Whenever we want to trade in a neutral environment in the market, it is very common to compare the straddle vs strangle option strategy because of the similarities that they share of all the option strategies out there.

The best way to compare both strategies is to use them in exactly the same situation so we can analyze their metrics and discover which is better or when to use one or another.

In this article, we are going to unravel the differences between the straddle vs strangle option strategy for both long and short scenarios using our option strategy builder excel.

Comparing both the straddle vs strangle option strategy

Before we begin to compare both strategies, we are going to briefly remind how both of them are created. We will leaving you a few links in case you want to deepen a little more before comparing the straddle vs strangle option strategy.

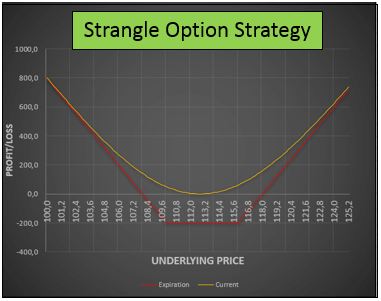

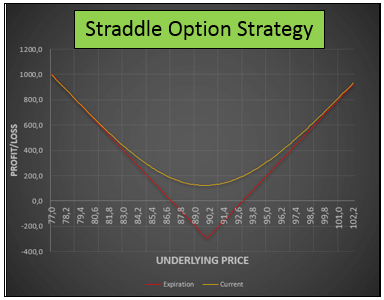

The long straddle option strategy is created when we buy a call and a put option, both At the Money, while the long strangle option strategy is formed by two Out of the Money options.

Long Strangle Option Strategy

In this article, we will be focusing on the Long strangle option strategy… Read more

Long Straddle Option Strategy

In this article, we are going to be reviewing the Long Straddle Option Strategy… Read More

The short straddle option strategy is formed by selling a call and a put option, being both of the At the Money, while the short strangle is created by selling them Out of The Money.

Short Strangle Option Strategy

In this article, we will be focusing on the Short strangle option strategy… Read more

Short Straddle Option Strategy

In this article, we are going to be reviewing the Long Straddle Option Strategy… Read More

That being said, we are going to start by comparing first both the long straddle vs strangle option strategies.

Long straddle vs long strangle options strategy

To be able to fairly compare the long straddle vs long straddle options, we are going to assume the same market conditions for both of them.

