Trading without enough volume in stock market can be quite dangerous because of the enormous differences between the bid and the ask in a particular stock.

At the same time, trading stocks with high volume but no price movement is something we should avoid because we will be finding our positions stagnate.

In this guide, we will be learning the definition of volume in stock market and everything we need to find and trade correctly with high volume stocks that move in any direction.

But before that, we will take a look at what is volume in stock market, why it is important, and the many different situations we might find while trading.

So, let us begin!

What is volume in stock market?

When we talk about the trading volume stock definition, we refer to the number of shares interchanged between traders or investors during a specific time.

For example, if we measure the stock market volume of one day and find out that it was two million, that was the number of shares that have been exchanged in one day.

How does volume in stock market work, and what does stock volume indicate?

Using a technical indicator called trading volume in stock market is a very interesting way to gauge the emotional state of the traders and the investors over the asset.

If we find a healthy, increasing price trend, this one will be typically accompanied by a very strong stock volume. Simultaneously, if the price is falling and falling, we will also find that the volume in the stock market will be quite substantial.

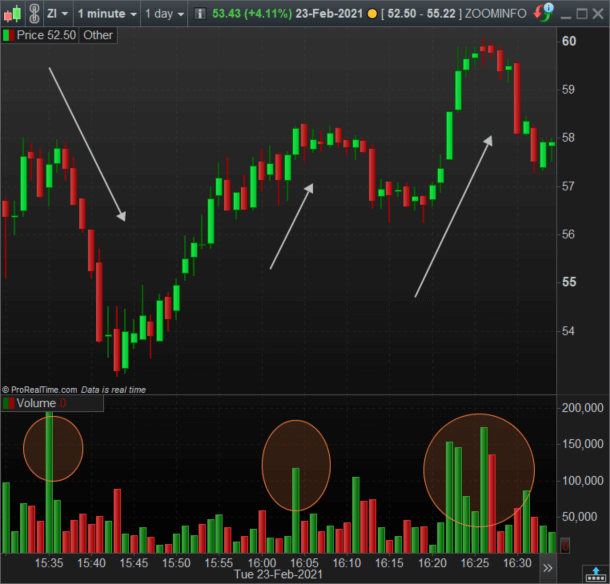

Let us take a look at this example here to help you understand how does volume in stock market work.

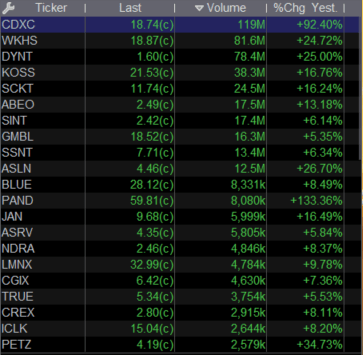

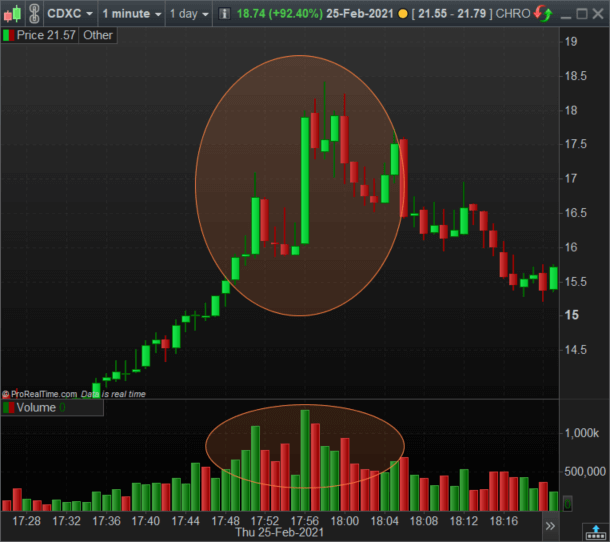

In the previous image, we have displayed the stock volume when the price beggings to move. As you can see, on the left side of the screen, we have a volume spike followed by a bearish trend, indicating that there is actually quite a lot of movement in the price.

At the same time, we can see that the two following marked stock volume spikes also indicate a very massive price movement.

Be aware that this is a one-minute chart.

In other words, we are registering more than 100.000 shares exchanged in one single minute of trading!

Why is volume in stock market so important?

The reason why volume in stock market is so important is because of the simplicity it gives us to enter and exit a trade, just like it happens with a call or a put option.

The higher the stock volume, the easier it is to buy and sell at a price we really want, avoiding the ask and bid spreads of the asset we are dealing with. We should always look for high trading volumes if we want to perform well in the market, especially if we are going to day trade.

So, let us jump now to see more specific metrics that will help you know which stocks to trade and which ones to avoid, attending only to the stock volume.

Three different ways to measure the trading volume in stock market

Before jumping into the metrics we should look for, first, we need to define the three possible ways you need to know that a trader can measure the trading volume.

The three have the same base and use variations of the same parameters, but it is very important to know why and how to use them.

