What is the Stochastic Indicator? – Your 101 Guide To Truly Understand This Poweful Tool

The Stochastic Indicator or (stochastic oscillator) is one of the most useful tools we can use in the technical analysis of any of the assets available in the market.

The reason why this indicator is one of the most used in a trading system is the great accuracy it provides to our trades.

In this article, we are going to fully explain what is the stochastic indicator, how to read it, and how to use it. Also, we will be explaining some variants of the indicator, such as the Stochastic RSI or the Stochastic Momentum Index.

But first of all, we need to understand what is the stochastic indicator and how to use it in our strategies, so let us get started!

Table of Contents

What is the Stochastic Indicator?

The stochastic indicator is an oscillator that tries to determine the momentum of an asset. The key of the stochastic stock indicator is that it compared the closing prices of the asset to its previous price ranges.

By doing so, the stochastic indicator is capable of identifying when the current momentum of a trend is beginning to fade and foresee an immediate change in the direction of the prices.

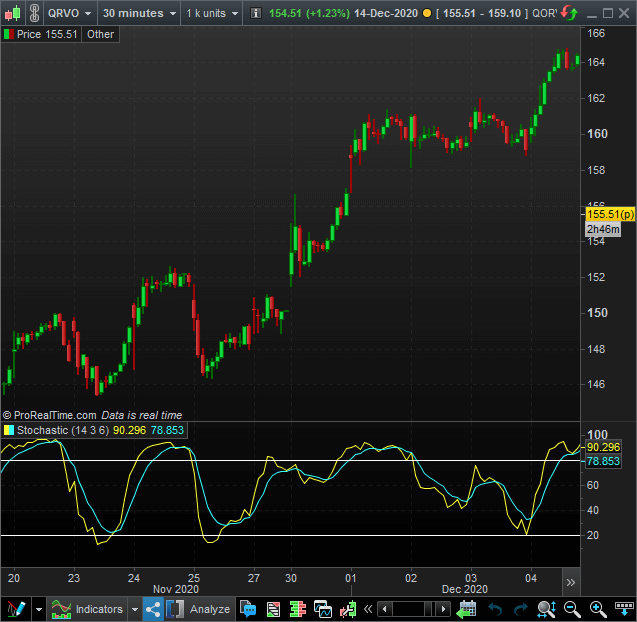

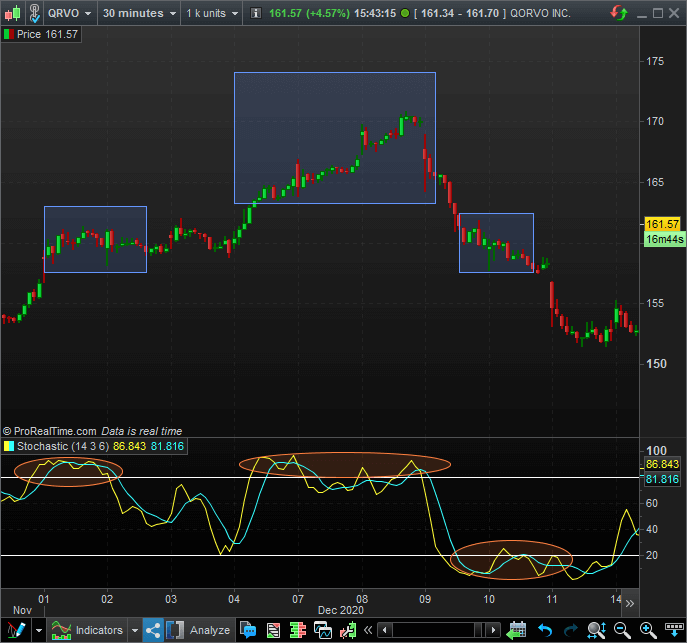

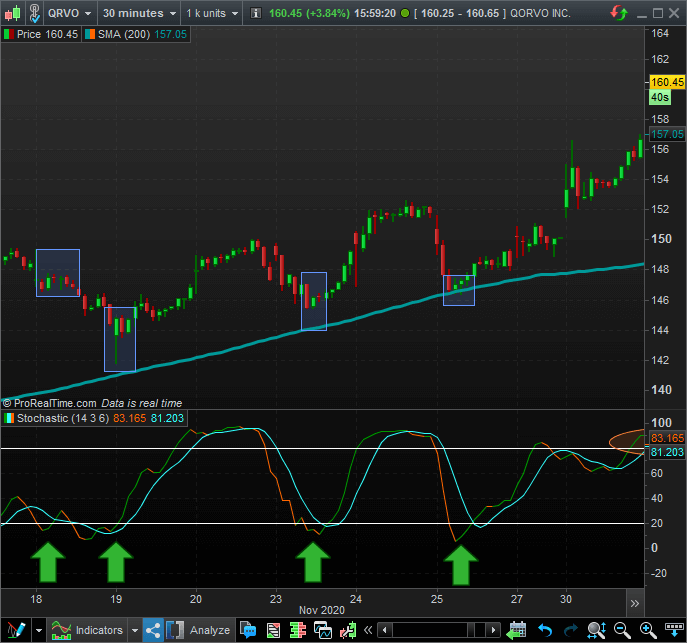

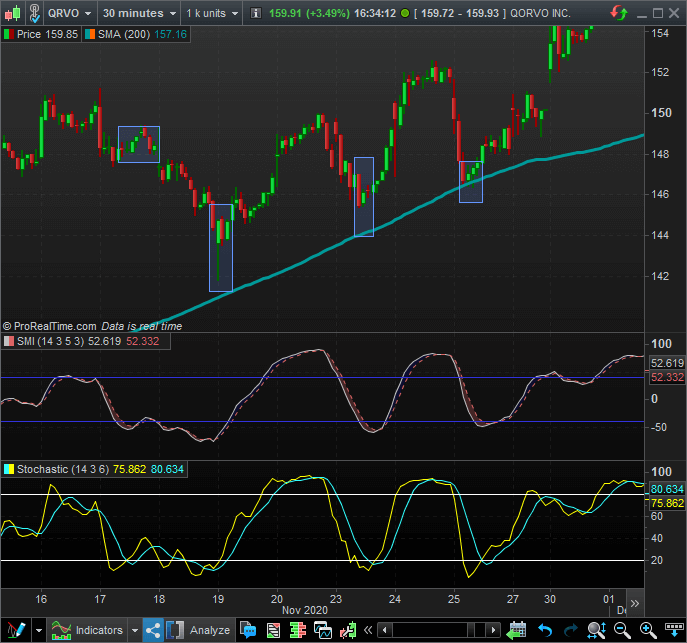

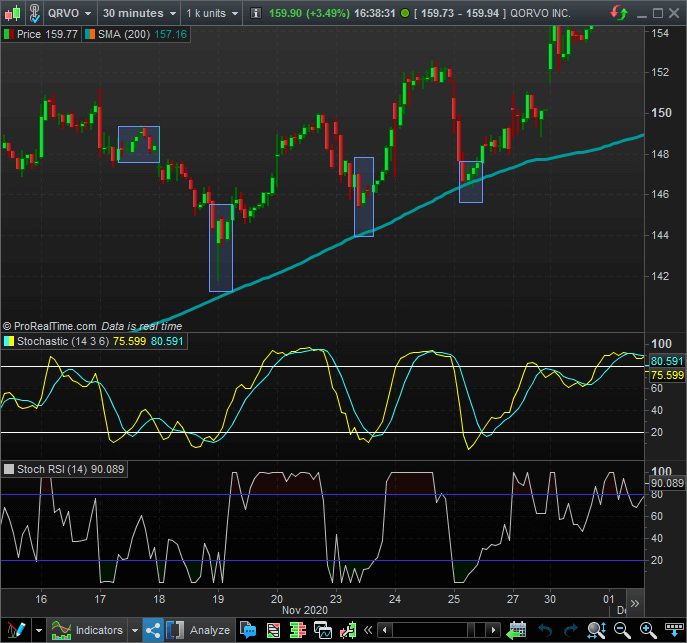

The best way to learn what is the Stochastic Oscillator is by using a visual example like this one here.

In the previous image, we can see a price chart displayed in a 30 minutes time frame and the stochastic indicator at the bottom of the graph.

Now that we know what is the stochastic indicator let us proceed to explain how it works and how is composed.

How does the Stochastic Indicator work?

As an oscillator, the stochastic indicator will help us to identify weakness in the momentum of the trend.

The complete stochastic indicator is constrained between 0 and 100, and it is formed by two lines called fast stochastic or %K and slow stochastic %D that will define the overbought and the oversold zones.

Do you need a fast Stock Trading Journal that helps you make better decisions?In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal |

What is fast stochastic indicator (%K) exactly?

