Option Gamma is one of the most useful of the greeks to consider in options trading and when dealing with Out of the Money options because of the acceleration it provides to the option premium.

Like other greeks, the gamma greek is an expression derived from the Black-Scholes model of financial options.

In this article, we’ll look at what the gamma greek refers to, we will see how to apply it to our stock options trading and see how to get the most out of it.

So, let us begin!

What is option gamma?

Option gamma will tell us how much will option delta change if the underlying varies.

Therefore, by using it correctly, an option trader will be able to tell if the trade will receive a better amount in profit if the underlying stock price moves in the right direction.

Option gamma will always be a positive number. And the real use of gamma lies in the acceleration effect over the option premium of a trade.

How Option Gamma affect our contracts?

As a general rule, an contract option will begin to increase its option premium as the option becomes from Out of the Money to an In the Money. And option gamma will determine how fast that option premium will increase.

That is the reason why, if we are dealing with Out of The Money options, we should look for those contracts with the highest option gamma. That means that we will be making faster profits as the underlying moves in the direction we wanted.

To be able to identify which is the direction of the asset, we highly recommend you to use some kind of technical indicator that allows you to detect the trend. For example, we could use the supertrend indicator, that will show us the current trend of the asset.

When the Out of the Money option turns and becomes an In The Money option, the option gamma will start to decrease, as delta is reaching the unit.

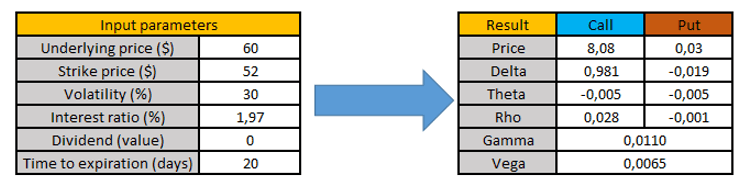

In the calculator above, you can see how delta has almost reached the unit, and there is hardly any option gamma left.

An example of Option gamma in action

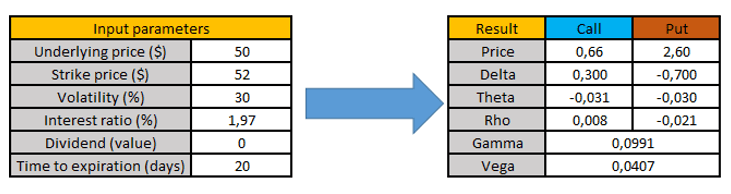

For example, suppose we want to open a trade on a company whose underlying price is currently at $50.

We will be picking a call option whose strike price is $52. Compared to another Out of the Money option, the call option we have just picked will have a reasonably high gamma, and thus, the acceleration effect over the option premium will be better.

In this case, option gamma is 0.0991. In other words, it is suggesting that for every dollar that the underlying moves to the upside, the option delta will increase by 0.0991.

When is option gamma highest?

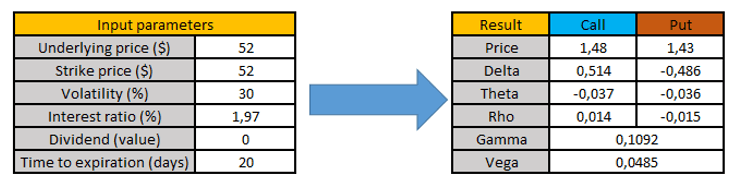

Option gamma highest value is found when the option becomes an At The Money option.

This greek will begin to decrease if the underlying moves away from that price, regardless of the direction.

In this case, option gamma highest point is 0.1092 and delta will increase or decrease that value when the stock price moves away from the strike price.

Can option gamma be negative?

No, technically, option gamma cannot be negative.

It is always a positive value that is used to add or subtract value to option delta.

Is option gamma additive?

Yes, as we could think of it as the different parts in which delta is divided.

For example, for a call option whose delta is 0.50 and with an option gamma of 0.10, if the underlying rises one dollar, the call option will have a delta of 0.60.

However, if the underlying does decrease in one dollar, delta will become 0.40.

Can option gamma be greater than 1?

No, precisely for the same reason before. Option gamma is the multiple, and different part delta is divided.

Gamma cannot be greater than 1 for the same reason that delta is not greater than one.

An option gamma greater than 1 would mean that delta is greater than 1 also, and that would be impossible because the option cannot reevaluate more than the underlying price does.

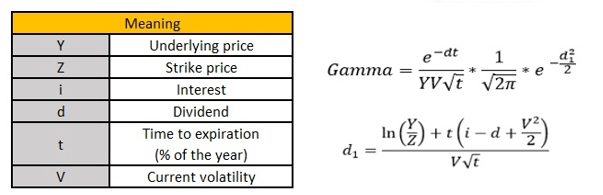

How is option gamma calculated?

The way of calculating gamma in options is derived from an expression given by the Black-Scholes option pricing model.

First, it is necessary to obtain all the parameters of the mathematical model, since we are going to need them. The expression is the following

How to calculate option gamma in excel?

If you are interested in the option calculator that we have been using in this article, you can donwload it for free along with our Options Guide too!

Last words about Option Gamma

The greek option gamma is a parameter that the buyers should always be aware of when trading slightly Out of the Money options.

If you want to learn more about how gamma affect the options, we have a detailed example in which we state the differences between an In The Money and an Out of The Money option contract in this link here.

Gamma is just one of the five more existing greeks that we can take into account when designing our options trading strategy. Among other greeks, we can find theta or rho, which will how us how time decay and dividends affect our trades.