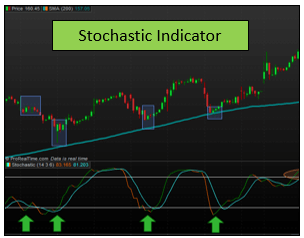

The CCI indicator or the Commodity Channel Index indicator is a very similar technical analysis tool to the stochastic indicator.

It is a momentum-based oscillator that will help us to determine the state of the asset we are dealing with.

In this article, we are going to be reviewing what is CCI indicator, how to use it, and how it works. We will take a look at the different signals it will provide us and how to interpret them in the best possible way.

Finally, we will learn about some strategies we can use with this tool, and we will detail some examples to make the best from it and use it in our desing of a trading system.

What is CCI stock indicator?

The CCI indicator is a momentum oscillator that will tell us if an asset is entering an overbought or oversold period.

Also, we will be able to learn the price direction and the strength of the asset, showing us if we should open or close a trade in the first place.

Let us take a look at how the Commodity Channel Index indicator is displayed in a graph.

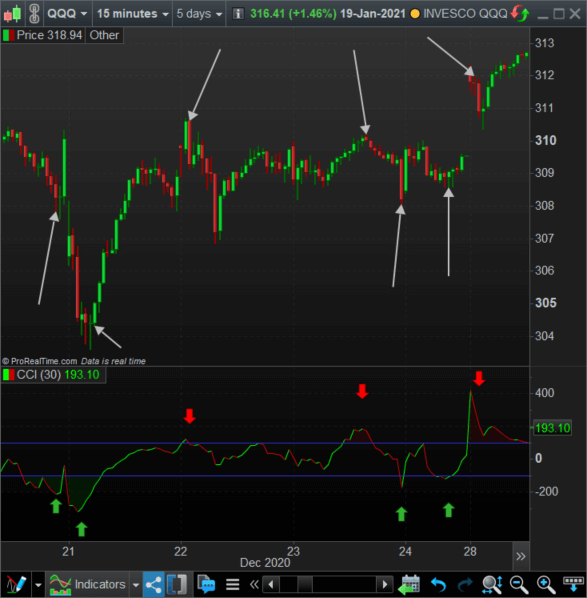

In the previous image, we have displayed the CCI indicator at the bottom of the chart and, over the QQQ, the Nasdaq ETF.

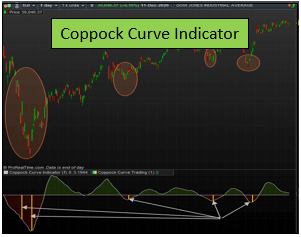

As you can see, it is pretty similar to the stochastic indicator, but it has a few differences that we will be reviewing later.

Now that we know what is the Commodity Channel Index indicator and how it looks like, let us take a look at how does it work.

How CCI indicator works?

The CCI indicator shows us the variations of the price compared to its statistical average, and we could say that it is an indication of the market speed.

The best way to understand how CCI indicator works is by learning how it is calculated, as it will give us a better idea about how this indicator can help us in our trading.

How to calculate CCI indicator?

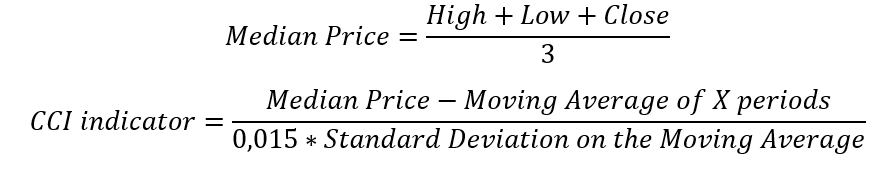

We need to know that the Commodity Channel Index indicator calculates the distance between a price and its average over a certain period, divided by 1.5% of the standard deviation.

Let us translate that into the CCI indicator formula to make things clearer.

As you can see, the CCI indicator formula is relatively easy to calculate compared to others, such as the Supertrend indicator or the ADX indicator formulas.

Once we know how the CCI indicator is calculated, let us take a more in-depth look at how to use it.

How to use CCI indicator? – CCI indicator strategy

There are two ways to use the Commodity Channel Index indicator, and again, they are very similar to the stochastic indicator.

CCI indicator strategy: Overbought and Oversold strategy

The easiest way to use the CCI indicator is by using the overbought and the oversold strategies, just like the stochastic. In this case, the CCI indicator is not bounded between, so we will consider a high value (more than 100) to be an overbought zone.

Similarly, if the CCI indicator is in a value that is lower than -100, we will consider it an overbought zone. In these cases, we can proceed just exactly as we would with the stochastic indicator.

- Bullish Signal: If the Commodity Channel Index is under -100 and begins to rise, we will buy the asset.

- Bearish Signal: If the CCI stock indicator is above the 100 threshold and begins to fall, we will sell the asset.

Let us take a look at a more visual example in the same graph that before.

We have marked the bullish signals with green arrows and the bearish signals with red arrows inside the CCI indicator in the previous graph.

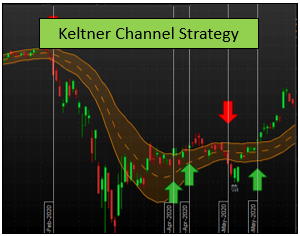

As you can see, the Commodity Channel Index provides good signals, but what we really recommend is to combine this CCI indicator strategy with a trend filter, such as a 200 exponential moving average.

CCI Indicator strategy: Bullish and Bearish Divergences

The second way we can use the CCI indicator is by looking for bearish and bullish divergences. These are stronger signals than the ones provided by the previous strategy, but they also appear less.

The rules to correctly use the divergence CCI indicator strategy are the following:

- Bullish Divergence: A Bullish Divergence in the CCI indicator occurs when the stock price makes new lows while the indicator starts to climb upward

- Bearish Divergence: A Bearish Divergence in the Commodity Channel Index indicator occurs when the stock price makes new highs while the indicator starts to go lower.

Let us take a look at the following graph.

Here, we have represented a bearish divergence in the CCI indicator. As you can see, the Commodity Channel Index indicator made two peaks, but the previous was higher than the latter, while the price did not accompanied the move.

In that case, there was a strong movement to the downside after the divergence was completed.

In this case, we have a bullish divergence in the 15 minutes chart of AMD. The CCI indicator made a higher low, but the price did not accompany the movement of the indicator, marking us a bullish divergence that is yet to be completely developed.

As you can see, this is quite similar to the stochastic divergences or the Relative Strenght Index indicator divergences. We could say that the divergence is the best signal offered by the CCI indicator, as it predicts a strong movement in the market.

CCI indicator settings

Typically, when we decide to use the CCI indicator, the standard format uses 20 periods for the moving average.

However, we found better results changing the CCI indicator settings to a 30 periods moving average. Like always, changing that parameter depends entirely on you, but we always like to provide you with our best experience.

Does the CCI indicator repaints?

Unlike other indicators such as the Zigzag, the Commodity Channel Index indicator will not repaint. Once the candlestick is close, the indicator will stay as it is.

Last words about the Commodity Channel Index indicator

As you can see, the CCI indicator is quite similar to the stochastic indicator, as we have previously stated, but they are calculated differently.

While the CCI indicator uses the standard deviation to create the channel, the stochastic considers the rate of the previous prices change, which made both indicators unique in their own way.

In any case, we have found that the best signal offered by the CCI indicator is the divergence, like in many other cases. However, this one is hard to find.

Like always, we recommend you take a look at this indicator in your own trading platform before considering using it in your trading strategy and do not forget to use a trading volume indicator too.