Of the many different option strategies that exists out there, the iron butterfly option strategy is one of those that we should use in a neutral market.

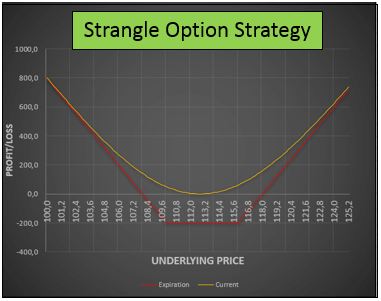

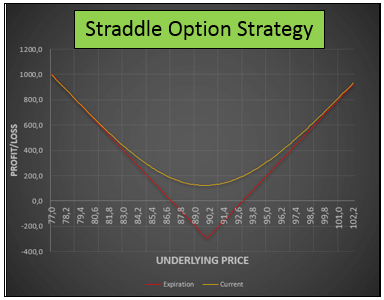

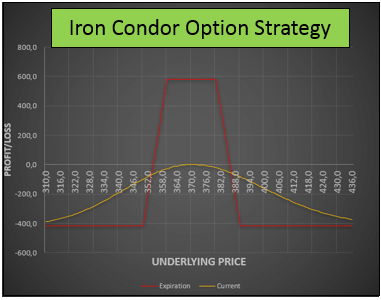

Usually compared with the short strangle or the short straddle, the iron butterfly option strategy is a particular case of the iron condor that we can use in trading.

In this article, we are going to be focusing on what is the Iron Butterfly option strategy, how to take the best from it and how is affected by the volatility and the time decay when we use it on a stock.

What is Iron Butterfly option strategy?

The iron butterfly option strategy is a selling, neutral strategy that focus on taking advantage of the time decay when the underlying is not moving in a particular direction.

The iron butterfly is formed by four legs, two of them will be sold (an At the Money call and an At The Money put), while the other two will be bought (an Out of the Money call and an Out of the Money put)

Typically, the strike prices of the sold options will be the same, and the Out of The Money options will be taken at the same strike distances to create a balanced Iron Butterfly option strategy.

Let us take a look at an example of what an Iron Butterfly option strategy would look like