Reading the raw trading volume in stock market

The first way to measure the trading volume in an asset is by simply using the stock volume technical indicator we have seen in the previous example.

In absolutely every trading software, stock volume is a by default technical indicator that we can add to our charts. This is the easiest and more simple way to read the trading volume in stock market. We are going to be using ProRealTime trading software to check the charts.

In the example above, we have represented the prices of Zoom Video Communications, along with the average daily trading volume in the lower part of the chart. As you can see, the typical stock volume for an average day in this company is about 10 million.

Reading the average volume of stock

The second way to measure the trading volume in the stock market is by applying an average to the stock volume indicator we already have. For example, if we using a simple moving average applied to the trading volume, we will obtain the average volume of the stock.

Again, we have represented the same chart, but in this case, we have added the simple moving average in the trading volume indicator. In this particular case, we are representing the average daily trading volume with the yellow line on the stock volume indicator.

Using the average daily trading volume, we can easily see which days the company has a high volume trading peak, being easy to locate interesting trading zones.

Relative volume compared to the average trading volume

The third way to determine the stock volume is by comparing if the current volume is higher or lower than a previous trading volume measure. This filter is typically called relative volume, and it measures precisely that.

Depending on the trader, the relative volume can be measure by comparing the actual volume today with either the previous volume yesterday or the average trading volume obtained through the moving average. The typical thing to do is to use the first approach.

In the previous trading volume chart, we have marked the days in which the stock volume is two times the trading volume of the previous day. In other words, we have drawn with blue circles some days with a relative volume of 2.

The relative volumen is very easy to measure using the default scanners that ProRealTime offers.

Let us now dive a little more into the importance of volume in stocks.

What does high volume mean in stocks?

Whenever we find a very high volume in stock market, it is a clear sign that we are going to be seeing a lot of activity surrounding the stock.

A high trading volume in stocks means that the particular stock is being highly traded and invested, and the population of traders and investors are watching the price, ready to buy and sell the shares.

Having a good volume is a good sign for the trader because it will allow him or her to take advantage of the lower bid-ask spreads. However, this is not the only factor that we should consider when deciding when to trade. We should always make sure that the technical analysis favors our trade.

What does low volume mean in stocks?

Contrary to the previous case, we should always stay away from the low-volume stocks because it will be quite difficult for the broker to fill our order if we are trading with limit orders.

What a low trading volume means in stocks is that the particular stock has no interest for the investors and traders. We should always stay away from those kinds of stocks.

Now that we know the three different ways to measure the stock market volume and which kind of stocks we should look for, we are going to be learning some metrics for future references.

What is a good average volume in stocks?

Let us take a look at the different trading volumes we can find in the stock market.

What is a good volume for stocks for a swing trading perspective?

One of the main questions we should ask is what is a good volume for stocks to be able to trade properly and without a substantial bid-ask spread.

If we are going to be swing trading, the stock average volume we should ask for at least 500.000 shares traded in one stock in one day. That is a good volume for stocks to be traded. With such a number, we will have no problem, especially if we are going to be swing trading or investing.

Of course, that is following the first way to measure the trading volume in the stock. However, in this case, if we only look for those stocks with an average trading volume higher than half a million, we will be reducing our spectrum.

Keep in mind that those stocks that trade with such a high volume are more likely to be a large-cap company or a popular stock in the long term, which is precisely a good idea to swing trade. However, if we are going to be day trading, the moving average trading volume measurement might not be a very good idea.

What is a good volume for day trading then?

If we want to day trade, the best thing we can do is to keep things simple.

Our aim at day trading is to look for those stocks with the higher movements in the market, and that means we are going to be focusing on stocks that receive strong trading volume spikes.

In this case, we should look for a nominal trading volume higher than 500.000 shares, but also with a relative trading volume higher than 1.5 or so. The reason is simple: we want liquidity in the market, and we want to find attractive volume spikes.

As we stated before, ProRealTime charting software offer us these scanners by default, so we can easily watch these peaks of volume. If you are interested in this software, you can download it for free here:

However, even following these criteria, it could be difficult to choose which stock to trade. If we want to take those stocks with the best movements in the market and the stronger potential to make profits, we will need to look for penny stocks.

What is a good volume for penny stocks?

To find the best stocks to trade, we need to focus on companies with the highest trading volume in the entire stock market.

The reason is simple: an extremely high stock volume means that quite a lot of traders and investors are looking to a particular stock, and that means that it is more likely that the price will move much more than any other.

So, in penny stocks, the higher volume, the better. You can easily find more than 20 million shares traded in a single penny stock and in a matter of minutes or hours. However, attending to the volume of a stock is not the only thing we should pay attention to when deciding to trade a stock or not.