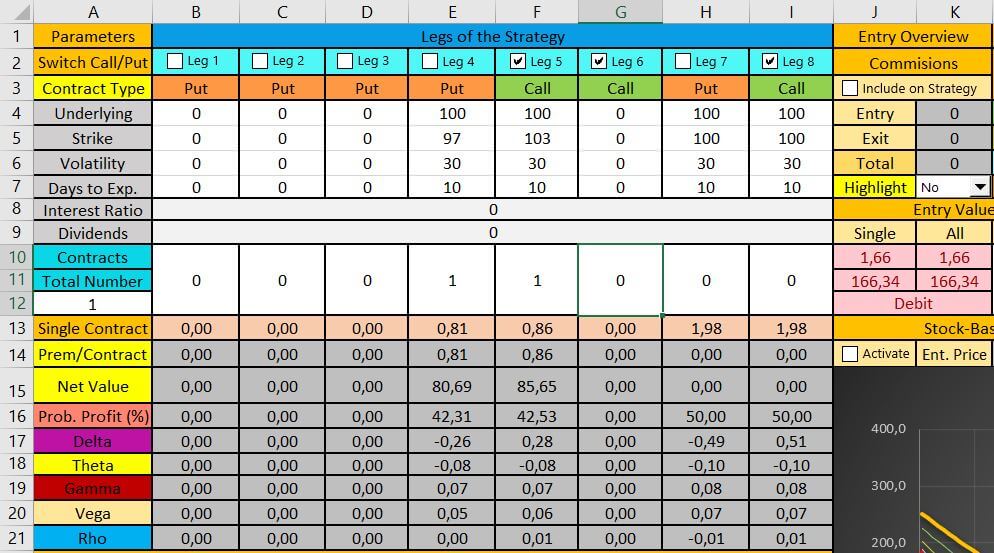

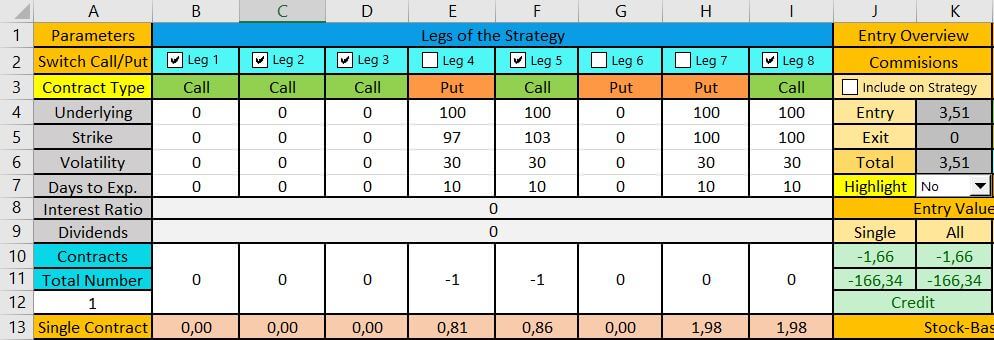

We will be trading a stock option whose underlying price is $100, we will assume a volatility of 30% in every strike price and we will set 10 days to the expiration in every case.

Now, for the long straddle we will have the strike price of $100 for both options and for the strangle we will take $103 and $97 strike prices for both the call and the put option.

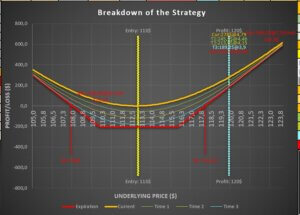

Let us take a look at the advanced option profit calculator to learn the option premium that we have to pay in order to open these trades.

As we can see in the previous comparations, in order to open the long strangle, we will need $1.66. On the other hand, to be able to open a long straddle under these conditions, we will have to pay $3.66

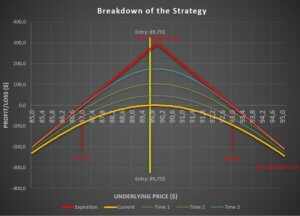

Long straddle vs strangle option strategy risks and profits

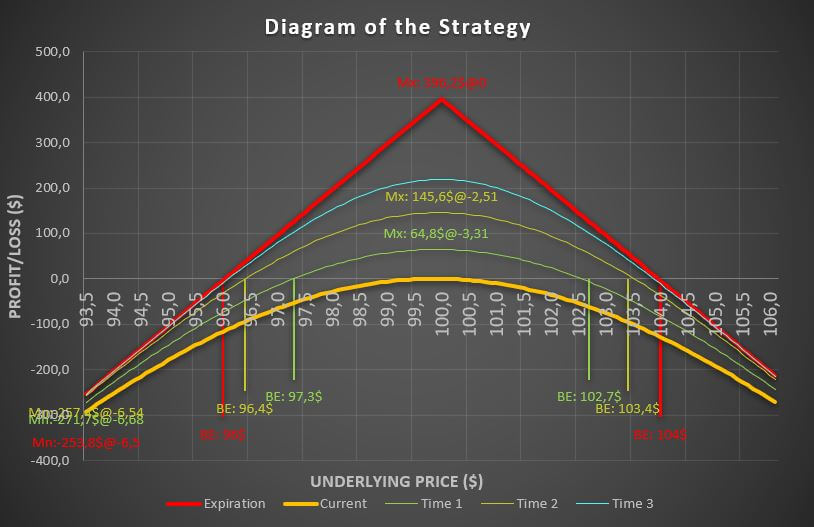

In both strategies, the risk is defined by the money we paid when we opened the trade. That means that the maximum loss is defined by the premium paid, which is $1.66 for the long strangle and $3.66 for the long straddle.