Example of a balanced Iron Butterfly option strategy

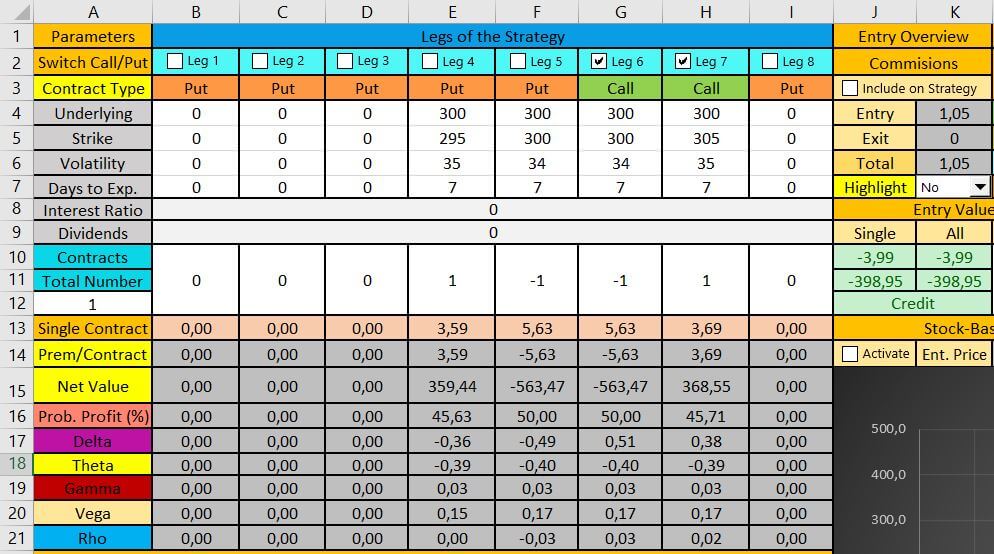

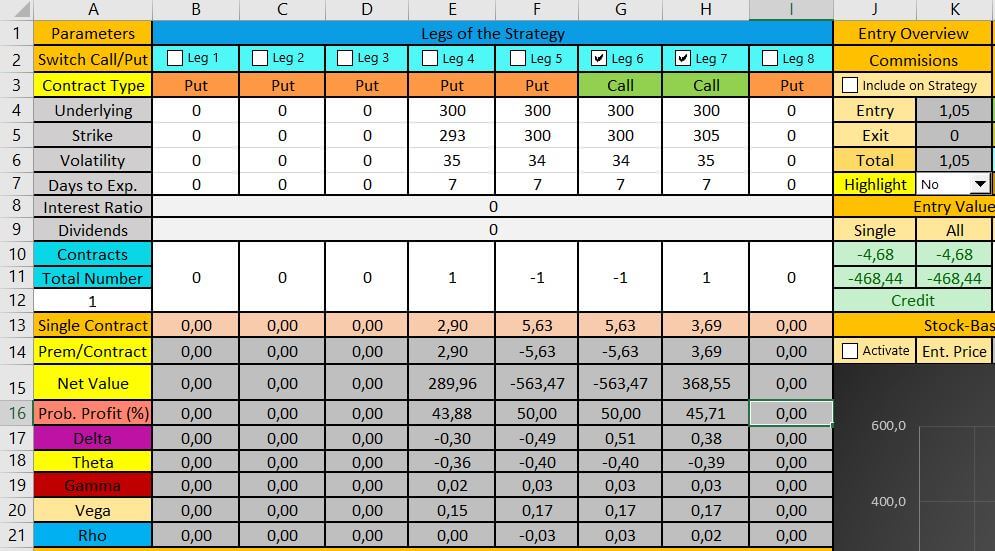

Let us suppose that we want to trade a stock whose underlying price today is at $300. In order to open an Iron Butterfly, we will be selling the call and the put option with a strike price of $300 and we will be buying a call with a strike price of $305 and a put with a strike price of $295.

In the following image of our advanced profit calculator, we can the performance of this trade.

As it can be seen, once we open this trade we will be receiving $398,95 as premium for selling the Iron Butterfly option strategy.

Now, we are going to take a look at the maximum risks and profits that the strategy can provide us

