The RSI Relative Strength Index or the RSI stock indicator is one of the best momentum oscillators in the entire technical analysis of any of the assets in the market. Using this indicator correctly, we will be able to find the best entries to make some profits with any stock or option of our choice.

In this article, we are going to be reviewing what is the RSI relative strength index indicator. We will learn how to correctly set it up and how to find the best signals it can provide.

Also, we will explain the relative strength index formula, so you can really understand why the indicator is so powerful and useful when it comes to trading.

So, let us begin!

What is the RSI relative strength index indicator?

The RSI stock indicator (or relative strength index indicator) is a momentum indicator used in the technical analysis of stocks or any other asset.

It is used to measure the current changes of the price to determine if the stock is facing an oversold or an overbought period. The relative strength index will always oscillate between 0 and 100.

How does the RSI relative strength index work?

As the indicator moves between 0 and 100, we will consider an oversold period when we find the stock rsi below 30 points.

Alternatively, we will consider an overbought period when we find the stock rsi above 70 points or so.

The best way to explain this is by using a visual example of a price chart.

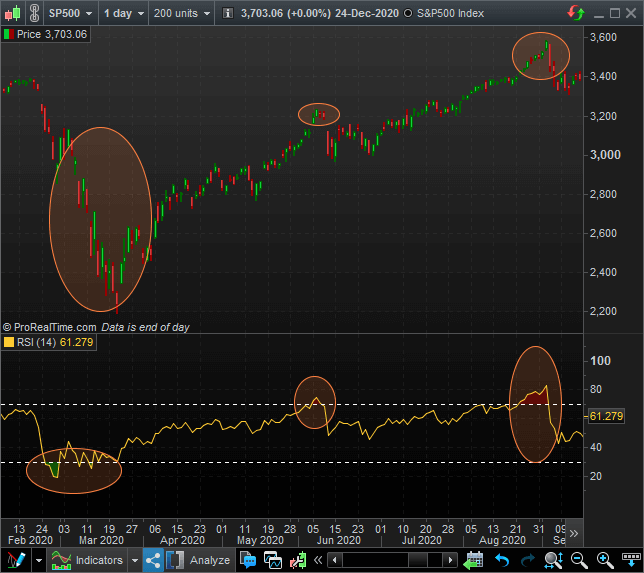

In the previous image, we can see the relative strength index S&P 500 at the bottom of the daily chart.

In this case, we have spotted an oversold period in the left part of the chart, in March 2020. Also, we can find two overbought period at the center of the chart and at the right part of the chart, at the end of August of the same year.

Before getting into more details about how to interpret the indicator, first, we are going to take a look at how the RSI relative strength index formula is composed so we can have a better understanding of how it really works.

The RSI Relative Strength Index formula

As with many other indicators like the KST oscillator, the calculation of the RSI Relative Strength Index formula will only require one single parameter to be defined before its calculation.

This parameter is the number of candlesticks we want to include in the operation, and the typical is 14.

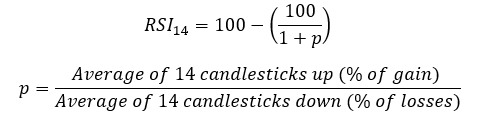

The relative strength index formula is as follows:

For example, if in the previous 14 japanese candlesticks, we had registered 10 days with an average gain of 0.75% and 4 days with an average loss of -0.23%, the parameter p would be 0.75%/-0.23%.

That would complete the basic RSI Relative Strength Index formula. However, in some softwares such as ProRealTime, you might sometimes find an additional calculation that intends to smooth the indicator, just like it happened with the stochastic indicator. This last step is calculated as follows:

This last step of the RSI Relative Strength Index formula is applied in some of the trading software available at the market to make the indicator more smooth. What you will most likely find on the software is the indicator only under the name of RSI.

How to use the RSI stock indicator? – The RSI trading strategy

When it comes to applying the RSI Relative Strength Index to our trading scenario, we should be careful with one particular RSI trading strategy, as this one would lead us to many false signals in the long term perspective.

