Is Options Trading Gambling? Sorting Fact from Fiction for US Investors

Options trading is a way for investors to potentially profit by buying and selling options contracts. But is it a legitimate investment strategy or is it just another form of gambling? In this article, we’ll explore the risks and benefits of options trading and compare it to gambling.

We’ll also provide tips on getting started with options trading and offer insights on market trends and regulation. Whether you’re an experienced investor or just starting out, this guide will help you navigate the complex world of options trading.

Understanding Options Trading

Options trading is a complex and sophisticated investment strategy that allows traders to buy or sell options contracts with the potential for profit. Understanding the basics of options trading is essential before diving in.

What are Options?

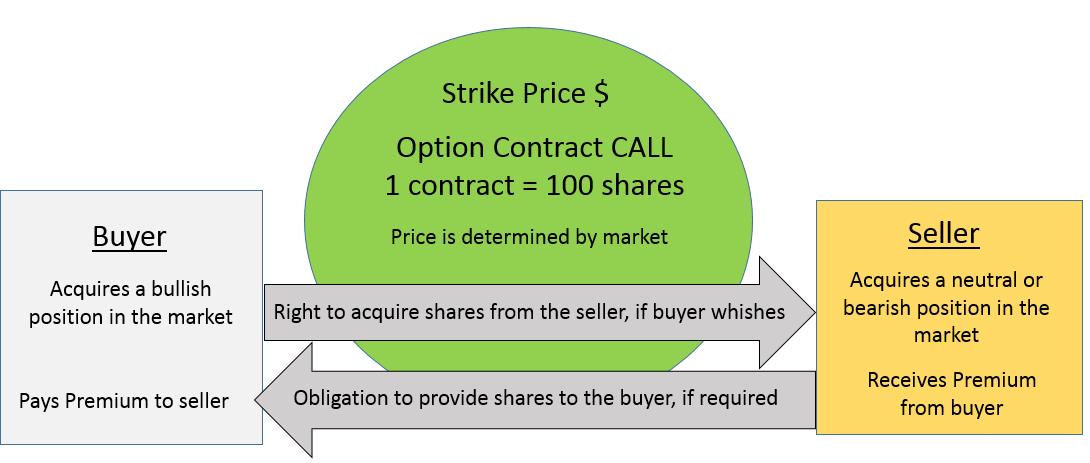

Options are contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. The underlying asset can include stocks, commodities or currency pairs.

Options contracts represent 100 shares of the underlying asset.

How do Options Work?

Options contracts can be bought or sold with the aim of profiting from changes in the price of the underlying asset. For instance, if a trader has a bullish outlook on a particular stock, they may buy a call option, which gives them the right to buy the underlying asset at a specific price (strike price) within a specific time frame.

If the price of the stock rises above the strike price, the trader can exercise their option to buy the stock at the lower strike price, then sell it at a higher market price and make a profit.

Types of Options

- Call options: give traders the right to buy an underlying asset at a specific price within a specific time frame.

- Put options: give traders the right to sell an underlying asset at a specific price within a specific time frame.

- Weekly options: have shorter expiration dates and can offer a higher return potential but carry higher risk.

- Regular options: have a longer expiration period which helps reduce the risk.

The Risks of Options Trading

While options trading has the potential for high profits, it also carries risks that traders need to consider.

The risks come from various factors including the volatility of the underlying asset, expiration dates, and market fluctuations. It is vital to manage risk effectively by setting stop-loss orders, diversifying portfolios and developing a strategy that fits your risk profile.

Options Trading vs. Gambling

Options trading has long been debated as a legitimate investment strategy or a form of gambling. In this section, we will explore the pros and cons of options trading and compare it to gambling.

We will also discuss the importance of skill and knowledge in options trading, highlighting the differences between gambling and investing.

Is Options Trading a Form of Gambling?

Some argue that options trading is a form of gambling because options traders are making bets on the future price movements of stocks, often with little understanding of the underlying securities.

While there is a risk involved in options trading, it is not the same as gambling.

The Differences Between Gambling and Investing

- Gambling is a game of chance, while investing involves analysis, research, and calculated risks.

- Gambling generates revenue for the casino, while investing generates revenue for the economy.

- Gambling involves no productive activity, while investing can create jobs and stimulate growth.

Skill and Knowledge in Options Trading

While there is some element of chance involved in options trading, it is not solely a game of chance.

Options traders require knowledge, skill and proper risk management to be successful. Some key factors to consider while engaging in options trading:

Educate Yourself on Options Trading

- Read books and articles on options trading to gain knowledge of the markets.

- Take online courses or attend seminars to learn about options trading strategies and techniques.

- Stay up-to-date with market trends and news to make informed decisions.

Mastering Risk Management

- Always have a clear understanding of the risks involved in options trading.

