You may have heard of some traders that encourage you to have a very large account in order to begin trading either options or stocks. By large account, we mean more than 5 figures account and that could be something not everyone can afford.

Let us explore this idea and let us tell you what we believe in this article…

Can you trade options with 1000 dollars?

One of the frequently asked questions that everyone formulates is this: can you trade options with 1000 dollars or so? Is it possible and viable in the long run?

Our answer is simple: yes. We believe we can trade with $1000 or whichever quantity you prefer, but of course, under two strict conditions: you must understand what you are doing and you must have practiced before.

The remaining question is how. What strategies are viable for an account such small and what should we do to stay afloat and become profitable?

Which strategies should we use to trade options with $1000 or a small account?

Primary, we would want to focus on those selling strategies. The reason is we will find ourselves winning more trades than losing, even though the risks involved are higher, just like we discussed here.

Of course, our broker will not allow us to sell naked options in our margin account and the risk involved in that methodology are too large for an account such small, so we will need to use another different mechanism to profit from the selling strategies.

Credit spread instead of naked options

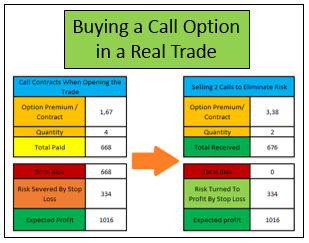

With the credit spread strategies, we are taking the best from the selling side of options while reducing our maximum risk to the difference between the strike prices of our strategy.

If you want to check more about the credit spread strategies, take a look at these articles here where we explain everything you need to know.

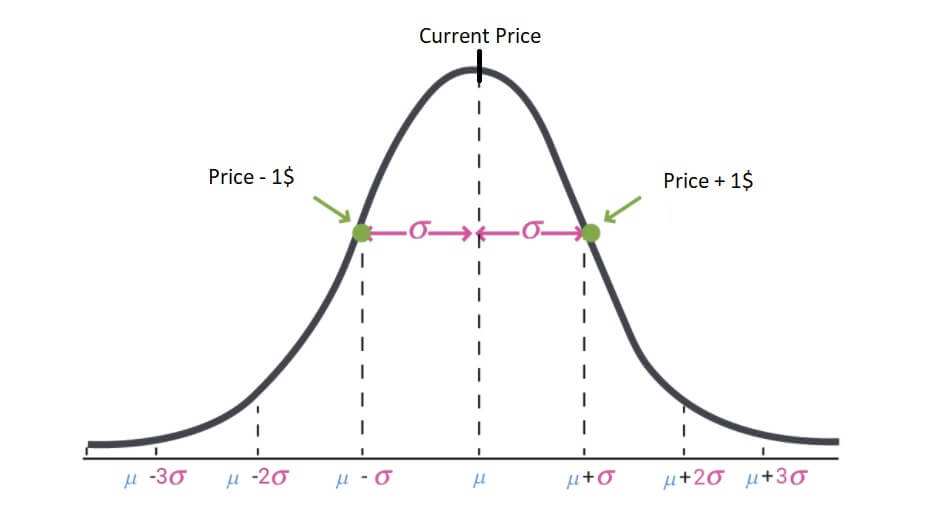

With the credit spread and with some technical analysis, we can easily pick a high probability of profit strike price and profit from time decay. Also, with this strategy, we avoid the problems of margin we encountered when dealing with a naked option.

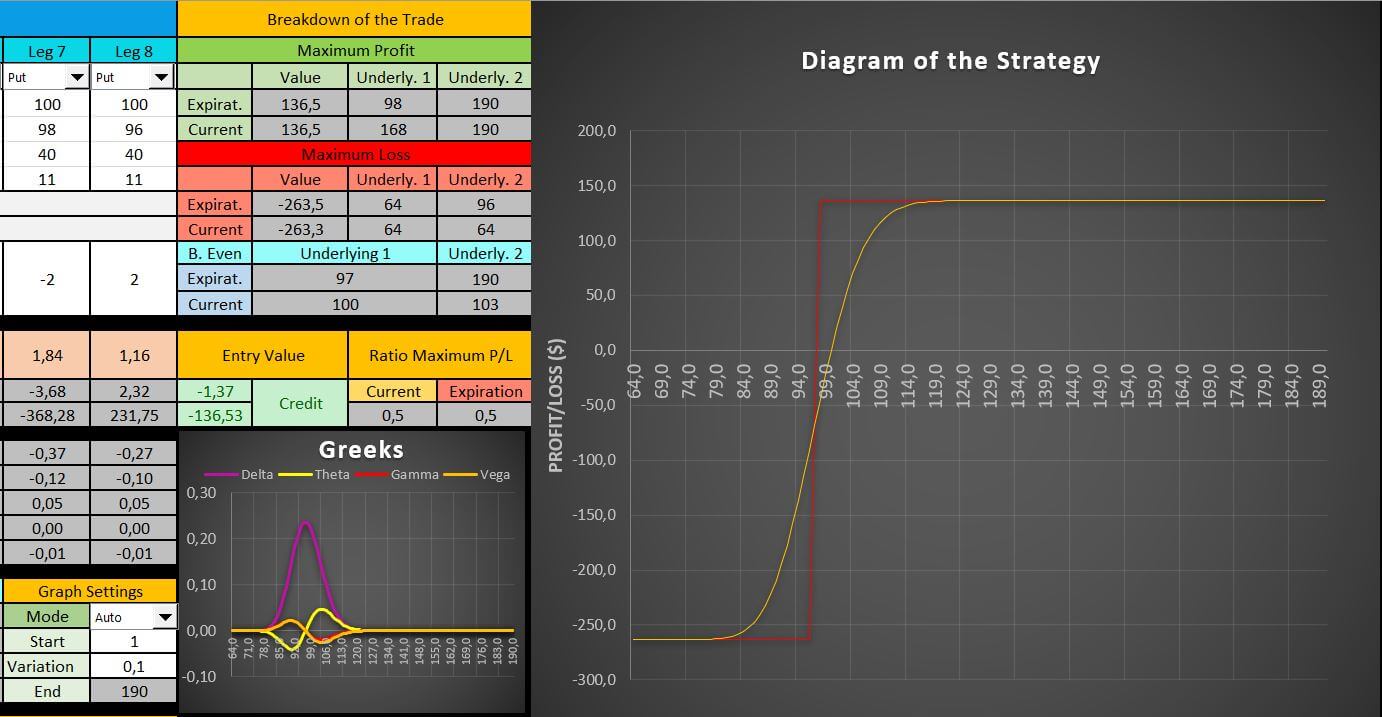

For example for an option whose stock price is $100, we could sell a put credit spread with the strike prices of $98 and $96. In this case, we would have the following…

As you can see, we will be opening 2 credit spreads, incurring a total profit of $136,53. We could have opened 5 credit spreads, but we do not want to put all eggs in one basket in an account such small.

Our profit to loss ratio is reasonable for a credit spread, but in case things began to go against our trade, remember we can open a call credit spread to mitigate risks and reduce our maximum loss, protecting our account further

In conclusion: Can you trade options with $1000?

The answer is yes, but again, you need to be very careful and know what you are doing. Remember to stick to those options strategies that limit the maximum loss to stay afloat in case everything went wrong and avoid opening massive positions to diversify.

Also, remember that an account such small will not allow to day trade options, so you need to take into account that.