When trading with options, one of the best things they provide is the leverage effect when we want to use them compared to stocks. In this article today, we are going to have a look at an example of buying a call option in one of the trades I took recently.

We will take a look at the risk-reward ratio, we will also consider the leverage effect, and we will be focusing on the strategy I took and why. So let get into it!

Defining the strategy to follow before taking the trade

Before taking any position over any stock option trade, the first thing to do is to pick the right strategy for the expected movement in the market.

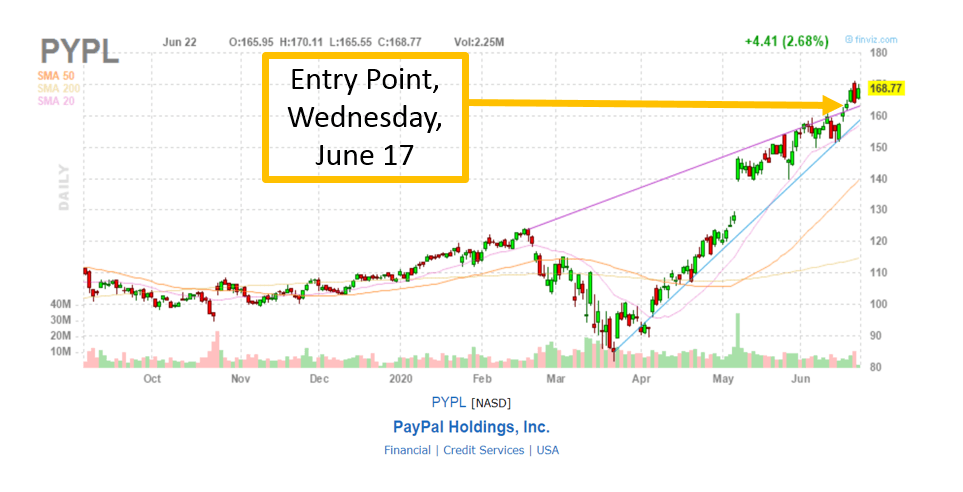

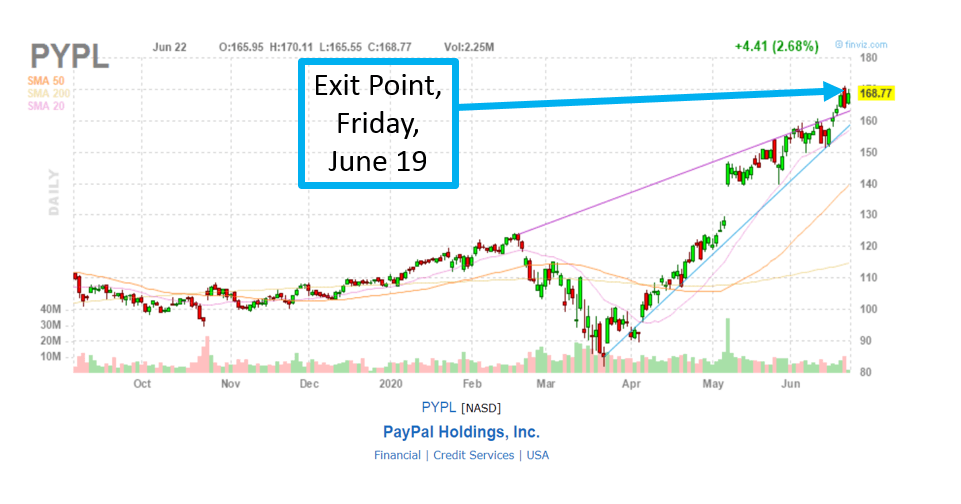

To do so, the first thing we must do is to identify and try to predict where the stock is going to move in the next few days. In this case, I expected the stock Paypal Holdings (PYPL) to go up quite fast in the next two days because it was about to breakout its upper resistance.

Let us use finviz free graph tools to follow this particular trade.

As you can see in the graph above marked with an arrow, I expected a bullish breakout. That day, the stock was trading at $162 or so, and I was waiting for the price to reach $170, or at least touch that threshold.

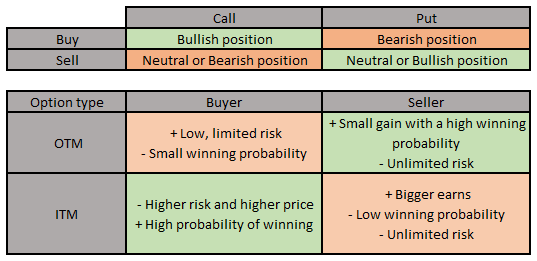

So, to make the best from this particular trade, reducing the risk as much as I could and maximizing the profit, I decided to buy a few call options.

