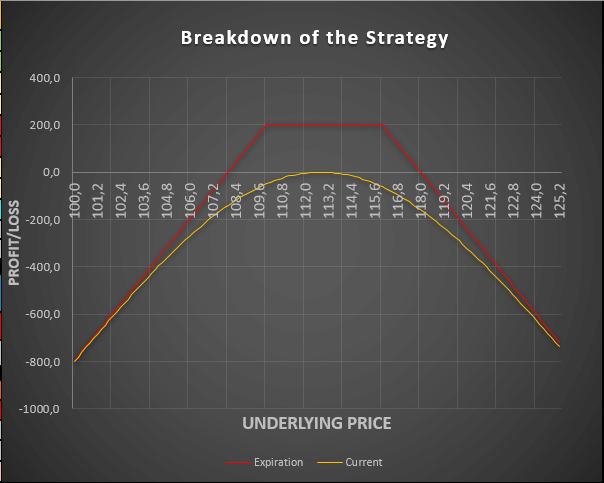

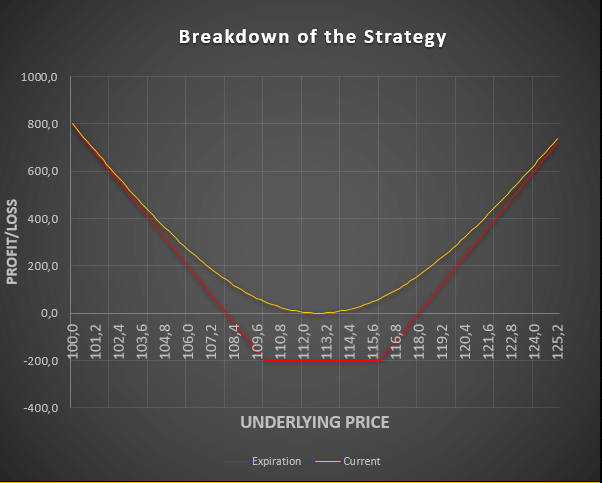

To understand a little better how our long strangle option strategy works, the best thing to do is to graph the performance of the strategy with our Advanced Option Trading Calculator Excel

As you can see, when the expiration date approaches, the value of our option strategy decreases because of the time decay the long Out of The Money contracts have.

If, before the expiration date, the stock price manages to close up near the strike price, we might still make some profits. However, such a movement is hard to see in the near term.

Long strangle option strategy margin requirement

In this case, as we are dealing with long Out of The Money contracts, the broker is not going to ask us for any margin requirement. In other words, we will be able to execute this trade using a cash account.

The reason is because the highest loss we can achieve is already determined by the money we paid to open the position, and nothing more.

What is a short option strangle?

The short strangle option strategy consists of selling an Out of The Money put contract and an Out of The Money call contract simultaneously.

However, in order to do this, we are going to need to have a fairly high amount of money in our account, as we are trading with margin. As you can deduct, we are going to need a margin account to be able to execute this trade.

When to use the short strangle option strategy?

We should use this option strangle strategy when we are not expecting any strong movement in the market. In other words, this strategy works best when the stock price is flat.

However, we must be cautious. As we are selling two contracts simultaneously, there is always the risk that the stock makes a very strong move in one direction or another, so this could make us face a high-risk situation if we are not aware.

Let us take a look at another example, but now selling an option strangle.

Short strangle option strategy example

Following the previous example with Match Group stock, let us now suppose we believe that instead of a strong movement in the market due to the earnings report, we expect the price to stay flat.

In these case, we are going to take the exact same trade, but this time, we will open a short strangle option strategy.