- Assess the potential outcomes of your trades before investing.

- Develop a risk management strategy that suits your investment objectives and risk tolerance.

In conclusion, Options trading should not be mistaken for gambling.

It requires a different skill set, understanding of markets, and risk management techniques. When done properly, options trading can be a lucrative and legitimate investment strategy.

Getting Started with Options Trading

If you’re new to options trading, getting started can seem overwhelming. But with the right knowledge and preparation, you can navigate the market with confidence. Here’s what you need to know.

Choosing Your Broker

Your first step in options trading is to choose a broker. Look for a broker that offers low fees, high-quality research tools, and a user-friendly trading platform. Some popular options include E-Trade, TD Ameritrade, and OptionsXpress.

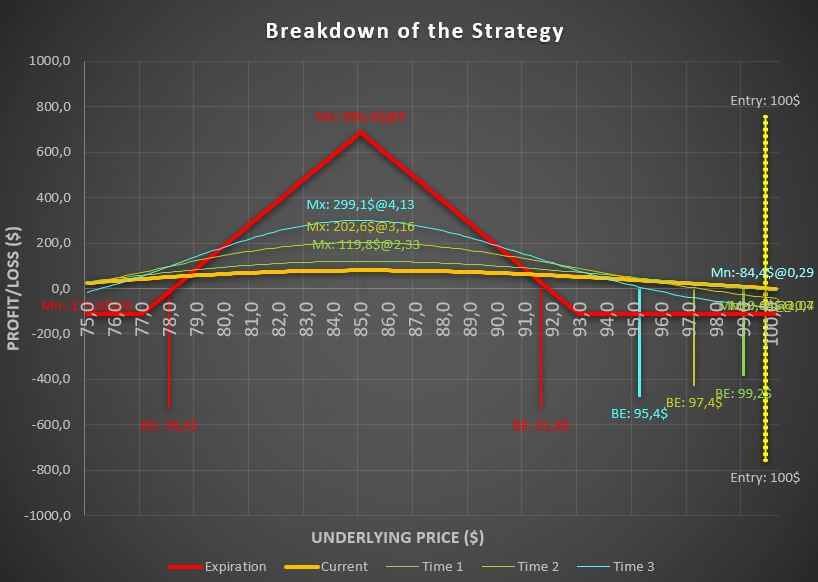

Break-Even and Profits

Before you make your first trade, you need to understand break-even and profit calculations. Break-even is the point at which you make neither a profit nor a loss, while profit is the money you make when you sell an option.

You can use online calculators or consult with your broker to help you understand these calculations.

Small Cap Stocks

When it comes to options trading, small cap stocks can be a good place to start. These are stocks with a relatively small market capitalization (typically under $2 billion), making them more volatile and offering higher returns.

However, they can also be riskier than larger, more stable stocks.

Retirement Planning with Options

Options trading can also be a useful tool for retirement planning. For example, you can use options to generate income from stocks you already own, or to hedge against potential market downturns.

However, it’s important to consult with a financial advisor to make sure you’re using options in a way that aligns with your long-term goals.

By choosing the right broker, understanding break-even and profit calculations, exploring small cap stocks, and utilizing options for retirement planning, you can get started with options trading with confidence.

- Choose a broker with low fees, useful research tools, and an easy-to-use trading platform.

- Understand break-even and profit calculations to make informed trades.

- Consider small cap stocks for higher potential returns.

- Explore options for retirement planning, but consult with a financial advisor first.

The Art of Options Trading

Options trading is not just about buying and selling contracts.

It requires a careful analysis of market trends and using various strategies to maximize profits and minimize losses. Here are some tips for mastering the art of options trading.