The fast stochastic indicator is the current value of the stochastic indicator.

Although it may sound confusing, when we refer to %K we are referring to the actual value of the complete stochastic indicator.

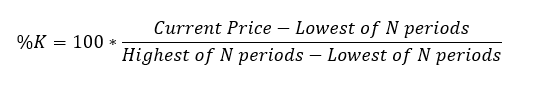

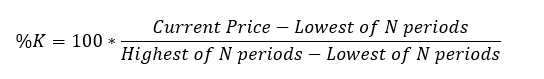

To help us understand this better, we should take a look at the main formula of the %K, which is as follows

When the fast stochastic indicator crosses over or under the slow stochastic indicator or %D, we will spot potential market entries. We will focus on this later in the strategies section.

So, what is slow stochastic (%D) then?

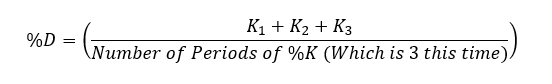

The slow stochastic is the number of periods of the moving average of %K. Again we will take a look at the formula to help you understand this better. For example, we are going to pick a 3 periods moving average to calculate %D.

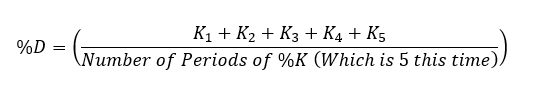

If we had picked a 5-period moving average for %D stochastic indicator formula, we would have written the following

That is how the basic stochastic oscillator works.

Stochastic Indicator Settings Explained

In many of the trading software, we will need to enter three parameters to configure the stochastic indicator settings correctly.

The reason for this is that the typical stochastic indicator settings allow us to apply what is called a %K smoothing before the %D calculation.

To avoid any more confusion, let us number the 3 steps we need to follow to complete the stochastic oscillator.

- First, we need to calculate the %K just like we saw before

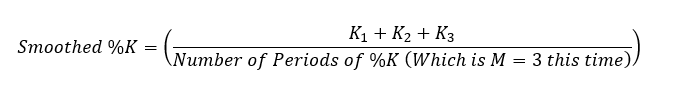

2. Second, we need to smooth the %K with the number of periods we want. For example, we are going to pick M=3 periods.

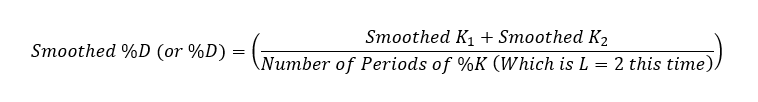

3. Third, we need to calculate the %D stochastic indicator formula, which is now also called Smoothed %D, using the Smoothed %K we obtained in the previous step. We are going to pick a L=2 period.

So, in other words, the typical stochastic indicator settings we will find in ProRealTime will need three parameters we have to enter for the oscillator to work properly. These three parameters are:

- The number of periods used to calculate %K, which is N, is our %K formula we saw before. Typically, N is 14.

- The number of periods for the Smoothed %K, which is M, is our formula. Typically M is 3.

- The number of periods to be considered for the moving average of %D or Smoothed %D of the smoothed %k, which in our example was L. Typically, L is 6.

As you can see, the only thing new to the basic stochastic indicator setting is a previous step before calculating %D. The reason for doing this is to have better signals while trying to catch the weaknesses of the momentum.

To make sure you fully understand this, we will look at the previous graph one more time.

In the stochastic oscillator, you will find two lines even though we had to define three periods.

To make things clearer, the yellow line represents the Smoothed %K, and the blue line represents the Smoothed %D or %D.

In this stochastic representation, we are not going to see the simple %K, as one could expect.

What we are seeing instead are the Smoothed representations of both stochastics. The reason is to simplify the view and keep the signals as easy to understand as possible.

Now that we have finished explaining the stochastic indicator settings and how does it work, we are going to jump to how to interpret the stochastic indicator.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

How to read the Stochastic Indicator?

We will identify overbought periods in the price when the stochastic indicator is above the 80 points threshold, while we will spot an oversold period when the indicator is under 20 points.

However, we should be very aware that a trend might be strong enough that the indicator may stay in an overbought or an oversold period during a certain time.

Let us take a look at the following graph

In the previous image, we have marked the overbought and oversold zones of the stochastic oscillator with an orange circle.

As you can see, the indicator does show us where the momentum is headed, but it does not succeed in marking us the trend.

For example, the oversold zone marked at the right part of the graph is only the beginning of what it looks like to be a bearish trend, even when the indicator tells us that we have an oversold price.