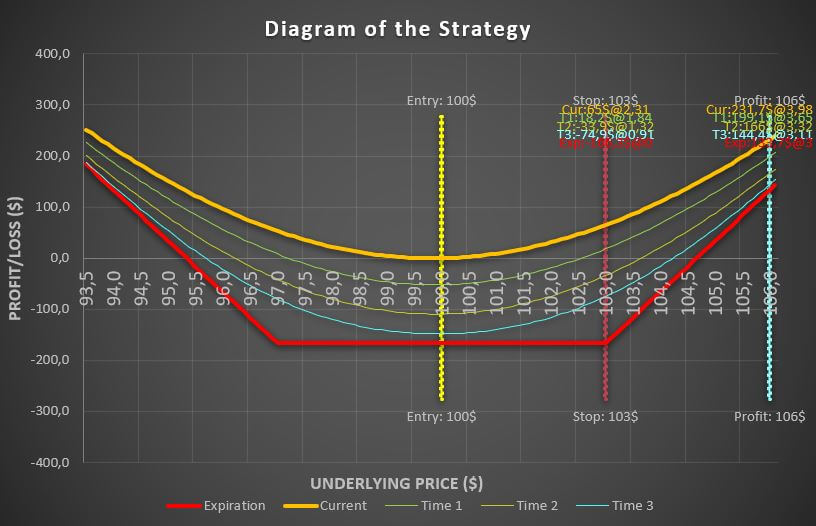

Now, because of the nature of these strategies, the maximum profit is theoretically unlimited. However, that is not realistic at all, so we will define two profit points in both cases and we will be measuring the results in every case and for every date to expiration that the Advanced Calculator show us.

The targets that we are going to set are the underlying price of $103 and $106, so let us now take a look at the calculator.

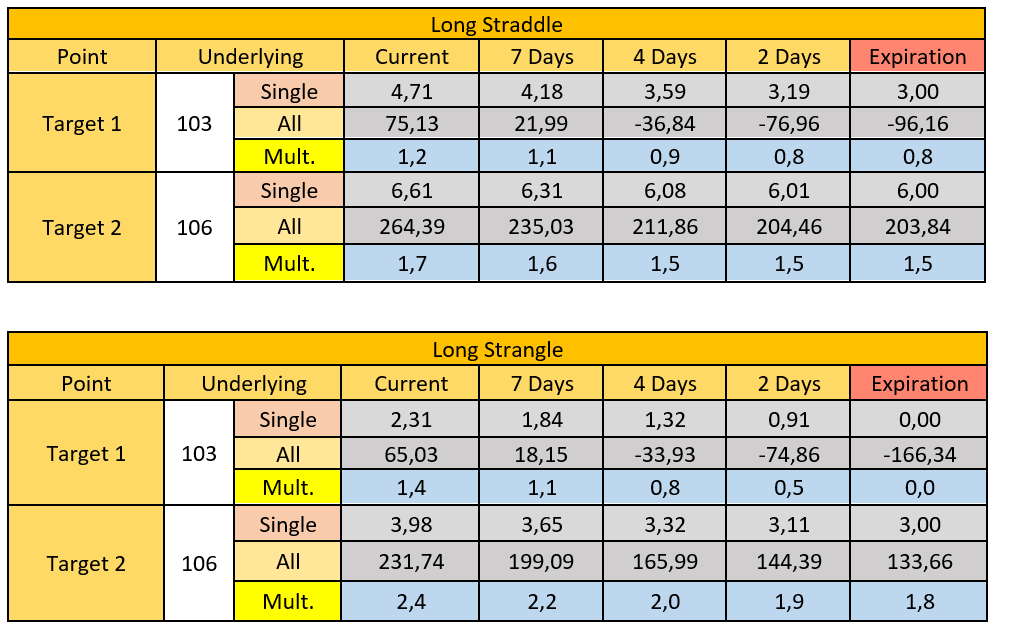

Comparing the long straddle vs strangle option strategy metrics

In the previous table, we can see three rows for every target. The “single” row will show us the premium value of one single strategy.

The “all” row will show us the net result of the strategy once we have deducted the premium paid when we entered the trade.

