One of the most interesting technical indicators available in the market is the one called Average True Range indicator or ATR.

Today, we will take a look at this indicator. We will see how to measure it, we will learn how to use it in our option trades and where to consult this data for free using the Finviz free scanning tool.

Also, at the end we will be talking about how to use Average True Range for stop loss orders in our trades.

So, let us get into it!

What is Average True Range indicator?

The Average True Range indicator, also called ATR, will help us measure the implied volatility in the market.

The indicator will provide us with a number, which is the maximum price variation in a bar or a candlestick over a particular period.

In other words, with the Average True Range indicator, we will be able to know quite accurately how much the price of a particular asset moves in the current timeframe, on average, of course.

How to read Average True Range indicator?

For example, if a stock option is trading at $100 today and its Average True Range indicator is 2.23, what this value is telling us is that the stock price will likely move $2.23 in the next session, between the high and the low prices of the candlestick.

It does not mean that it will be moving that precise value, but it will most likely do so. For example, the price could oscillate between $101 – $98.77 or $102 – $99.77.

We can not expect the price to go up or down the entire ATR value because that would not be realistic.

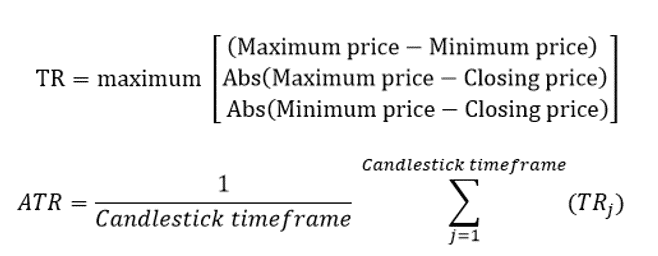

Which is the Average True Range formula? – How to calculate ATR

Although this formula will not be necessary to know since many trading platforms will calculate the Average True Range indicator just like in ProRealTime, it is always a good thing to know where the data comes from. In this case, the Average True Range formula is the following

Where the candlestick timeframe is the number of candlestick or bars, we want to take to calculate the formula. Typically, this number is set from 14 bars to 30 bars, depending on the timeframe. And that is how to calculate ATR indicator.

I mainly use the Average True Range indicator with 14 bars, which is the default in many cases.

How to use Finviz ATR Free Scanning tool to read the Average True Range Indicator?

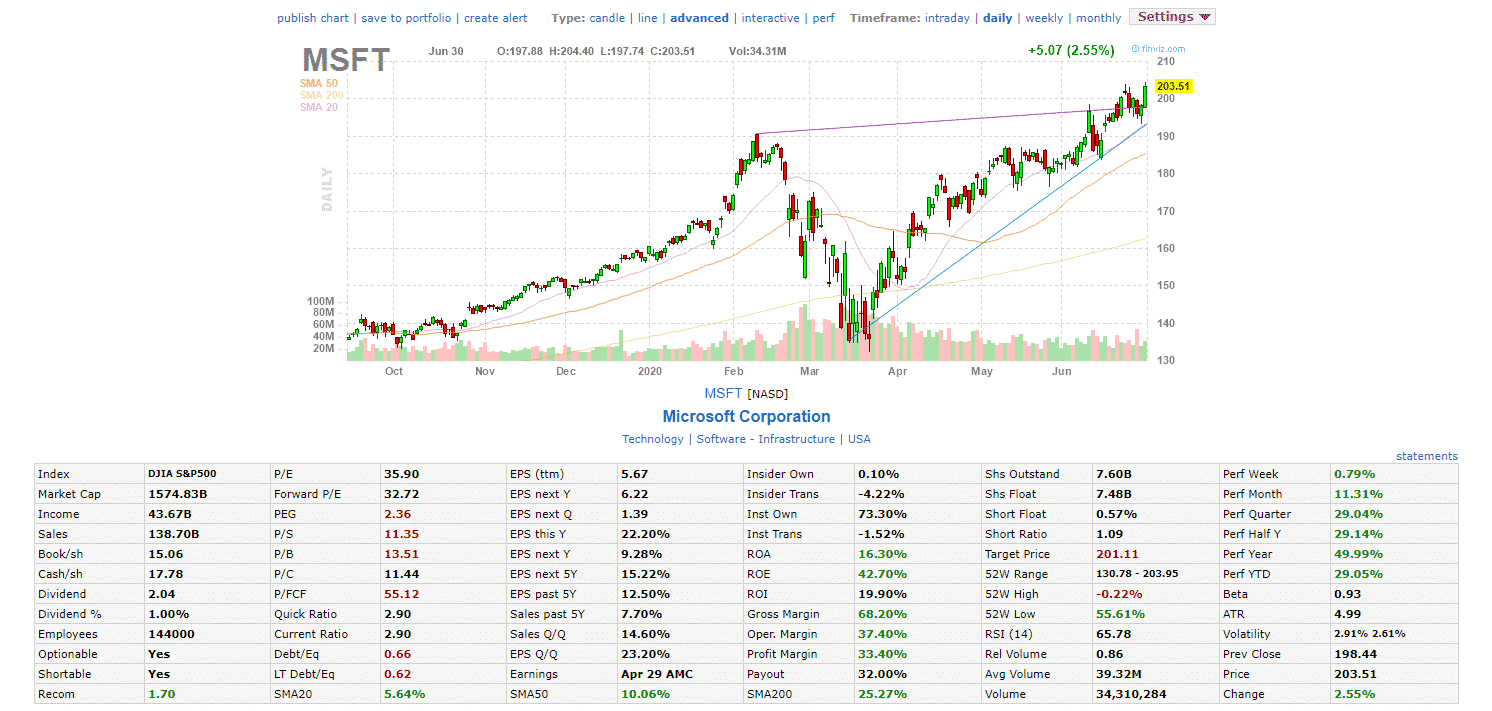

Between the many free features that Finviz possesses, they do provide the Average True Range data for every asset. Let us take a look at, for example, the stock charts from Microsoft Corporation (MSFT) in Finviz.

