Option rho, like the other option greeks, is a parameter that comes from the Black Scholes model of financial options, and it will allow us to see the effect that both dividends and interest rates have over our options.

Unlike the other greeks, options rho is usually considered the least important of the list because of the quality of the information this one provides to the strategy.

In this article, we are going to be learning what is rho in options, why it is not as important as the other greeks, and how to calculate it to our further trades.

What is rho in options?

Options rho is the parameter that measures how much the premium will change attending to the changes in the general interest rates of the market and the dividend issued (if the asset issues any, of course).

Options rho does not affect too much the option premium. In general, both the changes of the interest rates and dividends are quite slow and they do not impact the premium as much as other values such as the implied volatility.

So, with the rho option greek, we are measuring the impact of interest rates and dividends in our option strategy.

How does option rho work?

The easiest way to explain how does options rho work is with a practical example.

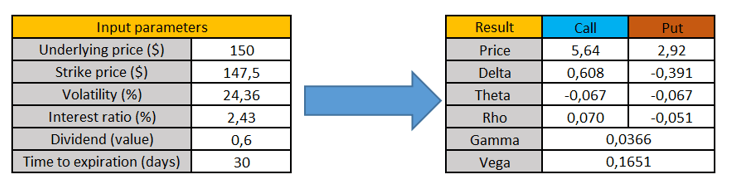

Let us suppose we are trading with an option whose underlying is about $150. If we picked a strike price of 147.5$, an implied volatility of 24.36%, and 30 days to expiration, we would have almost every parameter set to learn the premium.

However, we still need to set the interest ratio and the dividends to learn the option greeks rho value. We will choose the following data in our basic options calculator.

Option greeks rho, an example of how to use it

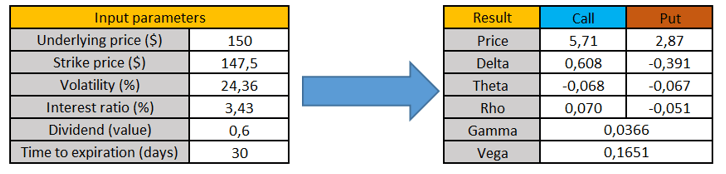

Options rho works as follows: for every point that the interest ratio or the dividend increases, the option premium will increase the value stated by this greek.

Following our example, if the interest rate increases by one point, we can see how the call option premium changes from $564 to $571, while the put option diminishes its value, from $292 to $287.

The effect of rho options greek

As you can see, options rho is not a particularly game-changing factor when trading options, for the reason that the interest rate is not going to dramatically change from one day to the other.

Can option greeks rho be negative?

Yes, but only in the put option, just like with option delta and theta.

If the interest rates increase by one point, the rho call option will provide a positive value to the premium. However, the options rho for the put will do the opposite.

Calculating option rho

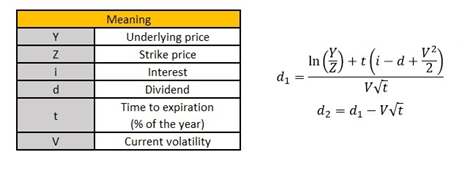

The way to calculate option rho comes from an expression given by the Black-Scholes model.

But before, it is necessary to obtain all the parameters of the mathematical model.

First of all, we are going to need to calculate two auxiliary parameters called d1 and d2. These are obtained as follows…

This is how we calculate the d1 and d2 parameters

In these case “ln” is the Neperian logarithm and “t” is the percentage of time to expiration, that was calculated as the number of days to expiration by 365 days

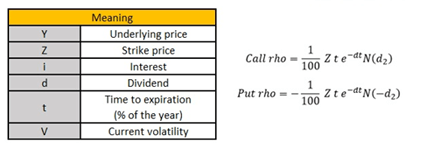

Option rho formula

The rho options formula is the following

This is how we obtain the option greeks rho

We know that calculating this or any other option greek is quite time-consuming. For that reason, if you want, you can download our free options trading calculator that includes a guide to start trading with options here:

Last words about what is rho in options

With options rho, we are now able to understand how the changes in interest rates and dividends affect the options premium of our strategy.

As we have seen, options rho is a parameter we obtain through the Black-Scholes model, but the truth is it does not change premium by too much.

In any case, of all the option greeks, rho is the least useful to our trades, unlike vega or gamma, which will give us useful information about the implied volatility or how the proximity of strike prices to the underlying affect option premiums.