The “Mult.” Row will show us the risk/reward ratio of the trade for the selected date to expiration.

Analyzing the long straddle vs strangle option strategy metrics

With this information, we can easily compare the long straddle vs strangle option strategy. We can see that, while the straddle behaves better when the expiration date approaches, it has a lower risk/reward ratio compared to the long strangle.

However, the long straddle has a lower risk compared to the long strangle. In any case, both strategies will behave better the faster the underlying price moves to either one side or the other.

Also, we must keep in mind that we have considered that the volatility has not changed in the entire trade. Remember that the long straddle and the long strangle will be very damaged when the volatility falls once we are already in the trade.

Comparing the short straddle vs short strangle option strategy

Now that we have compared the long variants, it is time to focus on the short straddle vs strangle option strategies.

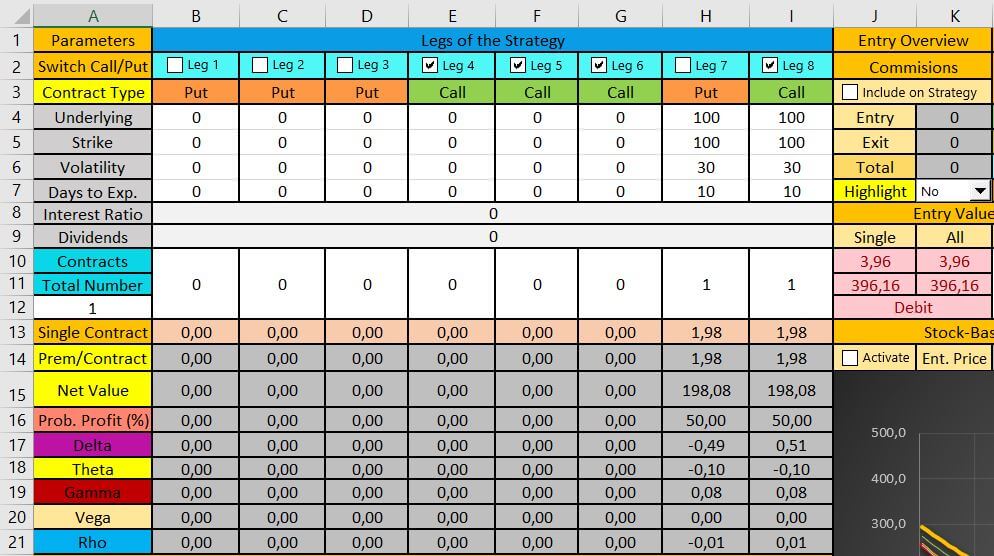

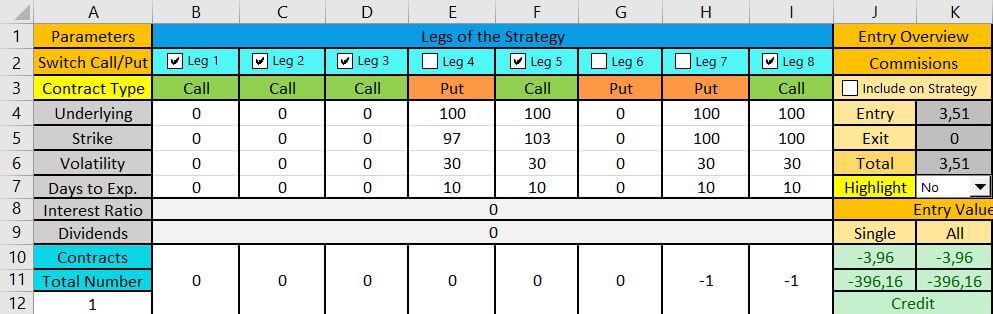

Again, we will assume exactly the same market conditions from the previous example, with the difference that we will be opening the short straddle and the short strangle.

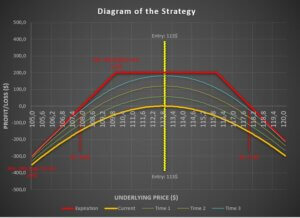

Let us take a look at the advanced option calculator to learn the premiums that we receive when we open these trades.