Configuring the call options of this trade

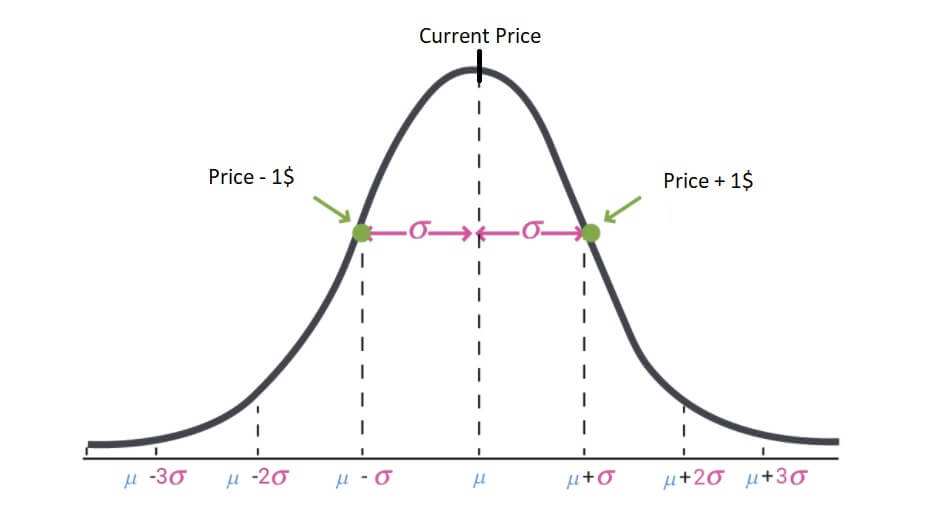

Let us now dive into the particular characteristic of this option. As we are buying a call option, we want it to perform in the best way we can. So, to do this, we are going to buy an Out of The Money call option, because it will have a low option premium and a high potential of reevaluation.

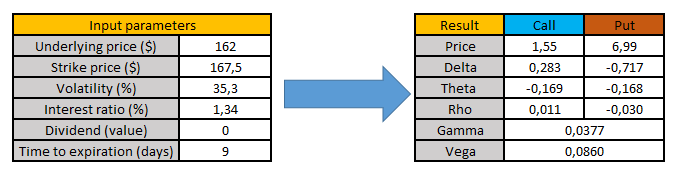

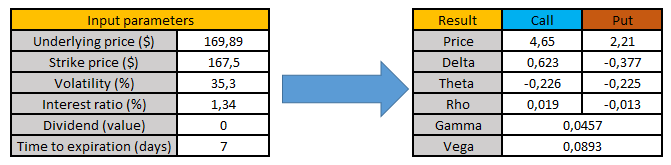

In particular, as the stock was trading at $162 price, I decided to buy the $167.5 strike price with a 9 days to expiration period, because it was quite cheaper and I predicted the price moving up to $170.

In the calculator above, this was the price I expected to buy the call options to open the trade. However, when it came to the real trade, I was not able to catch that exact price, and I had to buy the calls at a little higher price than the showed above because the stock began to move.

Setting the buying strategy to make it perform better

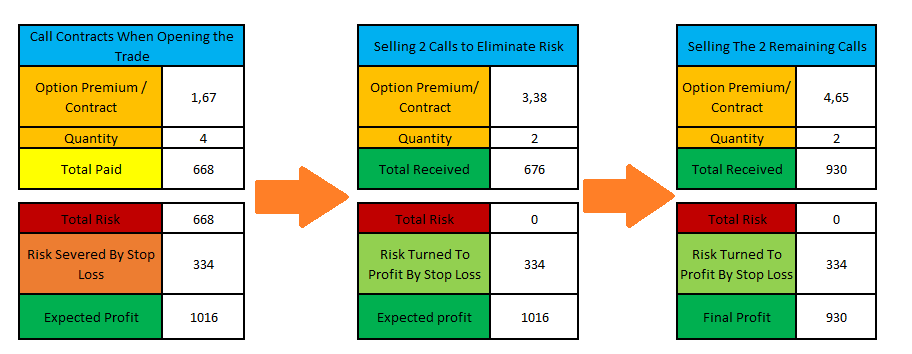

When buying simple calls or puts, I like to do it always with even contracts. For example, I do buy 2 or 4 contracts at the same time because I will manage my risk quite better during the life of the trade. Let us see how.

