Can you end up owing money when trading options? As an options trader, this might be one of the most important questions when we need to ask before trading any option in the market.

In this article, we are going to be discussing the things we need to be careful about before trading options because, yes, options trading can definitely put us on debt!

How can option trading put you in debt?

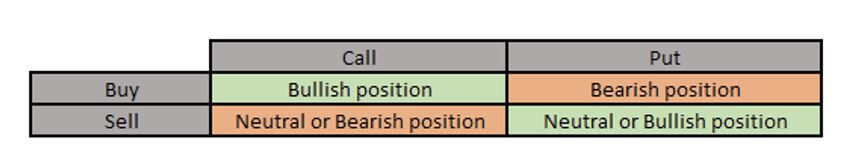

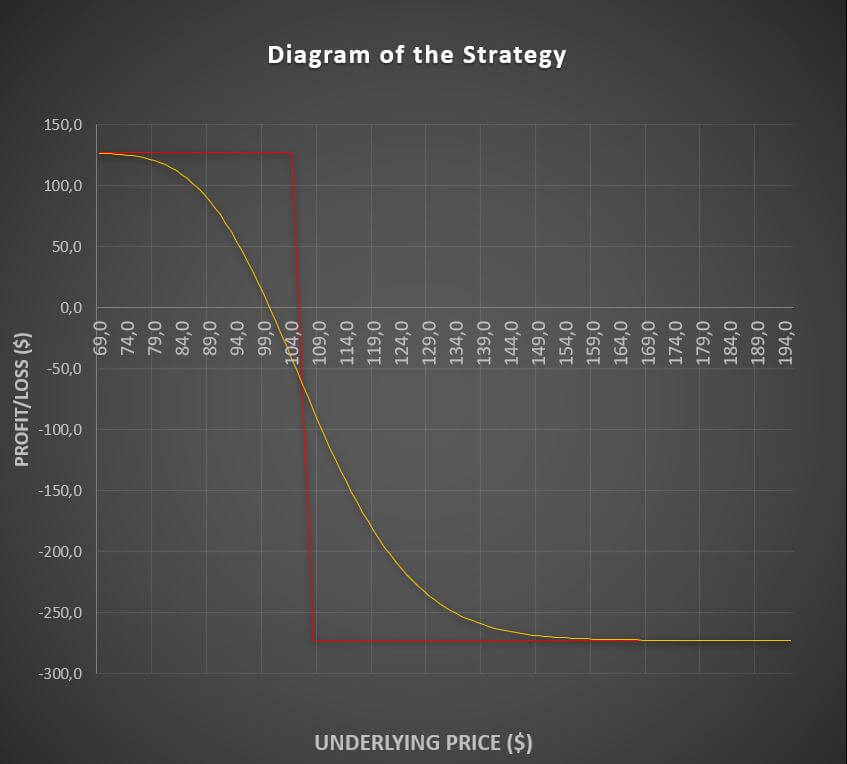

The answer is that it depends on the option strategy we use to enter the market. As you might already know, there are four ways to interact with options. You can either:

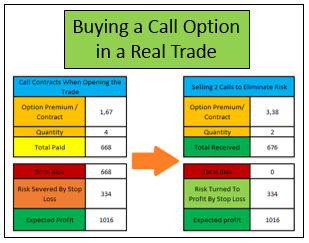

And you can choose a different strike price and combine as many options as you want. By their very own definition, by buying a call or a put option, we will never lose more money than the one we have invested in the trade.