As it can be seen, the premiums that we paid in the long scenario are now received in the short strategies. Let us now analyze the metrics of these trades.

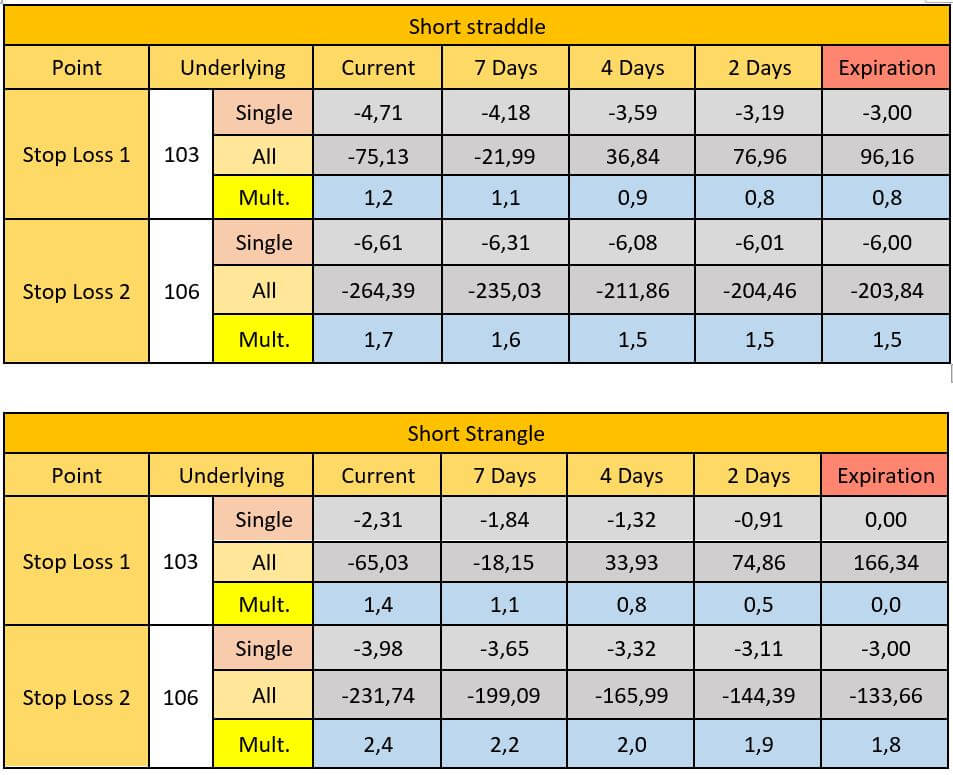

Short straddle vs strangle option strategy risks and profits

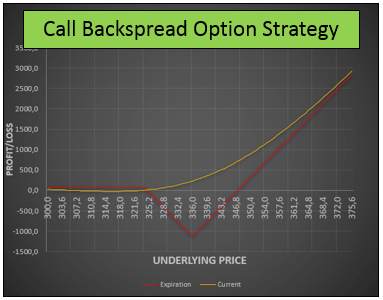

In both strategies, the maximum profit is defined by the premium we received when we opened the trade, which is $1.66 for the short strangle and $3.66 for the short straddle.

