A covered call is one of the most secure and stable option trading strategies that we can perform when we are shareholders of a specific stock.

In this article, we will review how does a covered call work. We will learn the different covered call risks and explain why we should be selling covered calls for monthly income to obtain a great deal if we have some stocks in our portfolio.

What is covered call?

The covered call strategy requires that we have at least one hundred shares in our portfolio to carry it out.

When we open a this strategy, we are selling a call option at a specific strike price over the particular stock we have in our portfolio, intending to obtain some profits for that sell.

How covered call works?

When we sell a call without having the shares in our portfolio, we are subject to an unlimited theoretical risk, since the share prices can increase indefinitely. Thus, we must be much more careful. Remember that when we sell a call, you are taking a bearish/neutral position on the market.

However, when we perform the covered call strategy, we will not be subject to unlimited risk, as we have the one hundred shares in our portfolio. That is the reason it is called a covered. The difference with selling a call is none other than we already have the shares.

Why should we use covered call?

When we have some stocks in our portfolio that are not performing as good as we expected, if we still want to have them, we could sell covered call to obtain some profits in exchange.

Let us see an example so we can understand this better. Let us suppose that a few years ago, we bought some shares of a company at a value of $20 and kept them in the portfolio. We thought that the price would be increasing over time, and we also wanted to profit from the dividends that the company offered us.

Now, over time, the share price has reached $40. However, with the arrival of the 2020 crisis, the market in general has become too bearish. Our stock has started to stagnate, but it has not lost too much value.

Since we do not know how long this crisis will last, and since the company has suspended dividends, we will set our sights on the option market.

When to use a covered call with an example

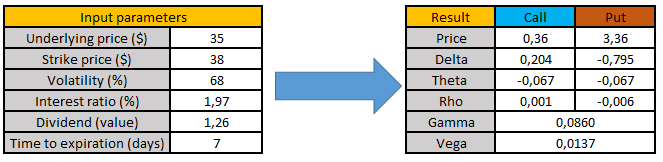

Let’s assume that the share value today is $35. Then, we access the option chains and look for those Out of The Money call options.

Since our intention is to keep the stock in our portfolio, what we will do is to sell an Out of The Money call option or, in other words, sell a covered call at a strike price that we are sure the price will not be reached in a certain period of time, such as $38. We should remember that many companies have expiration dates every week, as we saw in this article.

In a bearish market, it is typical that the implied volatility becomes relatively high. So, in this situation, we will indeed find a very high implied volatility in our option chain. Let us suppose we have found an implied volatility of 68%.

This will make our covered call strategy to be better than in any other scenario as we are going to be selling more extrinsic value compared to a low volatility scenario.

If we decide to sell this covered call for income, we will receive $36 for each contract we sell. Then, two different things can happen.

First Scenario: Our covered call expires without value

When the expiration date arrives in the following week, if the underlying price is below the strike price, we will retain all the premium paid by the call buyer when we executed the trade.

In this way, we will receive a small amount of money for merely holding on to the covered call strategy, and we will still be keeping those shares. The good news is that we will be able to repeat this operation the following week and so on if we wanted to do so.

If we managed to sell covered calls correctly, we would be obtaining profits every single week or month.

Second Scenario: Our covered call gets exercised, and we end up assigned.

If the underlying price is above the strike price at the expiration date, we will be most likely be assigned in our covered call example.

This means that we will have to sell our hundred shares to the call buyer. Let us take a look at the covered call risks to have a better perspective about what we should expect in these cases.

As we are dealing with this option strategy, in our particular case, we will not lose any money, since we bought the shares when they were worth $20, and now we will be selling them at the strike price, which is $38.

If, for some reason, we did not intend to give up our shares, we can always buy them back at market price so we can keep selling covered calls for monthly income or weekly income to keep profiting, little by little.

At the end of the day, if we want the covered call strategy to always be a winner, we have to be selling covered calls above the price we bought the shares. In this way, we will be ensuring that we make a profit if we are assigned while keeping the buyer’s premium in our pocket

Performance of selling covered calls for monthly income

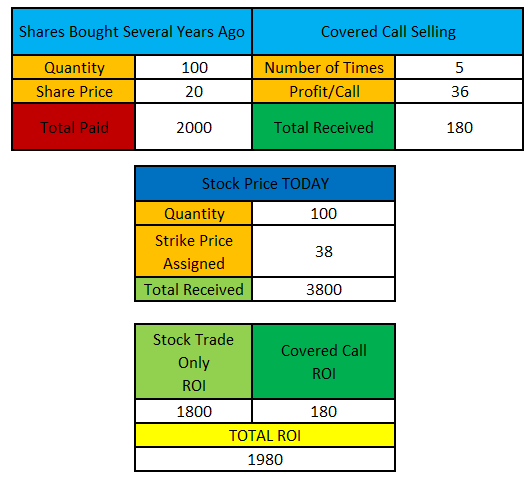

To show you a little more about how selling covered call for monthly income works, we will now assume that we have made five consecutive winning covered call strategies, until, in the last one, we will be assigned. To simplify, we will assume that the premiums obtained are identical, $36 each, and that we only sell one covered call contract every time.

Let us take a look at the performance after one month.

As you can see, at the end of the period, we would have obtained a return of an additional $180 by merely selling the covered call.

To make some more calculations, if we now obtain the percentage of profit that we get from this strategy concerning the value of our initial investment, $2000, we will obtain that by selling these covered calls for income, we had received 11.1% of the total investment.

In other words, by selling five of them, we would have recovered 11.1% of our investment. If we do this over an extended period, we will be able to recover 100% of everything we invested, resulting in getting the shares at the cost of 0.

Last words about the covered call option trading strategy

From all the option trading strategies in the market, the covered call strategy is extremely useful as long as it is carried out correctly. Remember that the key to making it work properly is that we should always choose a strike that is above the price at which we bought the shares.

This way, we will always have a guaranteed profit and make the covered call risks nonexistent!

This is a strategy that we should always keep in mind if we are investors, because it will definitely help us to optimize our portfolio. In any case, we highly recommend you to use this strategy supported by some technical analysis too. The reason is simple: whenever we spot a weakness in the active, we can act and use a covered call to take advantage!

Please explain how dividends impact selling puts and covered calls?

Thank you in anticipation.

Kader