There are many stocks or penny stocks with a very high volume, but no price movement, and those are the ones we should really be careful of. Let us take a look at this example here

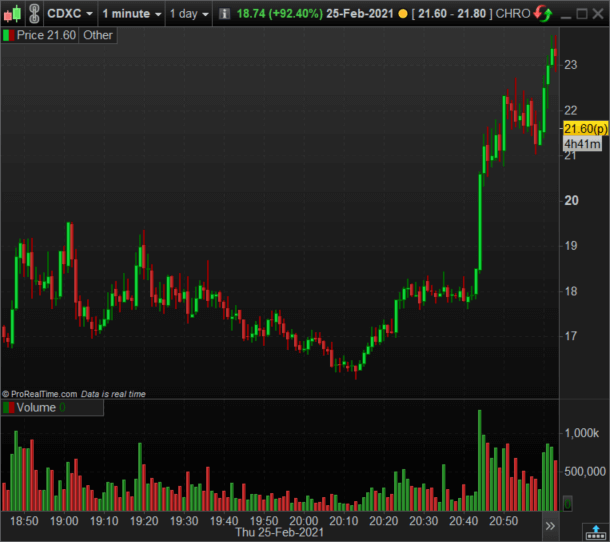

This one is a great example of a high volume but no price movement stock. As you can see, there is no point in trading these kinds of stocks, as they will be causing quite a lot of troubles. Compare the previous penny stock with the following

As you can see, there is no match here. This is a great candidate to trade, compared to the high volume but no price movement penny stock we have seen. If we want to day trade penny stocks, we should stick to the latter ones.

Okay, so how does volume affect stock price?

One could think that having a very high volume is the only necessary condition for trading. And indeed, stock volume in one way or another does affect the price.

The trading volume of a stock will not tell us if the price is going to rise or fall, but it will tell us if there is activity in the asset and how much activity.

We could think of trading volume as the fuel of the machinery. We need to provide fuel or gasoline for our car to work, but the car can either go forward or backward. In any case, it will need fuel. It is the same with the stock market.

The trading volume will not tell us where, but how capable is the price to move to one side or to another. A low volume stock is capable of moving, yes, but it is not very likely to do so.

How to find the best stocks to trade today based on trading volume?

As we discussed previously, depending on how we want to measure volume, we will find different types of stocks. Whether you are looking for swing trading or day trading, the easiest way to find high volume in stock market is by using a market scanner or a market screener.

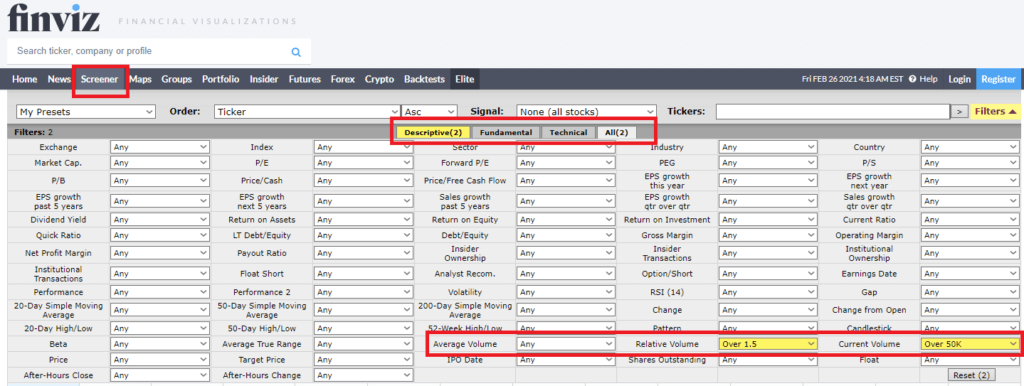

As we discussed, we do use the free ProRealTime scanners to search for stocks to day trade. However, you can always use the free Finviz scanner that will allow you to look for the three criteria we have seen before.

As you can see, marked in a red rectangle, we have three ways to measure the trading volume in stock market. We can easily change the parameters and criteria to follow, attending to our purposes to be able to find whatever we need.

If you want to access this scanner, you can do so by clicking on this link to Finviz.com.

The great news is that it is completely free, but it will only provide data from the current trading day. In other words, if you want to day trade, you should scan the stocks about fifteen minutes after of market open, which is the time the free Finviz scanner takes to refresh the data.

Of course, you can always use your trading platform to scan for the best stocks with the best trading volume, but we still like to provide a free tool for everyone to work with.

Last words about the trading volume in stock market

As we have already explained, the either nominal or average trading volume is a crucial tool to help us identify which stocks deserve to be traded or not.

We should remember that a very high volume means that the stock price is very likely to move to one side or another, but it does not tell us where to. That is something we should identify using other technical analysis tools, such as the stochastic indicator or the relative strength index indicator, for example.

In any case, we have seen three ways to measure the trading volume in stock market, that will help our purposes depending on what we want to trade.

We should stick to the average trading volume for swing trading, while for day trading, the best thing is to use either the nominal volume or the relative volume to find the best stocks or penny stocks.

We should always think of volume as the fuel of the machinery that will make it move to either one side or to another. If we have no trading volume in the stock market, we better stay away from that particular stock, making it very difficult to trade and make profits.