Option vega is one of the parameters we should pay special attention to when dealing with volatile options markets.

As with other greeks such as theta or delta, option vega is an expression calculated from the Black-Scholes model of financial options.

In this guide, we will learn how to use vega in options trading, what it is exactly and how to manage it.

Let us begin with the basics…

What is option vega?

Option vega is an option greek that will measure how much our option premium will vary when the volatility of the underlying changes.

Vega can be very useful to analyse the effect of the implied volatility on those options that only have extrinsic values, because those are the ones that the volatility affect more!

Vega is especially helpful in those assets with high, variable volatility, as we can get an idea of how much the option premium of our contracts will change.

How does option vega work?

Let us take a look at an example to see how option vega works in a trade and how does the volatility affects the option premium.

Let us suppose we want to open a trade on Fiserv.

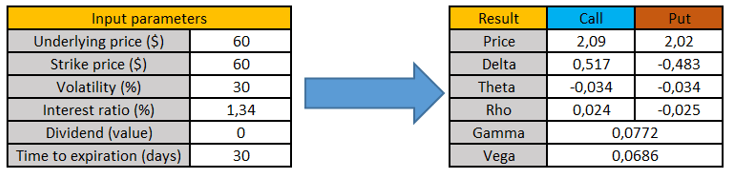

The underlying price is currently trading at $60. After taking a look at the options chains, we have determined that the best thing we can do is to buy a put option contract with a strike price of 60$. In this case, the implied volatility is about 30%.

On the calculator above, we can consult the option greeks for the example. As we have already explained, option vega will show us how much will the option premium change when the volatility increases or decreases by one single point.

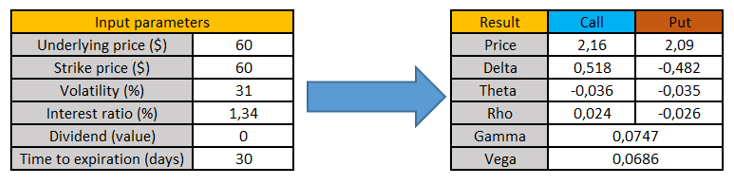

So, let us do that. We are going to increase the volatility to 31% and see what happens then…

As we can see in the option trading calculator, the put option has increased its option premium from $2.02 to $2.09. Option vega was aproximately 0.07.

Is option vega additive?

Yes, option vega is additive. Let us take the same example above.

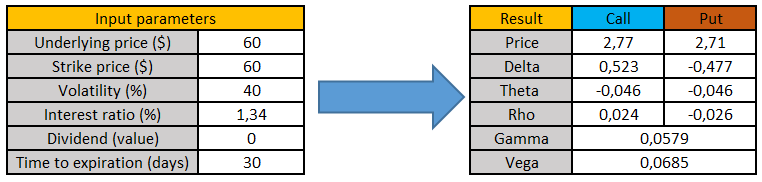

If we decided to increase the volatility by ten points, that would mean that our option vega now would have an additive effect of 0.685$. Let us take a look at the calculator below to see if this is true…

When the volatility was at 30%, the put option premium was 2.02$, and now, with a volatility of 40%, the premium has increased to 2.71$.

The difference between premiums is 0.685$, which was the value that option vega provided us.

When is option vega highest?

Typically, we will find the highest option vega when the option contract becomes At The Money.

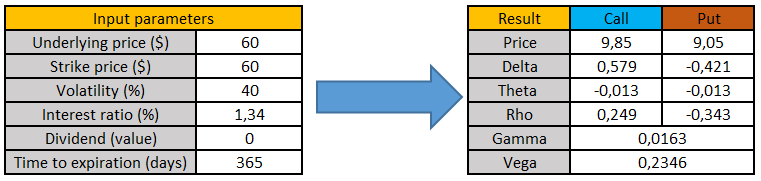

Also, option vega will be higher the farther away the expiration date. Let us change the expiration to a year now…

As we can see, option vega has changed from 0.0685 to 0.2346, and the reason is because we have increased the number of days to expiration and the option is now At The Money.

Can option vega be negative?

No, option vega cannot be negative, even when the volatility diminishes.

How is option vega calculated?

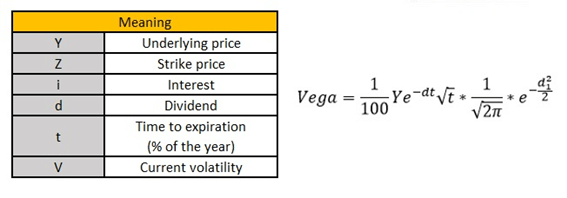

The way to calculate option vega comes from an expression given by the Black-Scholes model.

First, it is necessary to obtain all the parameters of the mathematical model. Also, is recommended to calculate the option premium first, which you can consult here.

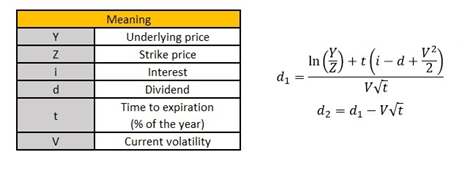

First of all, we are going to need to calculate two auxiliary parameters called d1 and d2. These are obtained as follows…

In these case “ln” is the Neperian logarithm and “t” is the percentage of time to expiration, that was calculated as the number of days to expiration by 365 days

What is the option vega formula?

The formula is the following

In this case, and unlike delta or theta, option vega formula is common to call and put options.

If you want to use our option trading calculator, you can download it along with out free Options Guide here:

Last words about Option Vega

As we have seen, vega is just one of the five main greeks.

With option vega will show us how much does the implied volatility affect our options. Remember, if you want to use it correctly, we need to take the volatility of the buying or the selling side, depending on what we want to do.