Avoid the Overbought and Oversold RSI trading strategy

First of all, we are going to learn what we should NOT be trading as a legitimate signal because this is the source of many, many false entries that will most likely lead us to frustration.

The common thing you can find over the Internet is this:

- Bullish Signal: When the RSI stock indicator enters below the 30 points threshold, we have spotted a bullish signal.

- Bearish Signal: If the RSI Relative Strength Index is above the 70 points threshold, we have a bearish signal.

Basically, what they are saying is to trade in the tops and bottoms of the RSI stock indicator.

The truth is that we should completely avoid this RSI trading strategy because it does not contemplate the trend of the asset we are trading with.

Let us show you an example of what we should avoid

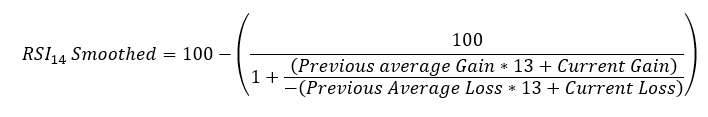

Take a look at the previous graph. In it, we can see that the RSI Relative Strength Index has spotted an oversold period. If we decided to jump and directly buy shares of this stock immediately when the RSI stock indicator entered the green area, we would not have made any profit.

Instead, we would have been making a loss over the next 3 days, and that was quite a loss!

In other situations, you may find over the Internet that the best thing to do is to wait until the RSI stock indicator rises above the oversold or the overbought zone and then buy or sell the stock.

But again, that is not a solid reason to open a trade because the 70 and 30 threshold are set up arbitrarily. We could have selected an 80 and 20 threshold, and still, we would have made any difference. For example, let us take a look at one particular stock that kept marking bearish signals over and over again.

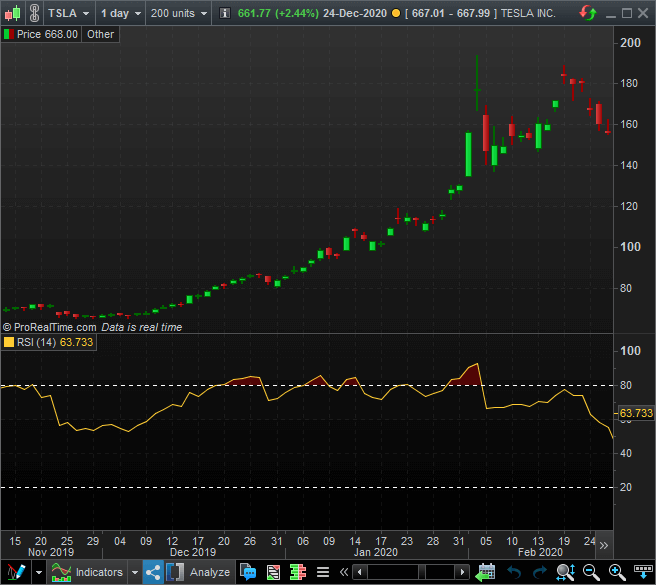

This is the Tesla represented in a daily stock chart before it did the stock split with the RSI stock indicator configured with a 20 and 80 threshold to define the overbought and oversold periods. The stock was in an incredible rally that looked like it would never end. And the RSI Relative Strength Index kept showing false bearish signals.

If we had decided to follow them, we would have made quite a huge loss in every one of the trades.

Then, is the RSI stock indicator useless in this strategy? The answer is yes, and no. We should treat the RSI relative strength index as a market gauge in this particular strategy.

The indicator actually tells us that the stock is really overbought or oversold, but that does not mean that the trend is going to change.

The Oversold and Overbought RSI trading strategy is just that, a market thermometer that will help us know and understand the situation of the asset, but nothing else.

Now that we know how NOT to use the RSI relative strength index, we are going to take a look at how we should actually use it to trade.

The best way to use the RSI Relative Strength Index: Divergences as our trusted RSI trading strategy

The proper way to use the RSI Relative Strength Index is by looking for divergences, as they will truly spot entries in the market. Let us define how an RSI divergence works

- Bullish Divergence: A bullish divergence occurs when the stock price makes new lows while the RSI stock indicator fails to make new lows.

