The stock bid and ask is a concept very important for traders, as it will determine how easy it is for them to make or to lose money when trading a stock.

In this article, we will be learning about what does bid and ask mean in stock trading, what is market spread, and about the people behind the scenes that make the market move when things get stuck, the market maker.

Let us begin!

What does bid and ask mean in stock trading?

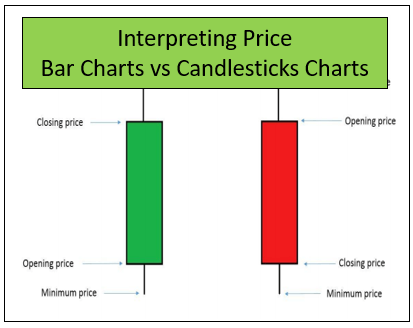

The bid and ask are referred to as the best prices that traders can buy or sell stocks at a given time during the season.

Whenever we take a look at the current price of the stock, we will see two different prices that are very close to each other.

For example, in the previous stock, the current price is 49.43$. However, the bid price is 49.38$, while the ask price is 49.46$. But, what does that mean?

The definition of bid price is the maximum price that a buyer is going to pay for the shares. The ask price is the minimum price that the seller is going to take for the shares.

Following our previous example, if we wanted to BUY the shares, we will need to pay the minimum price that the seller is willing to take: the ask price, 49.46$.

However, if we wanted to SELL the shares, we will need to do so following the bid price, 49.38$, which is the maximum price that a buyer is willing to pay for acquiring the shares.

As you can see, the stock market bid and ask price will make trading more difficult because the prices are far away from each other.

What is market spread definition?

The spread in stock market is the price differences between the stock bid and ask. The higher the market spread, the harder it will be to profit from the stock.

The reason is very simple, if we have a stock price of 50$ and a stock bid and ask of 49.70-50.30, to make money from this trade, we will need the price to move quite a lot to compensate for such a high market spread.

We must take into account that a high market spread is produced by low volumes in the stock. If we want to reduce the market spread, we should learn to scan for the best stocks to trade based on trading volume.

In the previous image, we can see the bid and ask prices are 49.12$ and 49.40$, creating a market spread of 0.28$, which is huge if we intend to day trade.

As you can see, the lack of volume makes things very difficult.

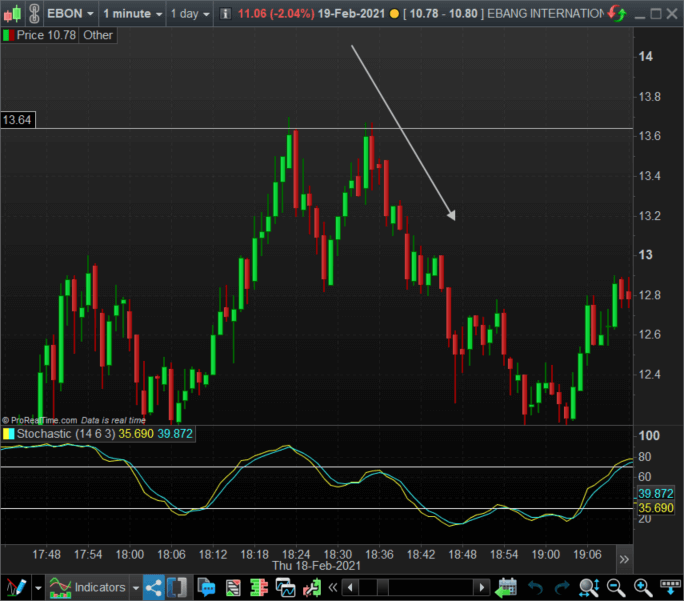

In this example, the stock bid and ask price are 10.78-10.80, making a market spread of 0.02$, which is much better. This is due to a very high stock volume, making it much easier to day trade.

As a reference, the stock bid and ask prices are no different from the options bid and ask prices that we can see in an option chain, and it is quite affected by the volume as well.

In both cases, the people behind the scenes that change and define the market spread in a particular stock or a particular option are the market makers.

What is a market maker?

The market maker definition is a person or a financial firm that has the task to keep the price of the stocks or any other security moving in one direction or another, creating a liquid market.

The stock market maker will be operating on both sides of the market, bullish and bearish, and it will provide bids and asks of a certain amount of shares. Let us take a look at an example.

If the stock bid and ask price were 49.12$ and 49.40$, the market maker will buy shares at 49.12$ while at the same time, it will be offering to sell shares at 49.40$, keeping a constant liquidity in the market while making a profit equal to the market spread of that stock or option.

Who is a market maker?

A stock market maker can either be an individual trader with very high liquidity or an institution such as a brokerage firm.

What are the tasks of a stock market maker?

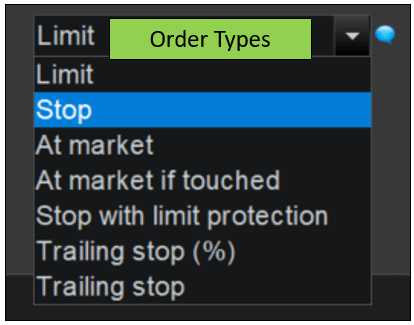

When a stock market maker sees a buying order of a particular stock, the market maker needs to sell the position to the buyer to keep the flow of stocks moving.

One could inevitably think that if the market maker will be losing money if it is always in the position to sell or buy at whatever price they find, that is not true.

While it is true that they face the risk of holding positions on either side, they can deliberately change the market spread.

For example, they could be buying a stock for a price of 49$ and selling it to traders at a 49.20$, making a profit of 0.20$. In a high trading volume, repeating this process again and again can really make a very good profit.

So, indeed, the stock market maker moves the stock price by changing the stock bid and ask prices to make profits for themselves. The higher the market spread, the higher the profits that the stock market maker made.

That is precisely the stock market maker strategy, to make profits little by little from the stock bid ask spread.

We should keep in mind that we cannot beat the stock market maker in their own game for the simple fact that they can always make money from a big market spread.

The only way to reduce this big disadvantage is to find those stocks with the highest volume to reduce the market spread.

Last words about the market spread, the stock bid and ask and the stock market maker

Trading is not easy because we need to fight against many factors that are biased against us.

As we have seen, the market spread is a huge handicap when trading. With a high market spread, we will encounter much more difficulties when trading because it will not be easy to buy and sell at the prices we really want.

In order to reduce the handicap produce by the stock market maker manipulation of the market spread, we should really stick to those stocks with the highest volume because we will encounter better stock bid and ask prices.

If you want to learn how to track those kinds of stocks, we have explained everything you need to know in this article.