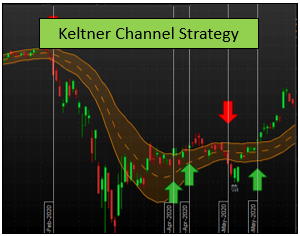

As we always recommend, the best thing is to use a trend detector indicator that allows us to determine the direction of the trend. The stochastic oscillator will work best, providing entry and exit signals to both long and short positions in an existing trend using stocks or call and put options.

How to use the Stochastic Indicator?

Let us get into the interesting part now. There are three practical ways to use the stochastic oscillator, and we will be taking a look at every one of them using a japanese candlestick chart.

Each one of them are based on an intraday chart of 30 minutes of candlestick data.

Stochastic Indicator: Beginning of the Movement

The first way to use the stochastic oscillator setting is by using only the Smoothed %K or the %K (fast stochastic indicator) to enter the trade.

We are going to suppose that we have spotted a bullish trend, determined by a 200-period simple moving average, for example.

- Bullish signals: We will spot them when we have a bullish trend, and the fast stochastic indicator turn upside when it is in the oversold zone.

- Bearish signals: We will spot them when we have a bearish trend and the %K or Smoothed %K turns downside when it is in the overbought zone.

Let us take a look at the following example here in a 30 minutes time frame.

In the previous graph, we have changed the color of the fast stochastic indicator to help you identify its changes better. Marked with a green arrow, we can see the bullish signals of the strategy showing us the best places to enter the trades.

However, if we take a more profound look at the left part of the graph, we can see a signal that is not entirely accurate.

To solve this problem, we could use the second strategy, which is…

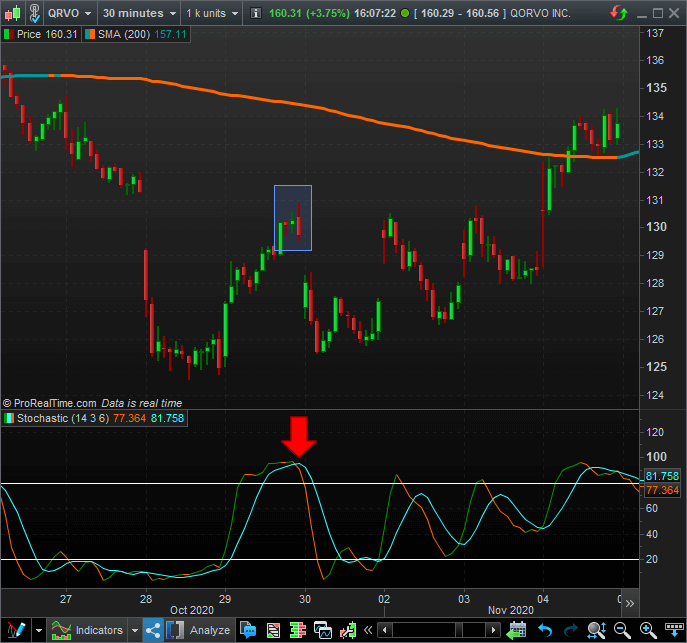

Fast and Slow Stochastic Indicator crosses on the overbought or oversold zones

Instead of using only one part of the stochastic indicator, to avoid those false signals, we will entirely base the strategy using both Smoothed %K and %D.

Their signals would trigger as follow:

- Bullish signal: In a bullish trend, we will spot a signal when the smoothed %K crosses the %D in the oversold zone.

- Bearish signal: In a bearish trend, we will spot a signal when the fast and the slow stochastic indicator crosses in the overbought zone.

If we take a look at the previous chart, the first false signal would disappear. Let us take a look now at another example, this time of a bearish trend following these rules.

As you can see, this time, we have only spotted one bearish entry following the rules we have described before.

These two stochastic indicator trading strategies are the most simple and straightforward to use.