- Bearish Divergence: A bearish divergence occurs when the stock price makes new highs while the RSI Relative Strength Index fails to make new highs.

Actually, the strategy works better if we find a signal when we are facing support and resistance in the market, because it will tell us to trade in the opposite direction, meaning that the price will probably bounce on that key level. Let us take a look at a few RSI Divergence examples so we can have a better perspective of this strategy in the following charts.

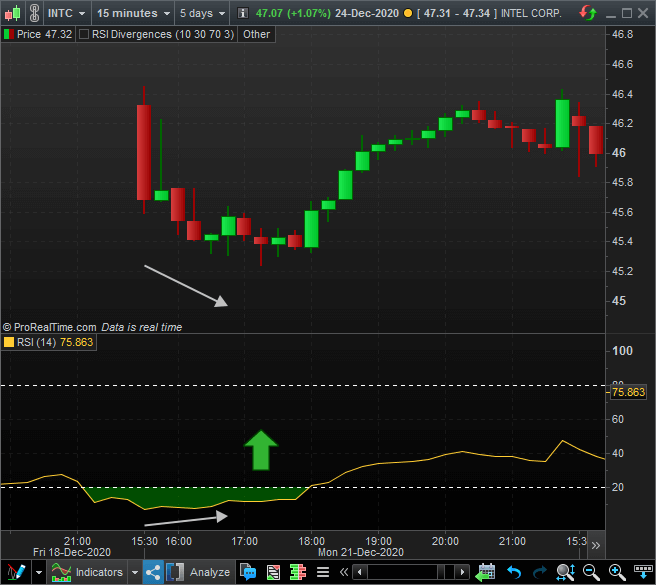

Here we have a bullish RSI divergence marked with white arrows in the indicator and stock price. As you can see, even when the RSI Relative Strength Index is in the oversold area, we will not pay attention until the divergence is completed.

In that case, we will jump into the market and buy some shares or options of the security.

And here we have a bearish RSI stock indicator divergence marked with a red arrow, in which we have spotted the beginning of a downtrend.

That is how we should be looking for signals in the RSI Relative Strength Index, by taking only divergences. Of course, not every divergence will be legitimate, but there is nothing perfect in the trading world, as you know.

We know that looking for the RSI divergences might be quite tedious if we do not have the tools to find them. To identify them quickly, we have modified the indicator so it shows the divergences with an arrow over the price.

If you are interested in this modification, you can download it for free for ProRealTime trading software along with our Free Stock Trading Guide so you can add it in your analysis.

How accurate is the RSI Relative Strength Index?

As we have seen, of the two possible ways to treat the indicator, the most accurate is the Divergence RSI trading strategy.

When to use the RSI relative strength index?

To understand when to use this indicator, we must be aware that by using the Divergence RSI trading strategy, what we are looking for is for a trend end.

So, if we are going to be trading trend reversals, we should not be looking for a trend continuation. Even when this sounds obvious, we should always keep in mind that a divergence spot a change in the trend, whether bullish or bearish.

In other words, we should use the RSI Relative Strength Index when we believe we are approaching the end of the trend, so we will give more credit to those divergences that are forming peaks and bottoms with resistances or supports.

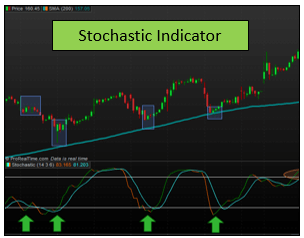

RSI vs stochastic indicator

One of the most usual things traders and investors tend to do is to compare the RSI vs stochastic indicator to determine which is better to use in their trading strategies.

As we saw in the stochastic indicator article, this one is a better tool to determine the momentum of the current prices because it compares the closing prices of the asset to their previous price ranges.