Iron butterfly option strategy risks and profits

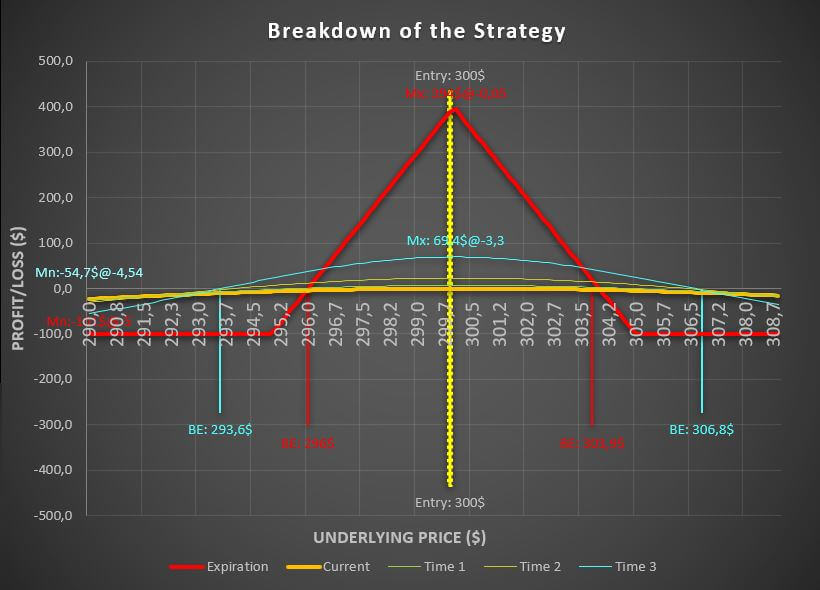

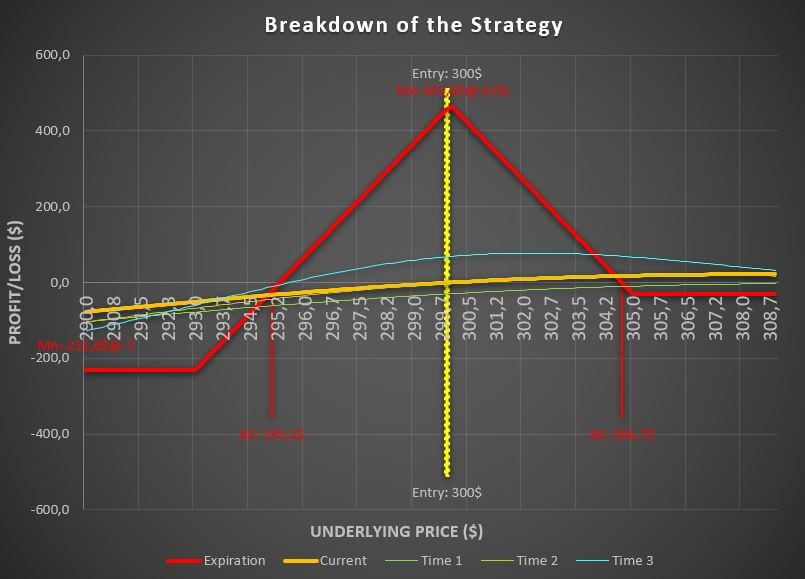

The best way to see the risks and profits of this strategy is by taking a look at the payoff diagram that our advanced calculator has provided

As it can be seen, the maximum profit at the expiration date is exactly the same value that we received as premium when we opened the trade, which was $398,95.

The maximum loss of this Iron Butterfly option strategy is defined by the difference between the strike price of the sold option and the bought option minus the premium received. In other words, it is limited to $101,05 in this case.

However, even when the risk/reward ratio of this trade is about 4, it is very important to take into account that the probabilities of the underlying to land exactly at the price of $300 are very low, so in reality, the ratio will be lower.

Of course, as this is a mainly selling strategy, time decay will be an advantage. As it an be seen on the diagram, the blue line represents the Iron Butterfly option strategy when there is still two days to the expiration date.

How volatility affects the Iron Butterfly option strategy?