Reading the Market

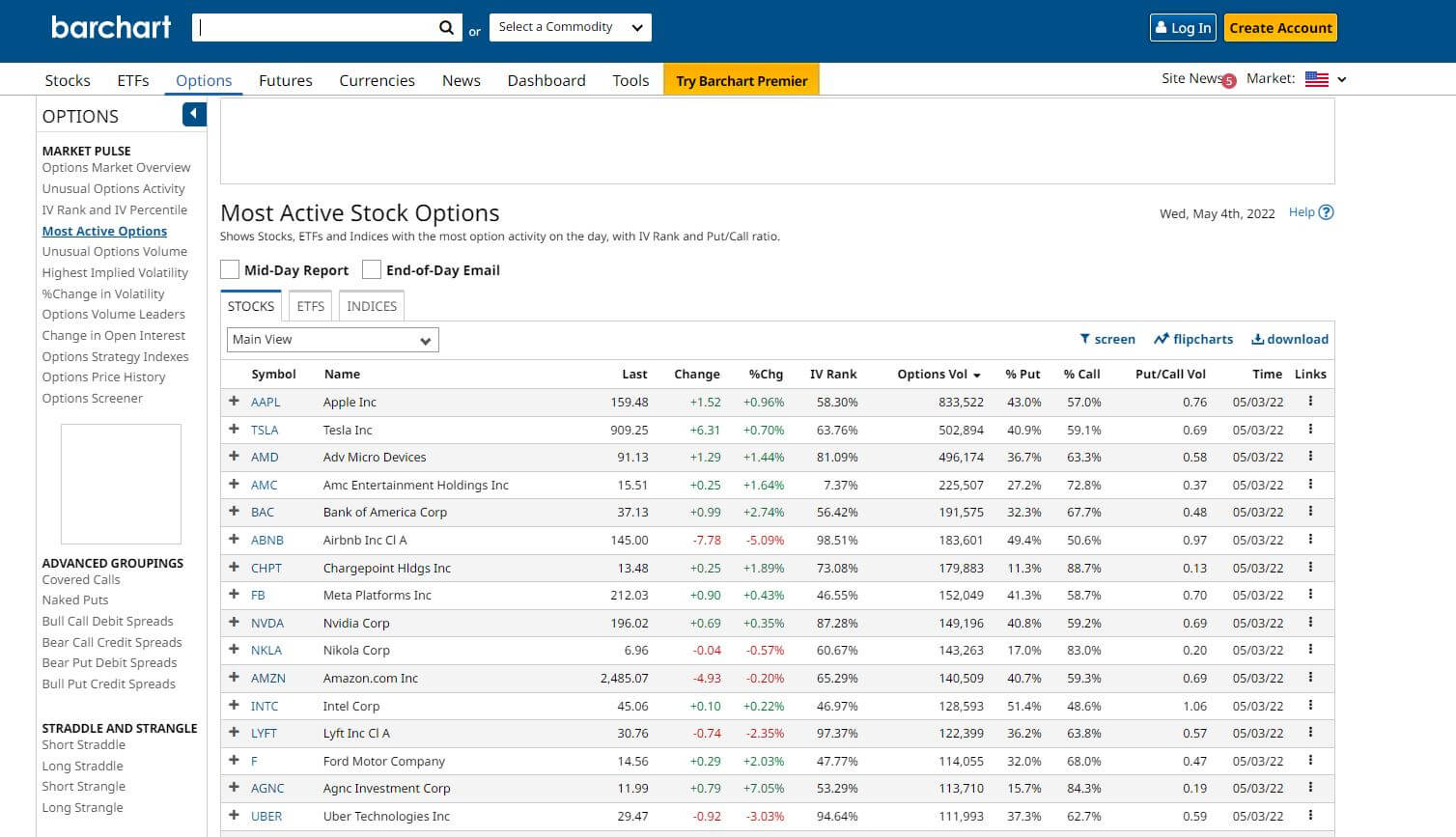

Market analysis is a crucial aspect of successful options trading. Traders need to focus on both macro and microeconomic factors that can affect the market. Additionally, traders need to be aware of industry news, upcoming earnings reports, and market trends.

Options traders should constantly monitor market data, including stock prices and trading volumes.

Technical Analysis

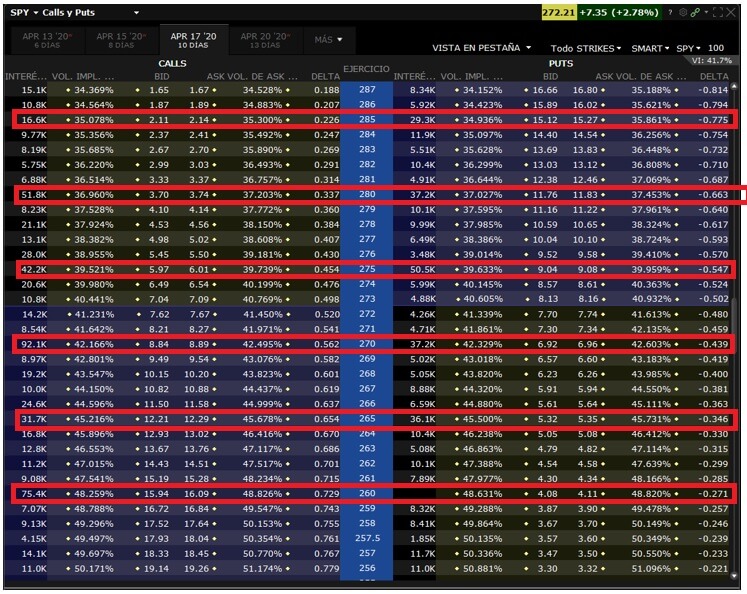

- Use charts to analyze past market trends and patterns

- Understand what factors affect option prices

- Use technical indicators to inform trading decisions

Fundamental Analysis

- Research company financial and operational performance

- Analyze industry trends and consumer behavior

- Pay attention to news and market sentiment

Trading Strategies

Traders can employ a variety of strategies when trading options. The right trading strategy depends on the trader’s individual objectives, risk tolerance, and market outlook. Here are some common strategies:

