Learning how to read an options chain is essential when trading options. This is one of the most important things we need to learn.

To be able to trade options, reading option chains is crucial because we will find every single piece of information around the contracts available, from the strike price to the implied volatility, even the estimated probability of winning the trades.

In this article, we are going to learn how to read an option chain correctly, taking a look at every detail we need to trade call and put options properly so we can create more advanced strategies such as the Iron Condor or the call ratio backspreads.

Let us begin with the most basic, which is…

What is an option chain?

An option chain is the standard format in which a broker displays every single option contract available for a particular stock or asset.

Using an option chain, we can trade either calls or puts. In the options chain, both traders and investors will be able to consult different parameters related to the options, such as the strike price, the greeks, the premium, and the volume of contracts currently traded.

What the options chain does not provide is the historical data of the contract, only the current data.

Almost every stock has an options chain. There is an options chain for Tesla, for Apple, for AMD…

How does the options chain work?

An options chain will be displaying all the relevant information of an option.

The most common parameters will be the premium, the strike price, the volatility, but in the vast majority of the brokerage platforms, we will be able to modify those parameters to include the ones we are interested in.

How to read an options chain?

Reading option chains can be quite complex when we are starting, due to the amount of data they provide. However, with time, you will find it is quite easy and straightforward.

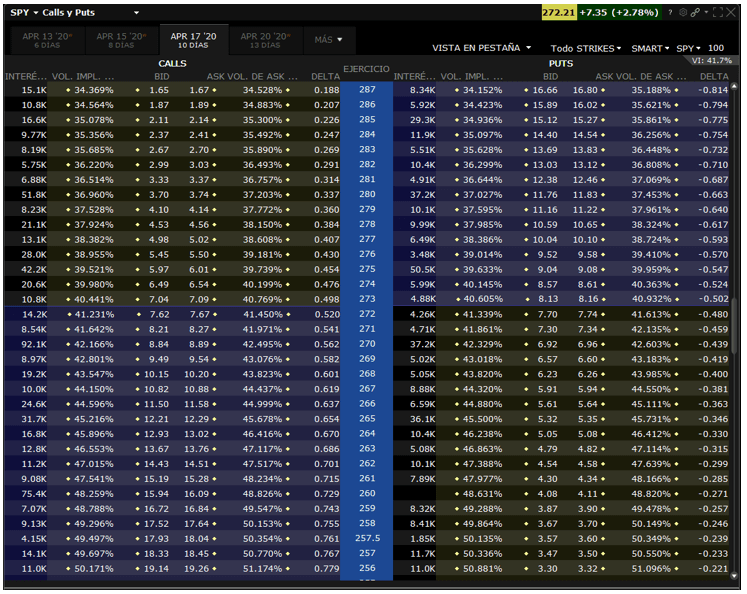

Let us take a look at an example using the SPY (SPDR), the most liquid ETF options in the world.

How to read an option chain: SPY option chain last changes

As you can see, there is a lot of information displayed on the screen about the last trade registered in the chain.

To be able to learn how to read an option chain correctly, we are going to break it down and analyze every data displayed.

Reading Option Chain Data

The Volume in the options chain

Let us begin from left to right.

The first column will show us the volume of contracts that are being traded. As with the stock trading volume, the options volume is vital to understand how liquid the trade will be and how easy is to open or close a trade.

We should be aiming to a high volume to avoid the large spreads between the bid and the ask and for our trade to exit correctly.

Let us suppose that we have a stop loss placed over an options contract that has almost no option volume. If the underlying price begins to move against us and the stop-loss zone is reached, in this situation, it is most likely we may not be able to exit the position as easily as we would like to.

We should be aiming to find, at least, a minimal volume of one hundred contracts exchanged in the options chain.