A buying strategy will never put you in debt

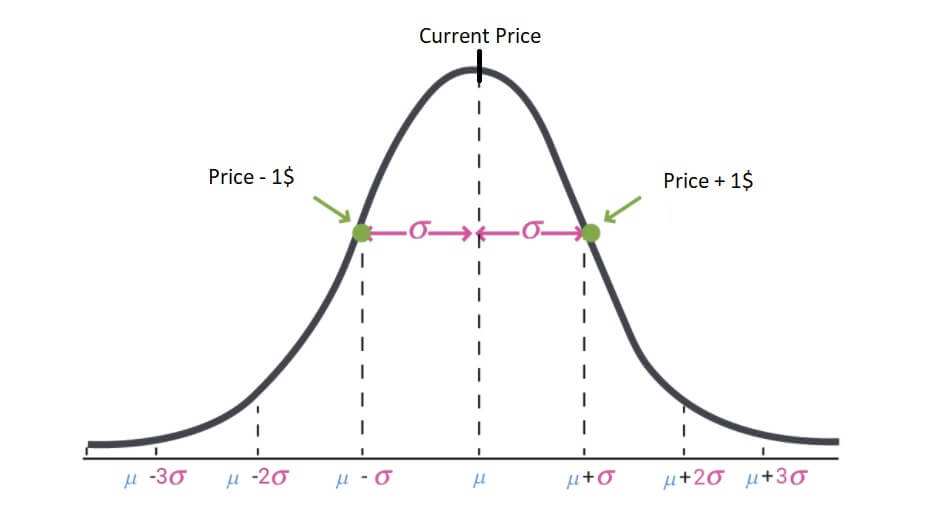

For example, if we buy a call option whose premium is $400, if the underlying price goes to zero, we will have only lose those $400.

As you in the previous diagram, we will only lose the premium in the worst-case scenario. This is true whenever we use a buying option strategy, we will limit our losses and we will never end up owing money when trading options.

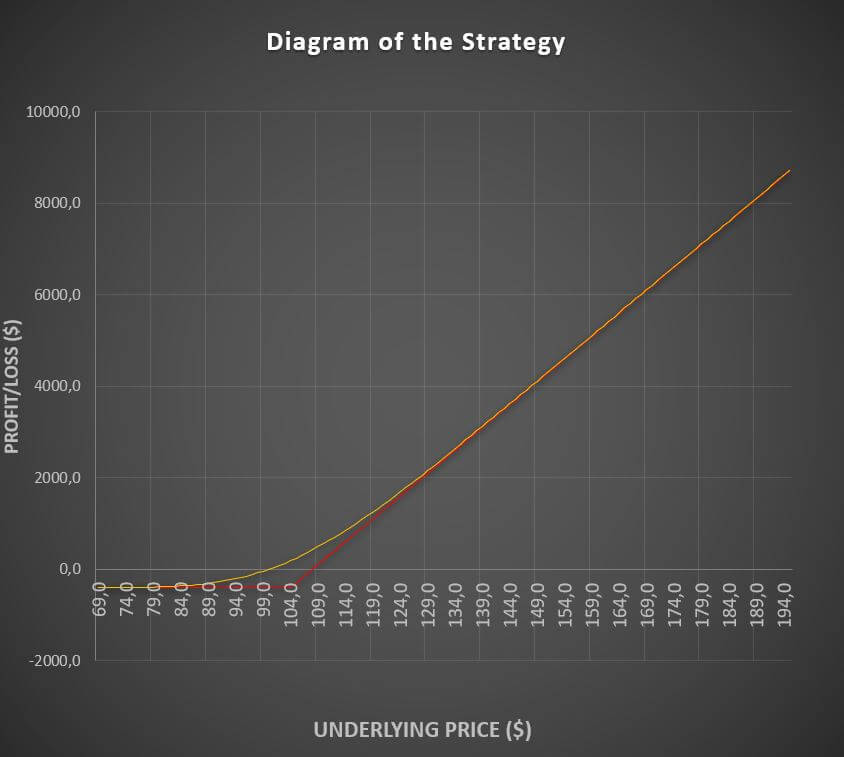

Some selling strategies will put us in debt

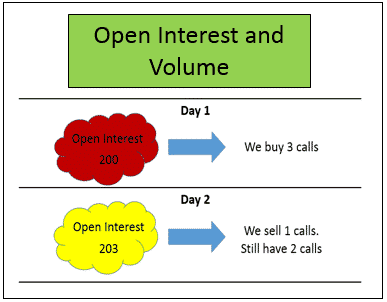

Instead, if we decide to sell a naked option, we might want to be careful. Whenever we sell a call or a put, we are on the other side of the transaction: we receive the premium for the option, yes, but we are exposing ourselves to very high risk.

