The selling put strategy is one of the most used in the option market when generating some income.

It is known that selling put options for income is a way to generate a constant profit without having to suffer the pressure of trading.

Nevertheless, it is not as secure as the covered call strategy as the selling put risks, if they are not treated carefully, can be quite dangerous.

In this article, we are going to be reviewing what is the selling put strategy, how to correctly set it up, and the two main reasons why would a trader submit the selling put risks in general.

What is the selling put strategy?

As its own name suggest, the selling put strategy consist of selling a naked put over a certain stock option or another asset. This option contract will typically be an Out of The Money option. So, whenever we decide to sell a put option, we will be receiving some option premium.

If we recall, by selling options, we are willing to accept an unlimited risk if the option contract ends up becoming an In The Money contract. However, the probability of this happening depends entirely on the strike price we decide to sell. If we choose to sell a far away Out of the Money option, the probabilities of the option expiring without any value, and keeping the premium in our pockets, are in our favor,

Why would we be selling puts?

Of course, the selling put risk is relatively high compared to the profit we will make and if we are not careful enough, we might have end up owing money.

There are two possibilities why a trader would be selling Out of The Money puts.

The first one is regarding a long-term option strategy, while the second one is related to a more option trading perspective. Let us take a look at both cases.

Scenario 1: Selling Out of the Money puts as a long term strategy

Let us suppose we would like to buy some shares of a specific company because they offer an excellent dividend amount that will provide us with a 10% annual return.

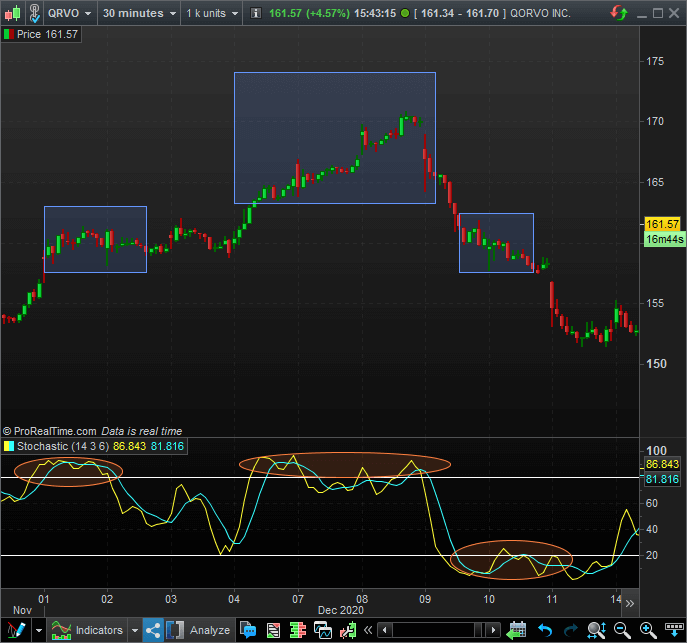

When we check the stock price using the stochastic indicator, we have found that the asset is overbought. So, the best thing we can do is to wait until the stock price decreases to a better value.

If we were stock traders, the only alternative we have is to wait until the price reaches the point we want to, so we can buy those shares and maintain them in our portfolio.

Nevertheless, an option trader may have a different perspective on this matter.

Manipulating the market to our favor using the selling put option trading strategy

With the same scenario in mind, instead of waiting while doing nothing, we will be selling Out of the Money puts. However, we will select a specific strike price, which should be the one we believe is the right price for the stock. The strike price we pick will be the price we are willing to pay for those shares.

Now, two things may happen from this point.

- If the option expires Out of The Money, we will keep the premium that the buyer paid us, and our contract will disappear from our portfolio. That means we can now decide to be selling a new option contract with the same strike price and then receive more premium, and so on.

- However, if the underlying price falls to the point where our Out of The Money option becomes an In The Money option, we will be assigned at the expiration date. Of course, we will keep the premium the buyer paid us, and this time, we will receive 100 shares of the stock for the value of the strike price each.

In the second case, by using the selling put strategy, we will have to pay for the total amount of the shares, and after that process, we will become shareholders of the company.

An example in the selling put strategy with a long-term perspective

Let us suppose we want to buy shares from a company whose share prices are now at $200. However, we consider that buying them at $170 is quite a better offer. We do not know when this price will be reached, but what we do know is that, after performing a technical analysis, the stock is now overbought, and there is no point in buying the shares at the current price.