Vertical Spread

- Buy and sell options at different prices (strike prices)

- Reduces risk exposure and provides limited profit potential

- Useful for traders who expect relatively stable market conditions

Straddle and Strangle

- Buy call and put options at the same strike price and expiration date

- Useful for traders who expect high volatility or an uncertain market

- Provides potentially unlimited profit potential but increases risk exposure

Paying for Premiums

Paying for premiums refers to the premium price that an options buyer pays to the seller.

The premium is the amount that traders pay for the right to buy or sell an underlying asset. Options traders need to understand how to manage premiums effectively to make a profit.

Here are some tips:

- Pay attention to implied volatility levels when buying options contracts

- Consider the impact of time decay on premium prices

- Use limit orders to control the price paid for premiums

Puts and Calls

Put and call options are the two types of contracts that options traders use.

Both types of contracts are based on predicting the price movement of an underlying asset.

Put Options

- Used when traders expect price declines in an asset

- Provides a right to sell an asset at a certain price (strike price)

- Maximum loss is the premium paid

Call Options

- Used when traders expect price increases in an asset

- Provides a right to buy an asset at a certain price (strike price)

- Maximum loss is the premium paid

The art of options trading requires a deep understanding of market forces, careful analysis, and smart strategies.

By focusing on these aspects, options traders can minimize the risks of trading and maximize potential profits.

The Future of Options Trading

In order to succeed in options trading, it’s important to stay up-to-date on trends and changes in the market. As we look to the future of options trading, there are several key areas to keep an eye on.

Trends in Options Trading

- The rise of cryptocurrency options

- Increased focus on ESG (environmental, social, and governance) investment options

- Growth of options trading in emerging markets

- Shift towards mobile trading platforms

These trends reflect changes to the way people invest and the types of investments they are looking for.

As options trading continues to evolve, it’s important to stay aware of new trends and adjust your strategy accordingly.

The Impact of the Stock Market

The stock market has a major impact on the options market, as the value of many options contracts is tied directly to the price of underlying stocks. As the stock market changes, it’s important for options traders to adjust their strategy accordingly.

- Increased volatility in the stock market can lead to higher profits for options traders

- Market crashes can lead to large losses for options traders who aren’t properly managing risk

- Growth in specific sectors or industries can create new opportunities for options traders

Regulation and Oversight

The options trading industry has historically been subject to less regulation and oversight than other types of investments.

However, this is beginning to change as regulatory bodies like the SEC (Securities and Exchange Commission) take a closer look at options trading practices.

- New regulations could lead to more transparency and safer investing practices

- Increased oversight could lead to higher fees and more restrictions on trading for retail investors

- Investors should stay aware of any changes in regulations and adjust their strategy accordingly

In conclusion, the future of options trading is characterized by change and evolution.

By staying aware of new trends, understanding the impact of the stock market, and monitoring regulatory changes, options traders can position themselves for success in this dynamic industry.

Options trading can be a complex and risky investment strategy that requires careful consideration and proper risk management. While it can be tempting to jump into the market and chase quick profits, this is not a sustainable or responsible approach to investing.

That being said, options trading can be a viable investment tool for those who have the knowledge, skill, and discipline to navigate the market. Whether you are a seasoned investor or just starting out, it is important to educate yourself on the risks and rewards of options trading before diving in.

By understanding the fundamentals of options trading, adopting a long-term mindset, and seeking out trusted resources and guidance, you can improve your chances of success in the market.

Resources for Options Trading

- Investment Books: There are a number of books on options trading that can help you understand the market and develop effective trading strategies. Some recommended titles include “Options as a Strategic Investment” by Lawrence G.

McMillan, “The Options Playbook” by Brian Overby and TradeKing, and “Getting Started in Options” by Michael C. Thomsett.

- Online Courses: Many reputable investment sites and online brokers offer courses and tutorials on options trading.

These courses can provide a solid foundation for understanding the market, as well as valuable insights into trading strategies and risk management techniques.

- Investment Websites: There are a number of reputable investment websites that offer insights, analysis, and tools for options trading.

Some popular options include Investopedia, OptionsHouse, and TD Ameritrade.

Choosing Your Next Trade

When choosing your next trade, it is important to take a thoughtful and strategic approach. Consider factors such as market trends, recent news and events, and the underlying assets of the options contracts you are considering.

Before making a trade, conduct thorough research and analysis, identify your entry and exit points, and be prepared to actively manage your positions…….