Short strangle option strategy: Out of The Money Call Option

Short strangle option strategy: Out of The Money Put Option

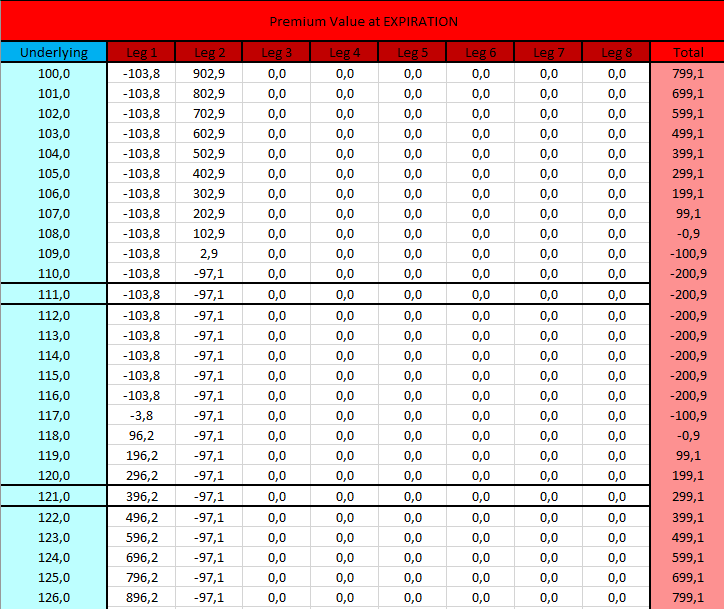

Taking the exact same strike prices, when we open this option strategy, we will receive $2.01 instead of paying them. So, for our strategy to fail, the stock price should rise above $118 or fall below the $108 threshold.

It is exactly the opposite situation we found in the long strangle option strategy.

The red is found above $118 and under the $108 threshold, while we will keep the premium the buyer paid us if the stock price remains in the green área.

However, in the red área, the risk is unlimited, as the price could fall or rise much more, but as you can already imagine, this is very unlikely to happen.

Short strangle option strategy payoff diagram

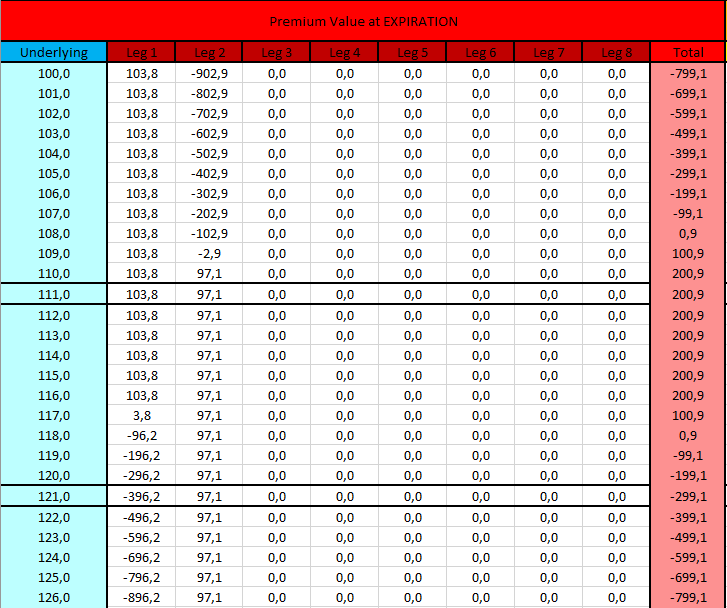

To understand a little better how our short strangle option strategy works, the best thing to do is to graph the performance of the strategy with our option profit calculator excel

As you can see, the short strangle option strategy payoff diagram is exactly the opposite we found with the long option strangle strategy. In this case, time decay benefits our trade as we are dealing with Out of The Money options.

In the previous table, you can check the exact values we could expect at the expiration date, which, again, they are the opposite we found in the long option strangle strategy.

Short strangle option strategy margin requirement

In this case, as we are shorting Out of The Money contracts, our broker is going to ask us quite a lot of money to let us open the trade. The reason is we must provide insurance that, in the case, we end up assigned, we can pay the buyer the money we have to.

Even when it is not very probable that any of the branches of the option strangle strategy ends up assigned, the broker will not allow us to open it unless we have the margin necessary. So, if you happen to have a small account, you may not be able to open the trade.

Last words about the option strangle strategy

An option strangle is a strategy with a multipurpose perspective, depending on the side we choose.

As a buyer, we should use the option strangle strategy whenever we feel that the market is going to make a very strong move in either direction.

As a seller, we should use the option strangle strategy whenever we believe the stock price is going to stay in a certain area.

Of course, there are other option trading strategies we can use to profit from both of these situations, but this is how we will make a better use of the option strangle.