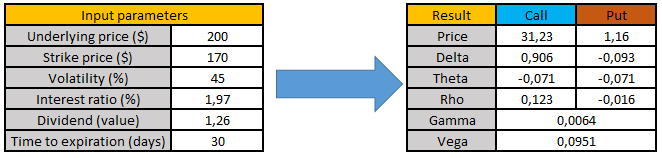

In this case, we can be using the selling put strategy. If we access the option chains of this company, we could be selling Out of The Money puts at a strike price of $170.

If we just set the selling put strategy, we will immediately receive $116 for just waiting for the share prices to decrease. Note that we are waiting a month for that to happen.

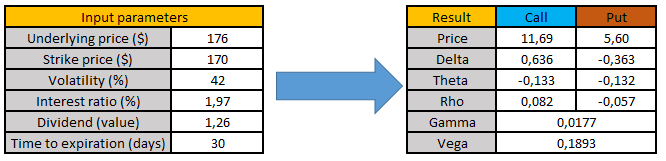

Now, if the underlying does not fall to that price, our option will expire worthless, and we would be able to be selling more out of the money puts to receive more. What would have happened then if the price had fallen to $176 and we have recently sold another put?

In this case, for opening the selling put strategy, we would receive $560. If the prices fall below the strike, we would be assigned then.

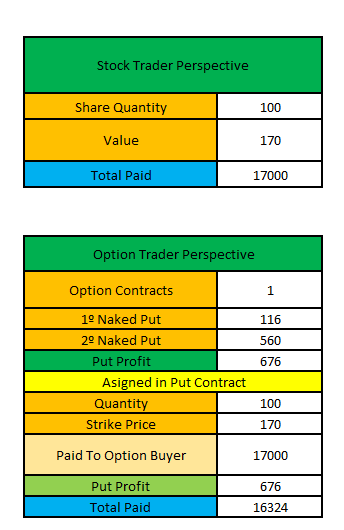

Breaking down the data from our example

The worst-case scenario occurs when the share price falls far beyond our strike price. For example, if the underlying price drops to $160, and we are assigned to the $170 strike price, we would be obtaining a losing position.

However, in any case, we will be purchasing the stocks at a lower price if we sum all the premium we obtained for every selling put strategy we opened in the past. That means, in reality, instead of paying $170 for the 100 shares, the net result would be $163.24!

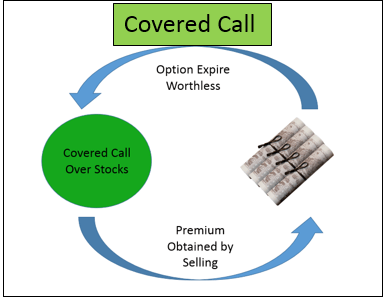

That is the real power of the selling put strategy. We are averaging down the share price every time we decide to execute this kind of trades. Of course, combined with the covered call strategy, we can average down the price even more than that.

Scenario 2: Selling put strategy as a trading perspective or selling put options for income

By selling put options for income, what we are trying to achieve is to let the option expire worthless. Our objective is to keep the premium the buyer paid us, but we do not want the option expiring In The Money.

In essence, we are using the same selling put options strategy, but in two different scenarios. However, we must be aware that the main reason that selling put options for income works is because of the probability of the option expiring In The Money is relatively low.

Typically, the market is continuously trending up, except when a crisis or recession hits the world. Assuming the market is biased in an upward trend, using the selling put option strategy, we are assuring a constant premium income with a high probability of the option expiring Out of The Money.

Of course, the selling put risk is no other than being assigned in a position we do not really want to take. That is the reason this is kind of trades can be dangerous if it is not well managed. If, by chance, we use the selling put options strategy when an uptrend just ended, and a bearish trend is about to start, the risk we are facing might be quite high.

In these cases, using a stop loss might be a very good idea.

Last words about the selling put option trading strategy

Of the option trading strategies available at the market, we should always be careful when selling options, but especially when selling puts if our intention is not to buy the stocks. In any case, the best thing we can do is to perform an analysis in the market before opening such a trade.

However, if we intend to buy some stocks, this strategy is far more advantageous than merely purchasing the stock market because we are getting paid for just waiting for the share prices to drop.

Here at Warsoption, we believe that selling calls is one of the most important tools for a investor!