In the Paypal Holding trade, I managed to buy 4 calls at $1.67 each. Now, after the order was filled, I immediately set a stop loss at half the option premium, so I could reduce the risk from $668, which was the total payment for those 4 calls to $334. Or, in other words, I set the stop loss for those calls at $0.84 option premium each.

Once I had set the risk in the trade, the next step was to calculate where should the stock price go so I could set a break-even point. The idea here is to sell half of the position when those two calls cover the entire premium I paid when opening the trade.

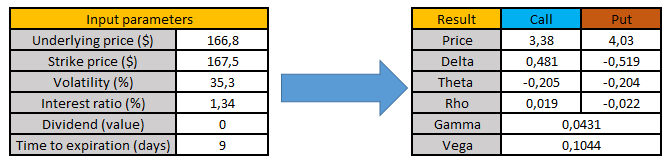

That is, when the stock price reached $166.8, the option premium of every call would have doubled from $1.67 to $3.38. When this happened, I would sell only 2 call options, reducing the risk of the trade to 0, because those two calls cover the $668 I paid when opening the trade.

After this is done, we will still have two call options in the portfolio. So, whatever it may happen with the trade, it is impossible to lose any money. At this point, I could just delete my stop loss option if I want or maintain it if the stock value does not rise where I predicted. Anyway, I like to keep the stop loss active, so I can still make money in any case.

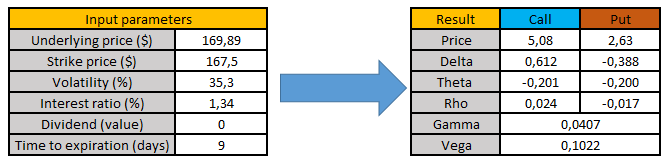

Now, the next step is to calculate the option premium expected when the stock price rises to $170, so we can set a profit target in the right way.

One of the unspoken rules in trading is to place your stops and objectives a few cents over or under certain thresholds because most traders will use them as reference points, creating resistances and supports zones in them. In this case, as I expected the stock price to reach $170, I decided to set the target price to $169.89, a few cents under that threshold.

In this case, the option premium showed in the calculator was $5.08 for every remaining call option, that would make about a $1016 profit if the stock price rises to that value on the same day the trade is opened.

However, unfortunately, the stock price did not reach that value that day, so I had to recalculate it every day until the price reached the threshold I expected. On the second day, that is, Friday the 19th, the stock price reevaluated to $170, and my profit order was filled.

I managed to close the trade at $4.70 option premium each call, so I earned $940 in this particular operation.

Now, let us check at the real risk-reward ratio expected

Calculating the risk-reward ratio of the PYPL trade

When establishing the operation, the first thing we did was to settle a stop loss at half the price of the option premium we spent when opening the trade. As we paid about $668 to open 4 buying call options, the maximum risk of this trade was set to $338, using a stop loss.

Then, our first profit target is set when two of the call options can cover the entire payment of the four calls. That is, we will sell 2 call options when the premium value is $3.38. After that point, our risk is set to zero, and everything we can expect is profit from the trade.

Take a look at the next image to see every stage of this process.

As you can see, the total risk-reward ratio is about 3:1, and that is a great way to obtain a swift profit in just two days. That is the reason why I do buy even call options, so I can perform this particular way of trading.

My top priority when opening these kinds of trades is to reduce risk no matter what and as fast as possible, so, if a disaster occurs, my money is still safe.

Using options, it is possible to control our risk better than with equities because we are simply placing less money in the market at risk.

But how did you spot this trade in the first place?

Many times, I do use an option signal provider that spots me a trade with a fairly high accuracy. In particular, I do use Options Pop Options Alert, that will email me with 3 trades every week that have a high potential of movement in the next 9 days.

Options Pop will provide with the stock company that is going to move, it will tell us if we should buy a call or a put, at which strike price and for how much option premium.

In other words, it will tell us where to put our money to make it grow every week, using their specialized technical analysis over the market

If you are like me, that it is hard for you to believe in those platforms that provide with signals, I can guarantee you that Options Pop is reliable. I have been using it for a few months, and it is one of the few that really works.

Also, they provide a 30-day money-back guarantee, so you can try it for yourself!

One of my golden rules is to never promote things that I have not tested or used previously, so you do not have to waste your valuable money and time. Options Pop can really help you, overall, if you are new to trading or if you want to develop your own strategy, while you earn confidence operating in the market.

I encourage you to take a look, you will not be disappointed! If you want to know a little more about Options Pop, you can check my review here to know everything that includes!

If you want to know what else can we do with the different option trading strategies, we recommend you to take a look at our option trading blog here.