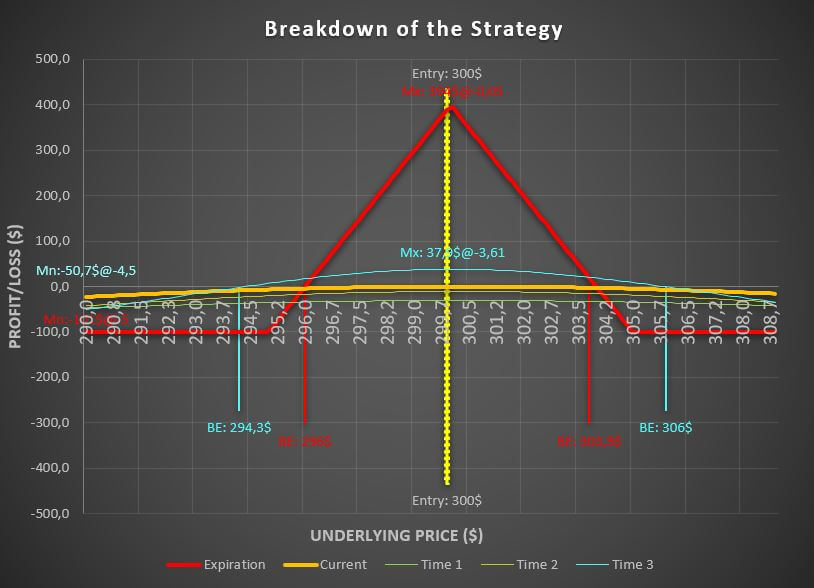

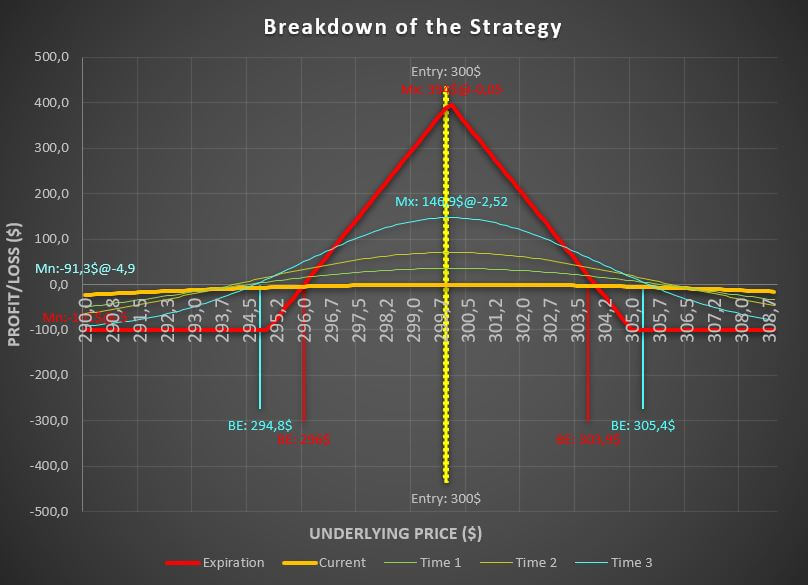

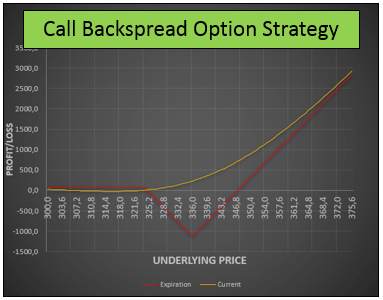

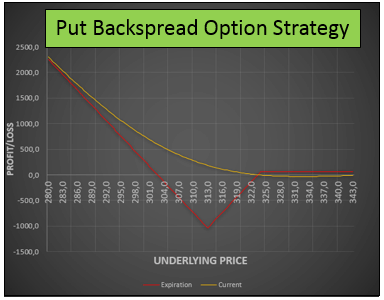

Just like what happened with the short strangle, the Iron Butterfly option strategy will be negatively affected if the volatility increases once we are inside the trade.

However, it will not be as drastic as with the short strangle because, in this case, the bought options will reduce the negative effects of the implied volatility.

In the following graphs, it can be seen how volatility affects the Iron Butterfly

Volatility increased by 10%

Volatility reduced by 10%

An example of an unbalanced Iron Butterfly option strategy

In the previous example, we have seen how to set a balanced Iron Butterfly option strategy. However, if we believed that the underlying price is going to be rigged for one side or for the other, we can simply decide to change the strike price of the Out of The Money option to take advantage of that.

For example, if we believe that the underlying price is going to rise, we will change the strike price of the Out of the Money put option to set it farther away.

Let us change the strike price of the put from $295 to $293 to see how the strategy would react.

Now, we will receive $468,44 when opening the Iron Butterfly. However, as we will see, the strategy will damage our account if the underlying happens to go down.

In the previous diagram, we can see how the performance of the unbalanced Iron Butterfly is.

Again, just like we saw in the previous example, time decay will be an advantage to this trade.

When to use the Iron Butterfly option strategy?

Just like with the short straddle or the short strangle, the Iron Butterfly option strategy is better use when we expect the underlying to stay neutral for a few days.

Compared to those two strategies, the Iron Butterfly will be better in terms of risk because we have managed to limit it thanks to the bought Out of The Money options.

Another very interesting comparison that we can make is the Iron Butterfly vs Iron Condor because, even when they are similar strategies, the results that we obtain from them can vary.

Which are the best stocks for Iron Butterfly option strategy?

The best stocks for the Iron Butterfly are those who have a high volume of contracts and open interest in their option chains.

In this other article, we have gathered a list of not only the best stocks for Iron Butterfly strategies, but for any other option strategy that you might want to trade in the market!

Where to get the Iron Butterfly option strategy calculator?

Would you like to get the Iron Butterfly option calculator that we have been using in this article? No problem!

Do you need a Calculator that helps you create and analyze any option strategy in record time?

Our advanced option strategy builder excel will allow you not only to create the Iron Butterfly, but any other strategy that you want!