However, there is another strategy more complex and useful yet to show than the two we have seen until this point…

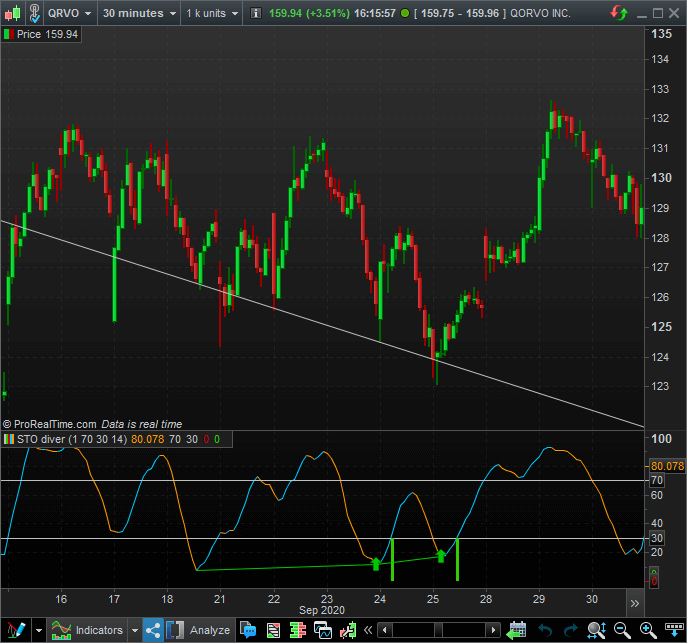

The stochastic divergence indicator

As with many other technical indicators, the stochastic oscillator also includes bullish and bearish divergences. These signals are the most powerful in terms of price movement, and they are quite likely to be effective.

- Bullish Divergence: we will spot them when the stochastic oscillator creates two bottoms, the previous more profound than the current one, while the prices keep getting lower.

- Bearish Divergence: we will spot one of them when the indicator creates two peaks, the previous higher than the current one, while the prices keep getting higher

The best way to explain these two signals is by using a visual example like this one here, in which we will find several bullish divergencies

This is a triple stochastic divergence, and as you can see, the price movement is huge when the last divergence is confirmed. In the previous image, we have only represented the smoothed %K to simplify the matter.

These are the three ways to better use the stochastic oscillator and take the best from it.

Does Stochastic Indicator repaint?

As you can see, the stochastic is quite a reliable tool to help us in our trading entries and exits. One of the biggest pros of this indicator is that it will not repaint itself.

In other words: Once the indicator has finished calculating its current period, the trace of the stochastic will not change, unlike other indicators such as the zigzag indicator.

Other Stochastic indicator settings that could be of use

As we stated at the beginning of this article, the stochastic oscillator is also used in other variants such as the stochastic RSI or the stochastic momentum index.

We are going to take a look at every of them to see what the differences are between them.

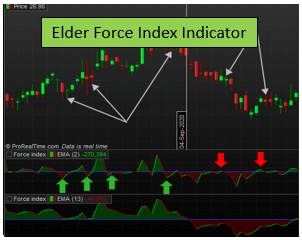

Using the Stochastic Momentum Index (SMI)

The stochastic momentum index represents the position of the close relative to the median point. The difference with the basic stochastic oscillator is that this one represents the position of the close relative to the highest and lowest points.

Also, with the stochastic momentum index, we are going to be using a double smoothing with an exponential moving average instead of a simple moving average.

In that way, we are going to make the signals quite more consistent.

As for the trading strategies, everything we have seen in the stochastic indicator applies to the stochastic momentum index, as they are based on the exact same rules but with different formulas.

Here in the following chart of a 30 minutes time frame, we can take a look at the difference between the two of them.

In the previous image, we can see both the stochastic momentum index and the basic stochastic. As you can see, the first one makes the indicator much more smoother compared to its basic form.

As for it uses, we can use the same strategies we have explained in one of the previous sections as they work exactly equal.

Using the stochastic rsi indicator

The stochastic rsi indicator simply applies the stochastic formula to the RSI indicator, and it makes it oscillate between 0 and 100.

The way to interpret it is by using the same rules as the RSI indicator provides. We have oversold and overbought zones in which we will identify the momentum of the price in any of the charts.

Last words about the Stochastic Indicator

As we have seen, the stochastic oscillator has a great variety of uses and modifications, and the reason for that is the excellent accuracy this indicator provides to our long and short positions.

The stochastic indicator will help us to identify the best moments to enter and exit in a trade if we manage to spot the trend correctly.

Here at Warsoption, this is one of the indicator we recommend best if you want to create a strategy, specially for swing trading because timing is essential if we are dealing with options for the short term.

As always, we recommend you to backtest this indicator and try it for yourself, as you surely will find it useful to your trading and investing strategies. Remember to be cautious and first, detect the general trend of the asset you want to trade or invest, as the stochastic indicator will surely work best if we manage to filter false signals, just as we have seen before.