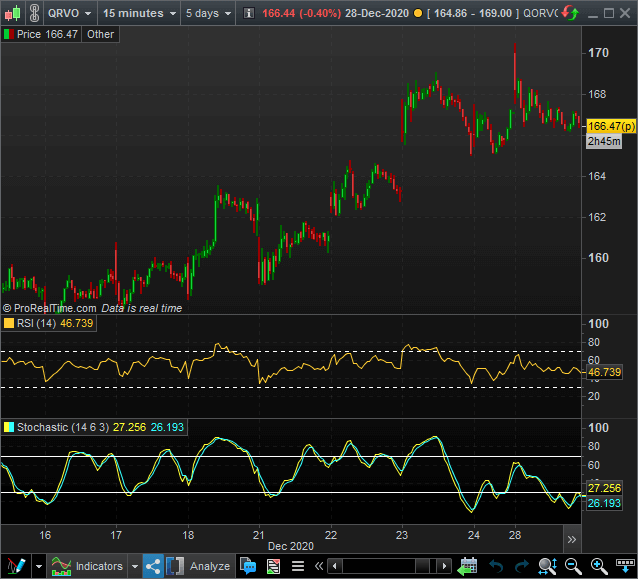

In other words, the stochastic indicator is better when it comes to determine the bottoms and peaks of the price. Here we have a comparison of the RSI vs stochastic:

As you can see, the stochastic indicator enters in the overbought and oversold areas easier and in a more accurate way than the RSI Relative Strength Index.

The best way to use the stochastic is by following trends, as we saw in its article, while for the RSI stock indicator, it is best used with divergences as a trend changer.

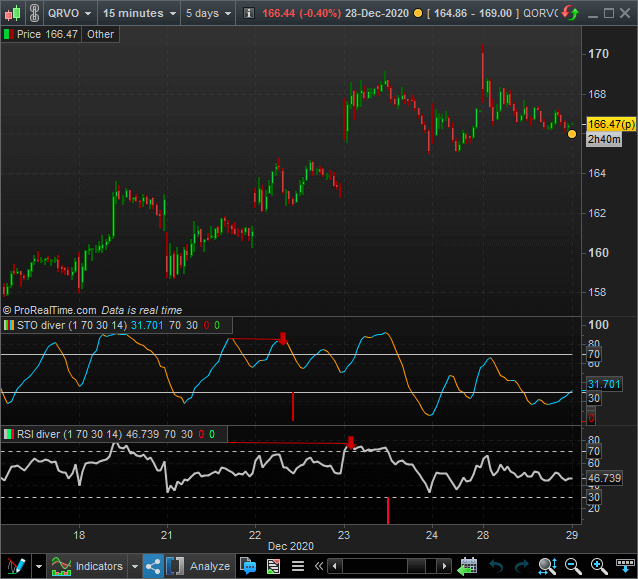

Now, if we compared the divergences between the RSI vs stochastic indicator, we are going to find that these are quite different. Let us take a look at the following graph to compare them

In the previous image, we have programmed both indicators to mark the divergences in an easy and simple way. As you can see, if we compare the RSI vs stochastic divergence, we will find that the RSI stock indicator divergences are more accurate than the stochastic.

As we said before, the best way to use the RSI Relative Strength Index is by looking for trend changes, and using the divergence strategy, we will be taking the best from this indicator.

This does not mean that the divergences in the stochastic do not work. No, this means that the RSI divergences are more reliable because the stochastic indicator is better used to jump in trends.

Either way, we can always use both tools and jump at the beginning of a trend and determine with the stochastic where will we be finding weakness and strength in the market

Last words about the RSI Relative Strength Index

As we have seen, the RSI Relative Strength Index is a momentum indicator that will be quite useful to determine the state of the current prices of an asset, whether a stock or a future.

Of the two ways of using the RSI stock indicator, we should stick to the Divergence RSI trading strategy, as this is the only one that really works properly. Of course, we could use the overbought and oversold stages of the indicator to help us identify the state of the price, but only as a gauge, not to open long and short positions in the market.

As always, we highly recommend you to take a look at the indicator before adding it to your trading strategy so you can test it and try it for yourself