Let us continue with the same example, but instead of buying the call, we now are going to be selling it.

If, in this case, the underlying price continues to rise and rise, our losses will be increasing just like we see in the previous graph.

If our account happens to be somewhat moderate, in theory, we can end up owing money when trading options strategies like this.

We say in theory because the broker will not allow us to accumulate a very large debt, as it will be liquidating the position for us in case things get nasty. However, that would not stop us from losing a large part of our money.

Apart from this, the broker will not allow us to open a naked selling position unless we have a very high margin in our account

So, yes, we can end up owing money when trading options. Does that mean that we should avoid selling options?

No, that is not the case either.

As we discussed in our previous article about why selling options is far superior to buying them, when we sell options we will have much more probability of profiting and we will make much more money selling than buying in the long run.

However, as we have seen, selling options is much riskier than buying them… so, what should we do?

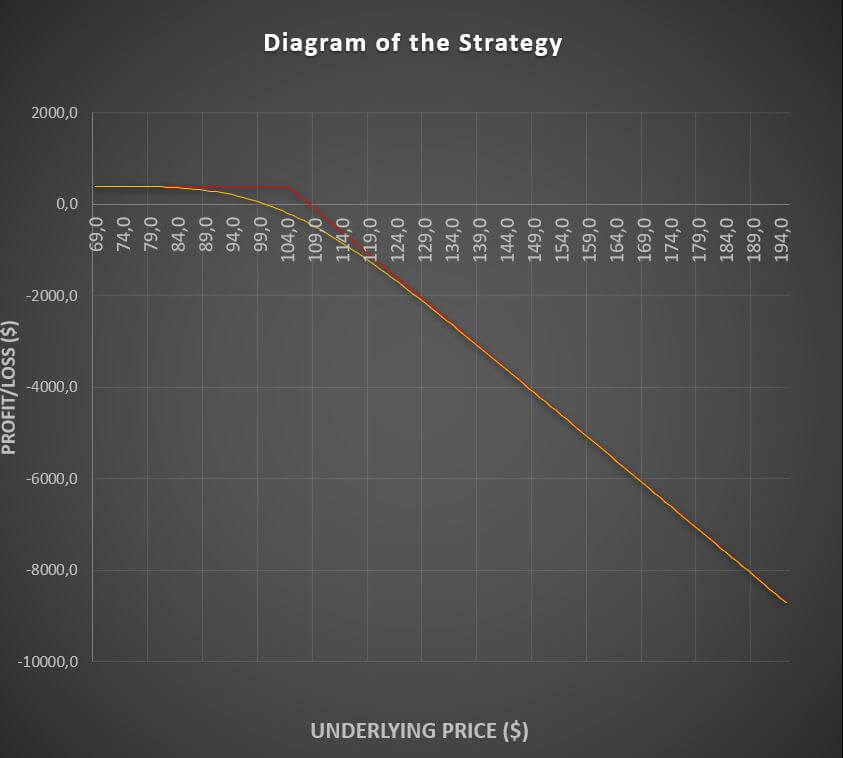

The solution to our problems: the credit spreads strategies

The only way to cut huge losses and avoid end up owing money when trading options as a seller is to use a credit spread strategy.

By using a credit spread, we are simultaneously selling and buying options with different strike prices. In that way, we will be limiting our losses to the difference between the strike prices of our options, and we will be receiving a credit every time we open a trade.

As you can see, we will be limiting our losses in case everything goes wrong and in that way, we will avoid ending up owing money when trading options.

If you want to know more about the spread strategy, we highly recommend you to take a look at any of the credit spread strategies here.

Last words about the question: Can you end up owing money when trading options?

As we have seen, if we are not careful enough, options trading can put us on debt and especially if we are selling naked options.

We highly recommend you perform a technical analysis over the underlying before opening trade to make sure it will move in the direction we desire. We would recommend you to use the TTM Squeeze indicator as it will help you to determine the momentum of the underlying.

Also, we recommend you take a look at the safest options strategy in the market so you can take advantage of it!