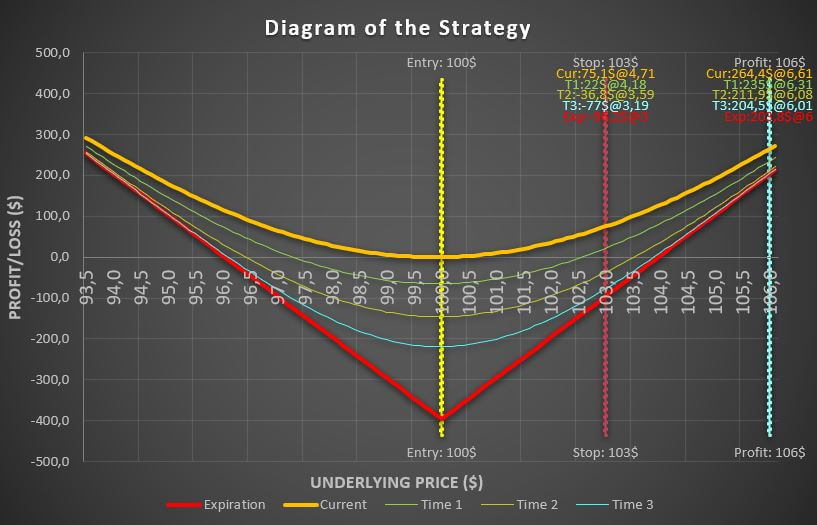

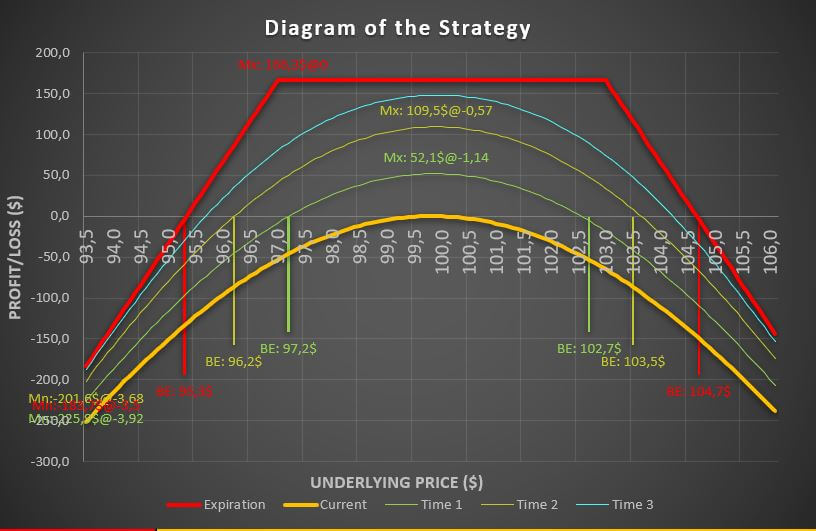

The risk is theoretically undefined, but that is not realistic as we could perfectly place a stop loss in some cases to avoid further losses.

For the sake of the comparison, we are going to set as stop losses the same underlying prices that we set in the long strategies as targets. That is, our first stop loss will be $103 and our second one will be $106.

Let us take a look at the value that the calculator show us now

Comparing the short straddle vs strangle option strategy metrics

Analyzing the short straddle vs strangle option strategy metrics

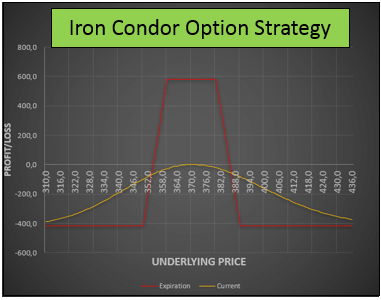

In this case, it is very easy to see that with the short straddle, it is very unlikely that we would get the maximum profit. And the reason is it is very hard for the stock price to stay exactly at the price at which we opened the trade.

In both cases we can see that the time decay will benefit our trade as the profits will be higher when the expiration date arrives.

As it can be seen, comparing the short straddle vs strangle option strategy, we will be obtaining worse results in the strangle but it will be much more probable that we receive the maximum profit because of the shape of the diagram.

Again, we must remember that an increment in the volatility once we are inside the trade will result in worse results.

Comparing the straddle vs strangle options which is better then?

It is very hard to say which long or short straddle or strangle is better, because everyone of them depends on the risk profile that you want to submit yourself.

What we can say is that the long straddle or the long strangle are great in case we really believe that there is going to be a strong movement to either side, and there is no other strategy that will provide you the characteristics that these ones gives.

While in the case of the short straddle vs strangle option strategy, we believe that there are better alternatives out there, such us the iron condor option strategy that provide much better risk/reward ratios.