The Open Interest in the options chain

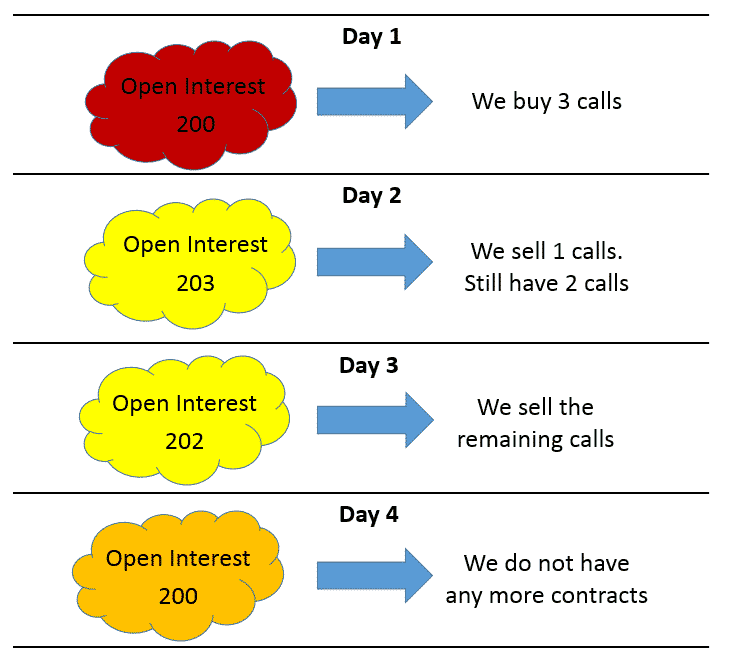

Open interest is the number of active contracts of a strike price of the options chain. It will show us the total number of contracts that other traders still have opened but are yet to be exercised, assigned, or closed.

In other words, it is the number of open positions in the options market for a particular strike. For example, if we decide to acquire 3 call contracts and keep them for a few days, the open interest in the current strike will increase by 3 points, as we have an open position in our account.

We discussed the differences between volume and open interest here, with much more details and with examples.

The Implied Volatility in the options chain

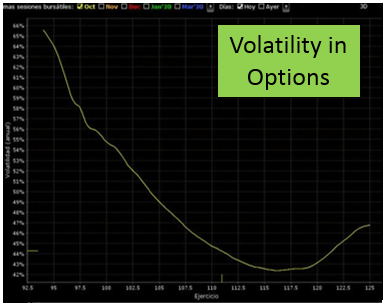

Following this guide about how to read an option chain, the next parameter is the Implied Volatility on both the bid and the ask sides of the strike price.

In the options chain, we will find two implied volatilities, one for the bid and another one for the ask price. Typically, you will find that the buying side has higher volatility compared to the selling side.

In any case, we should expect a difference of 4 to 5% between the bid and ask for those options chain that has the highest volume.

How to read an Option chain with Implied Volatility

Option premium in the options chain

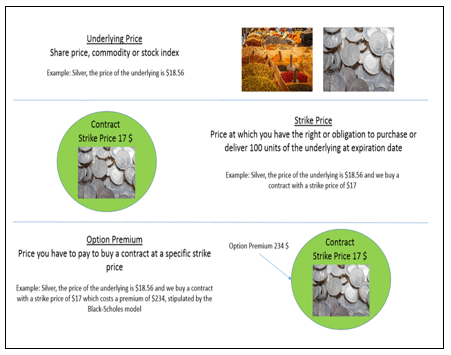

To understand how the option premium is displayed when reading option chains, we need to take a look at both the bid and the ask prices of the contract.

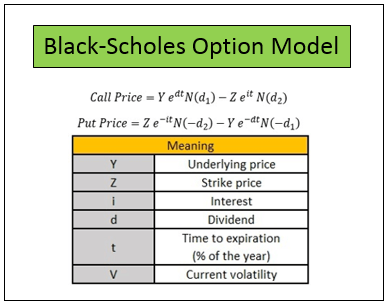

The bid is the minimum premium we need to pay for acquiring a contract. This value is calculated using both the Black-Scholes model, and it will be more accurate when as the volume becomes higher.

The ask is the minimum premium a seller is willing to sell an option contract. And again, this one is calculated using the Black Scholes model.

If you need a free options calculator to help you price the options, you can download it here alongside our free options trading guide!

The greeks on the options chain

In some brokerage platforms, the greeks are also included in the options chain. Typically, you will find the most important greeks to take into account in the trade. And in our case, we have added delta to the options chain.

If for some reason, your broker does not include the option greeks in your platform, you can take a look at our Advanced Option Profit Calculator, in which you will have a complete breakdown of the strategy you may use, as well as the greeks of every single leg.

How to read an options chain strike price and expiration date

The middle column shows us the strike prices available for the asset.

You should take into account that we will not always find strikes for every price. Only for those stocks whose shares are highly traded.

In the upper part of the brokerage platform, we can see the expiration date for the contracts. As we have already seen in this article about the most common expiration dates typically, contracts expire on the third Friday of each month.

However, there are others such as the SPY ETF whose contracts expire every two days.

Now that we know how to read an option chain, where can I find this information?

If you need to check the data provided by the option chain, every options trading brokerage offers that information.

However, if your brokerage does not provide this data, you can also check the option chain on the Nasdaq stock page in this link here.

Last words about reading option chain data

As you can see, reading option chain data is crucial for the traders and investors to be able to open a trade and to understand what is happening.

In this guide about how to read an options chain, we have covered everything we need to know to understand how to properly trade them.

In any case, before opening an option trade, we highly recommend you to use a technical analysis indicator that helps you to learn the state of the market.