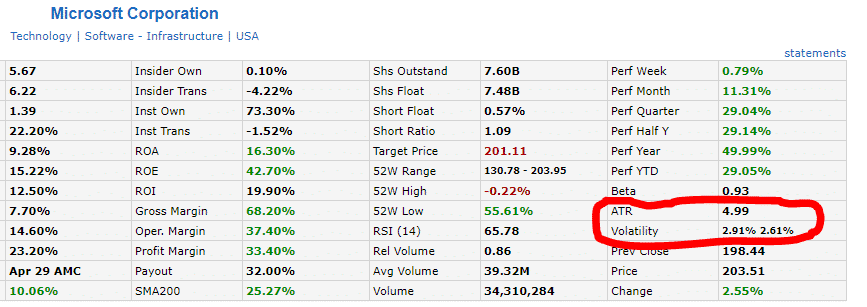

If you want, you can access Finviz here to take a look at any stock you prefer too and check the Average True Range indicator. In this example, as you can see, there are quite a lot of parameters that Finviz will show. Let us zoom a little more in the data below the graph.

As you can see, the Average True Range indicator provides us with a value of almost 5 points. That means, on average and daily, Microsoft stock price will be moving $5. That actually is a high ATR!

How to use the Average True Range Indicator in options?

Now that we know what data does the ATR provides us with and how to read it using Finviz, the next step is to understand how to apply this information in options.

How to use Average True Range indicator for selling options?

If we decide to be selling options, for example, a call option, our focus is that the stock price stays where it is, or at least, it does not surpass the strike price of our contract.

Using the Average True Range indicator to measure where we should set our strike price might be a very good idea.

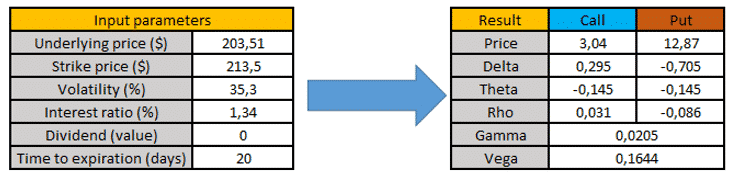

For example, if we were to sell a call from Microsoft Corporation because we expect that the price is not going to rise anymore, we could use the ATR to place that strike.

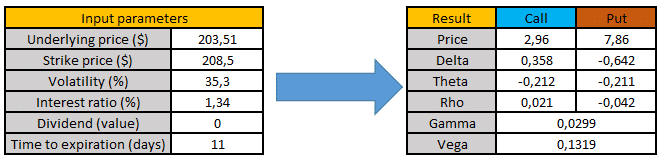

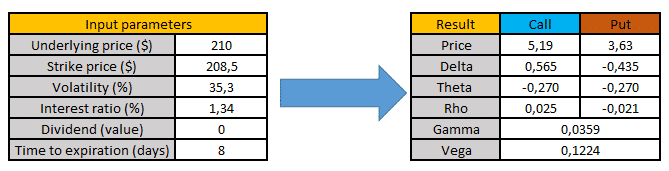

For example, we can sum the closing price of the stock plus 2 times the Average True Range indicator, so we are sure that the strike price will not be expiring In The Money. In this case, we will be selling the contract at $203.51 + $10 = $213.5 with 20 days or so to the expiration could be a good idea.

How to use Average True Range indicator for buying options?

To buy options, we should have quite a robust technical analysis to take the best from the trade. However, we could do exactly the same that in the selling options case.

Imagine now that we expect the price to go up in a few days. As the ATR is telling us that the most probable move in a single day is about $5, we should be buying a call whose strike price is near the sum of that value.

For example, the closing price in Microsoft was $203.51. If we now buy a call, we could set a strike price somewhere near to the sum of $203.51 + $5 = $208.5, as we expect the stock price to go up fast.

Using the Average True Range for stop loss and to set our profit target in options

Because precisely we are expecting a somewhat big move, if we set a strike price in the first ATR, we could set a profit target at half ATR more, that is, at $210.

Personally, I would pick $209.88 or so to avoid the possible resistance that we might encounter in a key point, such as a $210 price.

Doing this, we will take the best effects from gamma and delta, and our option reevaluates more.

Another question we could make ourselves is how to use Average True Range for stop loss, and we could do the following. We could measure the ATR to set a stop loss if the trade begins to move in a different way we expect.

For example, setting a stop loss at 3/4 ATR under the entry point could be the right place.

Another possibility is that you can set the stop loss at half the price of the option premium you paid to enter the trade, which is something we tend to do. In other words, our stop loss would be triggered when the option premium reduces its value to $1.48.

In that case, the profit-risk ratio would be 3.5 to 1 in this particular trade.

Last words about the Average True Range Indicator

When selling options, you might want to use the Average True Range indicator to set the strike in a price threshold that you expect the stock will not move to.

When buying options, you also want to use ATR to determine the strike price that you will purchase and the profit target you expect.

Apart from the Average True Range indicador, there are other tools such as the Bollinger Bands that will help us measure the volatility of an asset.